PEA Highlights

New Ingerbelle is expected to have total production of 768 million pounds of copper and 550,300 ounces of gold over its mine life, based on Measured and Indicated Resources only. The production plan assumes the use of Copper Mountain mine’s existing mine equipment fleet and mill.

“New Ingerbelle represents a low capital, low risk, high quality development project in a world-class mining jurisdiction,” said Gil Clausen, Copper Mountain’s President and CEO. “Our next steps include evaluating various operational alternatives to test against this Base Case, which assumes supplanting Copper Mountain Mine production. We will study incorporating New Ingerbelle into the Copper Mountain mine plan using the existing mill and study expanding the mill at Copper Mountain to increase the combined annual production. New Ingerbelle should give us tremendous flexibility as we execute our low risk growth strategy. This PEA demonstrates just how much potential value this project holds.”

Mining and Processing

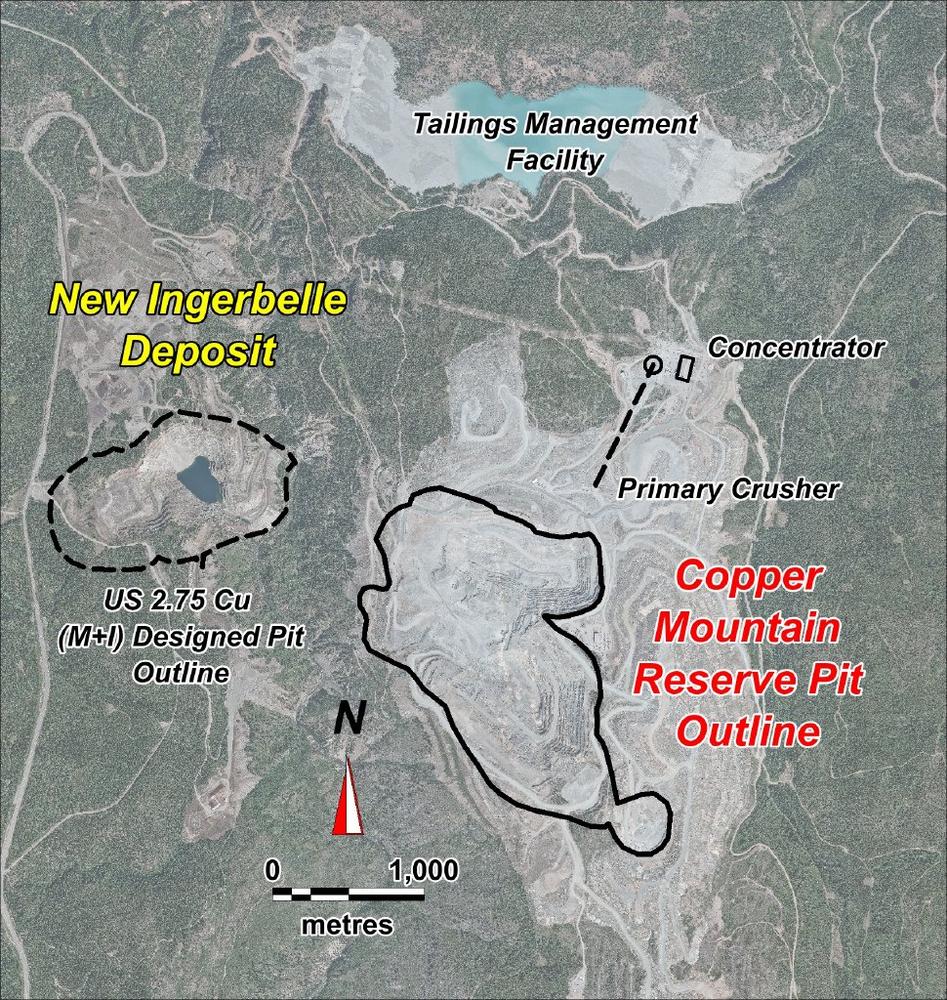

The New Ingerbelle mine design uses a US$2.75 per pound copper price Whittle pit shell (Measured and Indicated Resources only) generated using actual costs from the adjacent Copper Mountain Mine as a basis. Metal recoveries are based on historical Ingerbelle mill recoveries and metallurgical test work conducted on recent exploration drill core from the New Ingerbelle deposit.

The Whittle pit shell was used as the basis for an ultimate design pit, which has a final haul road and waste dump designs incorporated. This ultimate pit was sequenced to produce a life of mine (LOM) plan which includes three pushback phases that include haul roads. The study used the haulage profiles to determine mining equipment requirements. Capital and operating costs, along with copper and gold recoveries that were used, are outlined in the tables below. The PEA is based on the Mineral Resource which was previously published on September 21, 2018.

The PEA assumes New Ingerbelle mill feed would be trucked to the Copper Mountain operation, using Copper Mountain’s existing mine equipment fleet, the 40,000 tonnes per day (tpd) mill and tailings facility. Total mill feed mined is expected to be 175 million tonnes and total waste is expected to be 250 million tonnes for a low strip ratio of 1.43:1. The production plan for New Ingerbelle is based only on Measured and Indicated Mineral Resources. All 24.6 million tonnes of Inferred Resources mined were considered as waste in the pit optimization and LOM scheduling.

Capital and Operating Costs

The total initial capital cost required to start operations at New Ingerbelle is estimated to be approximately US$130 million. The estimate is largely due to the cost to complete a three-kilometre access road from New Ingerbelle to the Copper Mountain mine, pre-stripping and miscellaneous infrastructure upgrades. Total life of mine sustaining capital is expected to be US$63 million, which is mainly for mining equipment replacement and tailings dam expansions.

Average C1 cash costs, net of by product credits, are approximately US$1.52 per pound of copper. Total operating costs are estimated to be US$9.66 per tonne milled, which includes mining costs of US$3.06 per tonne milled and processing costs of US$5.32 per tonne milled.

Project Economics

The after-tax NPV assuming an 8% discount rate is US$394 million and the after-tax IRR is 65%. The economics are based on a long-term Canadian Dollar to U.S. Dollar exchange rate of 1.25 to 1 and bank consensus long-term metal prices of US$3.08 per pound copper, US$1,310 per ounce of gold and US$18.90 per ounce of silver.

The PEA is based on Measured and Indicated Mineral Resources that are included within a Whittle optimized pit shell generated using values based on copper, gold and silver metal prices of US$2.75, US$1,250 and US$16.50 and recoveries of 80%, 65% and 70%, respectively.

Technical Report

A technical report for the New Ingerbelle Preliminary Economic Assessment will be filed on SEDAR within 45 days of the date of this news release in accordance with NI 43-101 regulations.

Qualified Persons

The Mineral Resource estimate for New Ingerbelle that forms the basis for the New Ingerbelle PEA was prepared by Mr. Peter Holbek, B.Sc(Hons), M.Sc. P. Geo, who is the Vice President, Exploration of Copper Mountain Mining Corporation. Mr. Holbek serves as the Qualified Person as defined by National Instrument 43-101. Mr. Holbek consents to the inclusion of the mineral resource in this news release and has approved the mineral resource information included in this news release.

Mr. Stuart Collins, P.E., serves as the Qualified Person as defined by National Instrument 43-101 and is the Qualified Person for information regarding the New Ingerbelle PEA. Mr. Collins is independent of the Company and has reviewed and approved the contents of this news release.

About Copper Mountain Mining Corporation:

Copper Mountain’s flagship asset is the 75% owned Copper Mountain mine located in southern British Columbia near the town of Princeton. The Copper Mountain mine produces about 90 million pounds of copper equivalent per year with a large resource that remains open laterally and at depth. Copper Mountain also has the permitted, development stage Eva Copper Project in Queensland, Australia and an extensive 397,000 hectare highly prospective land package in the Mount Isa area. Copper Mountain trades on the Toronto Stock Exchange under the symbol “CMMC” and Australian Stock Exchange under the symbol “C6C”.

Additional information is available on the Company’s web page at www.CuMtn.com.

Note: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results. Readers are referred to the documents, filed by the Company on SEDAR at www.sedar.com, specifically the most recent reports which identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company undertakes no obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statement.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch