Ecommerce could see long-term benefits

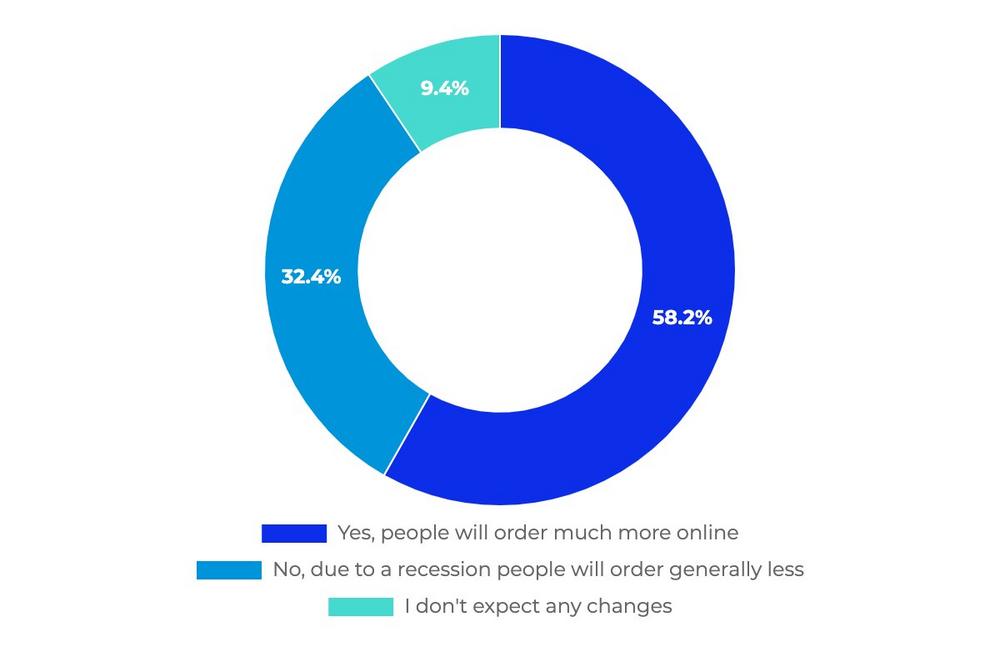

Regarding expectations on the duration and effects of the Coronavirus pandemic, a vast majority of the participants expect the crisis to last 3 to 6 months or longer and fear a long-lasting recession as a consequence of the current situation. Nonetheless, a majority of brands also consider ecommerce to leave the crisis as a winner, for more people start ordering products online (see Fig. 1). This could lead to a change in behavior that enforces an already existing trend and catapults ecommerce years into the future.

Supply and demand see bottlenecks and significant shifts

Although supply prices (costs of goods) are rather stable, sellers currently see negative effects on shipping and production, leading to quickly declining stock levels. About half of the participants have also described a decline in demand, however effects vary depending on what type of goods they are selling (see Fig. 2). One food manufacturer, for example, reports an increase in sold products and brand awareness: “Our sales have increased tremendously in people’s efforts to stock up their pantries. I believe this has introduced our brand to many, many new customers.”

Top selling products amid the Coronavirus crisis – current shopping trends

Due to the Coronavirus crisis, demand has been shifting. Between countries, the product categories experiencing the highest increase in demand, vary from country to country (looking at week over week estimated sales growth in % from 02 March 2020 to 09 March2020). In the U.S., groceries ride on the top (26% estimated sales growth), while Italy shows a growing demand on products for sports and (solo) outdoors activities (236% estimated sales growth). In Germany, toys and games see a peak (36% estimated sales growth).

However, there are also some clearly visible shopping trends common across all countries: groceries and home basics, medical supply, backyard and garden products, entertainment and activities, indoor and (solo) outdoor fitness, as well as home office tools have been trending, indicating that online shopping behavior is adapting to the new situation (see Fig. 3).

“We are facing a new and challenging dynamic environment for Amazon businesses. To help our clients find the right measures and cope with the current crisis, we have been setting up a newsletter with weekly updates and webinars,” says Franz Jordan, CEO of Sellics. “We are also constantly working on reliable and up-to-date information to provide as many insights as possible to support brands and agencies on Amazon in their decision making.”

In March 2020, Sellics interviewed brands selling on Amazon focusing mostly on the U.K., the U.S. and Germany for the analysis. Read the entire report on the Sellics COVID-19 customer survey here.

For the analysis on COVID-19’s impact on shopping behavior and winning products, click here.

Download all infographics and charts here.

Sellics is the leading Ecommerce growth software used by clients including Bosch, Brita and thousands of other brands and agencies to succeed in two of the most important e-commerce marketing channels: SEO and advertising on Amazon. Sellics is the only software that combines cutting edge, integrated tools for both Amazon SEO and advertising that allow brands and agencies to utilize synergies between both and unlock their full potential. Sellics’s AI-based advertising automation solutions enable brands and agencies to fully and efficiently scale their eCommerce growth and success. For further information visit www.sellics.com

Sellics Marketplace Analytics GmbH

Str. der Pariser Kommune 18d

10243 Berlin

Telefon: +49 (30) 55570-100

http://sellics.com/de

PR-Beraterin

Telefon: +49 69 970705-34

E-Mail: elisabeth.jost@psmw.de

![]()