The last hole drilled on the COD vein, Hole COD19-49 was drilled to test the COD vein at depth below other holes drilled in 2019. This hole intersected two quartz veined zones containing pyrite that have elevated gold contents.

Prospecting was done to evaluate targets for trenching and drilling in 2020. One sample assayed 55.8 grams per tonne gold, 379 grams per tonne silver and 270 ppm tellurium. This grab sample was from a previously unknown occurrence of frost-heaved blocks of vein quartz containing pyrite. This site is a priority for follow-up trenching.

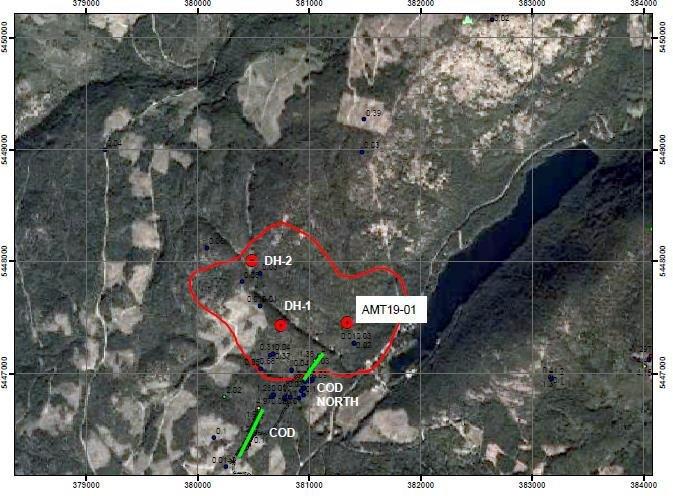

Hole AMT19-01 was a designed to test a large geophysical anomaly and was drilled to a depth of 718.8 meters (2,358 feet). The core was logged for geological features and sampled at intervals ranging up to 3.05 meters in length. Geochemical results indicate elevated copper, zinc and iron between 90.31 and 718.7 meters (628 meters). Copper values averaged 249 ppm Cu in 38 of 62 samples that contained 100 ppm or greater copper, with values ranging from 102 to 837 ppm Cu. The highest copper value was for a 0.32 meter sample at 714.06 meters depth, where sulphide mineralization (pyrrhotite and pyrite) was observed. Zinc averaged 175 ppm Zn in 48 of 62 samples containing ppm 100 or greater zinc, with values ranging from 102 to 572 ppm Zn. Iron averaged 10.0% Fe in 48 of 62 samples containing 5% or greater iron, with values ranging from 5.27 to 12% Fe.

The elevated values for copper, zinc and iron are associated with calc-silicate altered rocks and magnetite mineralization in the drill core. These features are interpreted as weak, skarn-type mineralization formed by iron-rich fluids that also carried copper and zinc. Historically, skarntype copper-gold deposits were the main source of metals produced in the Greenwood camp. The Phoenix deposit produced 28,341 kg of gold, 183,036 kg of silver and 235,693 tonnes of copper and the Motherlode produced 6,648 kg gold, 22,083 kg silver, and 34,918 tonnes copper.

Skarn mineralization typically occurs at or near the margins of porphyry-type intrusions, which likely generated metal-rich hydrothermal fluids that replaced and reacted with calcareous rocks (limestone or dolomite). Porphyry dikes were intersected in hole AMT19-01, and although calcareous units were not seen in the core, limestone is known to be a minor component of the Knob Hill Group, through which this drill hole passed. Hence the geological environment is favourable for skarn deposits. The alteration and mineralization are interpreted as distal since they are weakly developed. The conclusion is that the hole passed through a skarn-type magnetite calc-silicate replacement zone, possibly on the periphery of a larger skarn deposit. Hole AMT1901 may have intersected the edge of a major skarn deposit that is yet to be identified.

Further investigations will be done, including petrographic studies of the alteration minerals. A review of the geophysical results is also planned. Additional geophysical surveying may be done prior to drilling additional holes. Note that hole AMT19-01 was the first of three holes originally planned to target the geophysical anomaly (see image below).

Analytical results reported above were provided by ALS Laboratories in North Vancouver, BC., which is an independent and accredited commercial laboratory. Analyses for gold were done by fire assay with AA finish on 50 gram sub-samples, or by metallics sieve analyses. Analyses for silver and tellurium were by four acid digestion with ICP-MS finish. Silver results greater than 100 ppm, and Tellurium results greater than 500 ppm, were reanalyzed using a four-acid digestion and ICP-AES or AAS finish on a 0.4g sub-sample. Quality control was monitored using analytical results for reference standards and blank samples inserted into the sample stream at a frequency of 5% each.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

About Ximen Mining Corp.

Ximen Mining Corp. owns 100% interest in three of its precious metal projects located in southern BC. Ximen`s two Gold projects The Amelia Gold Mine and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past producing Huldra Silver Mine. Currently, the Treasure Mountain Silver Project is under a option agreement. The option partner is making annual staged cash and stocks payments as well as funding the development of the project. The company has recently acquired control of the Kenville Gold mine near Nelson British Columbia which comes with surface and underground rights, buildings and equipment.

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company’s reports, publicly available through the Canadian Securities Administrators‘ System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Ximen Mining Corp

888 Dunsmuir Street – Suite 888, Vancouver, B.C., V6C 3K4 Tel: 604-488-3900

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()