Winter Drilling Selected Highlights:

- Drill hole LE20-52 assays average 22.7% U3O8 over 7.5m from 318.5 to 326.0m, including 67.2% U3O8 over 2.5m from 322.5 to 325.0m

- Drill hole LE20-53 assays average 11.7% U3O8 over 10.5m from 317.5 to 328.0m, including 40.4% U3O8 over 3.0m from 324.5 to 327.5m

- Drill Hole LE20-51 assays average 14.5% U3O8 and 3.5% Ni over 7.5m from 322.5 to 330.0m*

- Drill Hole LE20-40 assays average 20.5% U3O8 over 4.0m from 322.5 to 326.5m*

- Drill Hole LE20-34 assays average 33.9% U3O8 over 8.5m from 326.0 to 334.5m, including 5.0m averaging 57.1% U3O8 from 328.0 to 333.0m*

- Drill Hole LE20-32A assays average 19.6% U3O8 over 8.5m from 329.5 to 338.0m, including 2.5m of 63.6% U3O8 from 334.5 to 337.0m*

*Previously released assay results

Craig Parry, Chief Executive Officer commented: “I’d like to congratulate our technical team on these latest results and on the highly successful winter drilling program. Drilling has continued to deliver long intervals of high-grade pitchblende uranium mineralization, confirming Hurricane as major discovery. It is worth noting that the Hurricane deposit is in an exceptional location in the eastern Athabasca close to key infrastructure and only 40km from Orano’s McLean Lake Mill. These latest results from our winter program come at a crucial time for the uranium exploration and mining sector. In recent days we have seen the major producers announce extended closures of their mines and mills which we estimate has reduced global uranium production volumes by over 50%. Already we have seen the uranium spot price rise over 30% from $24/lb three weeks ago to $31.50/lb today, breaking the important psychological barrier of $30/lb in the process. This rise has occurred without the full impact of physical product being removed from the market and when these announced supply cuts take full effect in coming weeks, we expect to see further upward pressure on prices. Against this backdrop IsoEnergy remains well positioned with $3.5m in cash and we look forward to reporting on plans for further drilling at our high-grade Hurricane discovery.”

Steve Blower, Vice President of Exploration commented: “The last two drill holes of the campaign have returned very high-grade uranium assays over long intervals. The southernmost drill holes on all five sections in the western end of the Hurricane zone are now all strongly mineralized. Clearly there is room for expansion of this very high-grade area within the larger Hurricane zone footprint, which now measures 575m long, up to 40m wide and up to 11m thick.”

Investor Conference Call and Webcast

The Company will be hosting a conference call today, April 15, 2020 at 11:00 AM PST (2:00 PM EST), to give a corporate presentation, discuss the winter drilling program, and host a Q&A for investors and other interested parties.

Details of the Call:

Participant toll free dial in number: (844) 618-5255

Audience URL:

https://onlinexperiences.com/Launch/QReg/ShowUUID=3DFB8AE5-B96E-4255-AE54-C68AD316766F

The presentation to be covered on the call can also be found on the Company’s website: https://www.isoenergy.ca/

Final Assays Received

Drill Hole LE20-52 (Hurricane Section 4435E)

Drill hole LE20-52 was designed to evaluate the potential for additional high-grade mineralization to the south of drill holes LE20-40 and LE20-34 (Figures 2 and 3). It successfully intersected a thick interval of strong uranium mineralization at the sub-Athabasca unconformity that averages 22.7% U3O8 over 7.5m from 318.5 to 326.0m. The interval includes a very high-grade section that averages 67.2% U3O8 over 2.5m from 322.5 to 325.0m. Within the very high-grade section is a subinterval of continuous off-scale (>65K CPS on an RS-125 handheld spectrometer) mineralization that averages 79.9% U3O8 over 1.5m from 322.5 to 324.0m. Figure 4 is a core photo of the mineralized interval.

Drill Hole LE20-53 (Hurricane Section 4410E)

Drill hole LE20-53 was completed 25m along-strike to the west of drill hole LE20-52 (Figures 2 and 5). It successfully intersected 10.5m of strong uranium mineralization at the sub-Athabasca unconformity from 317.5 to 328.0m that averages 11.7% U3O8 (Figures 2 and 4). The intersection includes a 3.0m subinterval of very strong uranium mineralization that averages 40.4% U3O8 from 324.5 to 327.5m. Within the very high-grade section is a subinterval of off-scale (>65K CPS on an RS-125 handheld spectrometer) mineralization that averages 62.7% U3O8 over 0.5m from 326.0 to 326.5m. Figure 6 is a core photo of the mineralized interval.

Next Steps

All assays from the 2020 winter drilling program at the Hurricane zone have now been received. Data compilation and interpretation of the drilling results are well underway, as is planning for a summer drilling program that will continue to define the extent of the Hurricane zone. The timing and amount of summer drilling may be impacted by the COVID-19 pandemic. The Company continues to monitor the situation will make decisions regarding future work programs in due course.

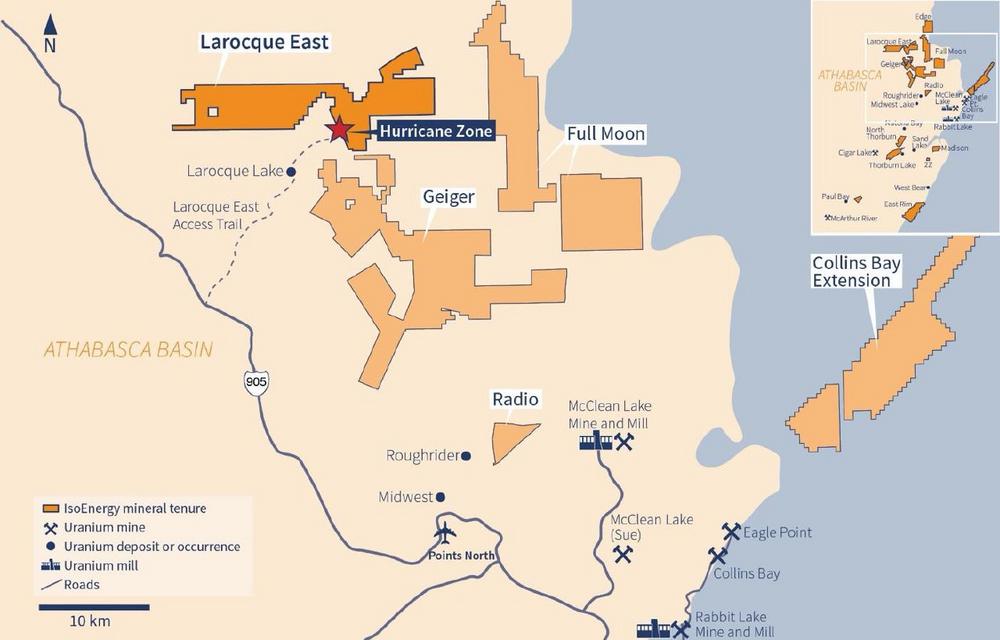

The Larocque East Property and the Hurricane Zone

The 100% owned Larocque East property consists of 20 mineral claims totaling 8,371 ha that are not encumbered by any royalties or other interests. Larocque East is immediately adjacent to the north end of IsoEnergy’s Geiger property and is 35 km northwest of Orano Canada’s McClean Lake uranium mine and mill.

Along with other target areas, the Property covers a 15-kilometre-long northeast extension of the Larocque Lake conductor system; a trend of graphitic metasedimentary basement rocks that is associated with significant uranium mineralization at the Hurricane zone, and in several occurrences on Cameco Corp. and Orano Canada Inc.’s neighbouring property to the southwest of Larocque East. The Hurricane zone was discovered in July 2018 and was followed up with 29 drill holes in 2019 and an additional 14 drill holes to date in 2020. Dimensions are currently 575m along-strike, 40m wide and up to 11m thick. The zone is open for expansion along-strike to the east and on most sections. Mineralization is polymetallic and commonly straddles the sub-Athabasca unconformity 320 m below surface. The best intersection to date is 33.9% U3O8 over 8.5m in drill hole LE20-34. Drilling at Cameco Corp.’s Larocque Lake zone on the neighbouring property to the southwest has returned historical intersections of up to 29.9% U3O8 over 7.0m in drill hole Q22-040. Like the nearby Geiger property, Larocque East is located adjacent to the Wollaston-Mudjatik transition zone – a major crustal suture related to most of the uranium deposits in the eastern Athabasca Basin. Importantly, the sandstone cover on the Property is thin, ranging between 140m and 330m in previous drilling.

Qualified Person Statement

The scientific and technical information contained in this news release was prepared by Andy Carmichael, P.Geo., IsoEnergy’s Senior Geologist, who is a “Qualified Person” (as defined in NI 43-101 – Standards of Disclosure for Mineral Projects). Mr. Carmichael has verified the data disclosed. All radioactivity measurements reported herein are total gamma from an RS-125 hand-held spectrometer. As mineralized drill holes at the Hurricane zone are oriented very steeply (-80 to -90 degrees) into a zone of mineralization that is interpreted to be horizontal, the true thickness of the intersections is expected to be greater than or equal to 90% of the core lengths. This news release refers to properties other than those in which the Company has an interest. Mineralization on those other properties is not necessarily indicative of mineralization on the Company’s properties. All chemical analyses are completed for the Company by SRC Geoanalytical Laboratories in Saskatoon, SK. For additional information regarding the Company’s Larocque East Project, including its quality assurance and quality control procedures, please see the Technical Report dated effective May 15, 2019 on the Company’s profile at www.sedar.com.

About IsoEnergy

IsoEnergy is a well-funded uranium exploration and development company with a portfolio of prospective projects in the eastern Athabasca Basin in Saskatchewan, Canada. The Company recently discovered the high-grade Hurricane Zone of uranium mineralization on its 100% owned Larocque East property in the Eastern Athabasca Basin. IsoEnergy is led by a Board and Management team with a track record of success in uranium exploration, development and operations. The Company was founded and is supported by the team at its major shareholder, NexGen Energy Ltd.

Craig Parry

Chief Executive Officer

IsoEnergy Ltd.

+1 778 379 3211

Investor Relations

Kin Communications

+1 604 684 6730

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release shall not constitute an offer to sell or a solicitation of any offer to buy any securities, nor shall there be any sale of any securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities referenced herein have not been, nor will they be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and such securities may not be offered or sold within the United States absent registration under the U.S. Securities Act or an applicable exemption from the registration requirements thereunder.

Forward-Looking Information

The information contained herein contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the price of uranium, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, the limited operating history of the Company, the influence of a large shareholder, alternative sources of energy and uranium prices, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()