“From exploration to production, we aspire to pour our first Dore bar as early as the end of this year.”

States Anderson CEO

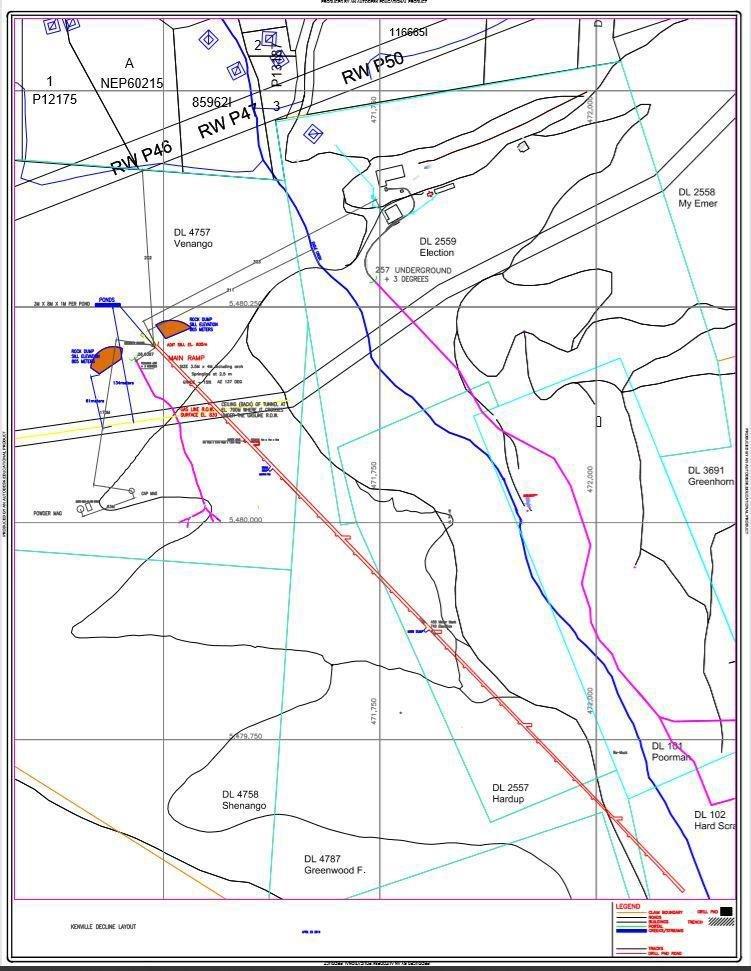

A new underground decline is planned to be driven 466 metres as a line drive at -15% grade from a starting elevation of 810 metres to the 740 metre elevation, then a further 40 metres at +3%. The decline is projected to cross at least two veins before reaching its target elevation, which lies at the center of a series of vein intercepts in holes drilled between 1995 and 2010. The end of the decline will also be in a favourable position for a raise to be driven to connect with the historic workings of the Kenville gold mine, to be used for ventilation and as a secondary egress as the mine is progressively developed.

Underground diamond drilling from the decline is planned to begin at about 200 metres from the portal. This drilling will follow-up historic 1995 drill intercepts on the Eagle veins, in an area where mineralized shoots are projected down from historic mined areas on the 257 and 275 levels. If successful, stope blocks could be defined between the 200 and the target 500 metre mark in the decline. The following intercept are examples of target intercepts before the 500 metre mark in the decline.

The 500 metre end-position of the planned decline is in line with a projection of mineralized shoots from the historic mine. At the 500 metre mark there are a number of drill intersections in the Flat vein and South Zone areas that indicate excellent potential for a bulk sample to be outlined.

Note: The above tables are based on information provided by previous operators that is considered historical. Although it is known that the drill programs were directed by experienced personnel and a quality control program was employed to monitor assay results, a qualified person has not verified the previous results on behalf of Ximen Mining Corp. Ximen believes the results are representative of the undeveloped mineralization at the Kenville property.

It is estimated that 4500 metres of underground drilling will be required to appropriately outline material for a bulk sample of 10,000 tonnes. The 740 metre elevation will likely be the first level from which potential vein stope mining will take place, via ramps driven up and down to cross-cut projected veins indicated from the drilling. An area extending over a strike length of 300 metres and a vertical distance of 150 metres will be developed for trial mining of a bulk sample. Once a stope block has been delineated by underground drilling, it can be developed by access ramps driven down by as much as -20% grade. Then, up to four vertical cuts can be made by taking down the back until the fourth cut has a + 20% ramp to it. The plan is to remove the vein material in the stope face and slash it on the up-dip side, which will minimize the waste rock generated. After a stope is mined out, it can be back-filled with waste from an adjacent stope.

Note: The technical information contained in this news release was obtained from the Kenville project database and is dated prior to 2016.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

“Christopher R. Anderson”

Christopher R. Anderson,

President, CEO and Director

About Ximen Mining Corp.

Ximen Mining Corp. owns 100% interest in all three of its precious metal projects located in southern BC. Ximen`s two Gold projects are The Gold Drop Project and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past-producing Huldra Silver Mine. Currently, both the Gold Drop Project and the Treasure Mountain Silver Project are under option agreements. The option partners are making annual staged cash and stocks payments as well as funding the development of these projects. The company has recently acquired control of the Kenville Gold mine near Nelson British Columbia and The Amelia Gold Mine in the center of the McKinney Gold Camp.

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Ximen Mining Corp

888 Dunsmuir Street – Suite 888,

Vancouver, B.C., V6C 3K4

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()