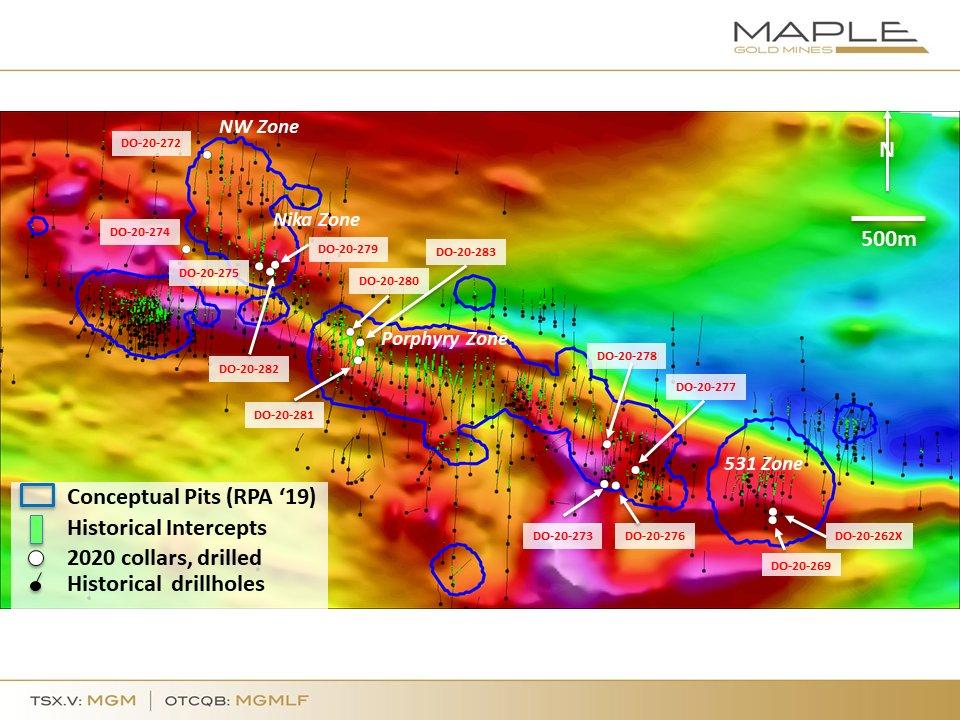

- NW Zone: Single step-out drill-hole completed with the objective of expanding the NW Zone pit-constrained resource area, which included testing the western continuity ~100 to the west of an adjacent historical intercept (1994) that cut higher than deposit average grade starting from only 41m downhole. The current pit-constrained resource at the NW Zone is 2.6 Mt @ 1.14 g/t Au for 96,000oz Au (RPA 2019).

- Nika Zone: Maple Gold’s discovery hole in this area cut 50m @ 1.77 g/t Au from 297 metres downhole in 2018. Limited follow-up drilling during 2019 intersected broad lower grade gold mineralisation and the Nika Zone supported a new conceptual pit (3.6 Mt @ 0.94 g/t Au for 109,000oz Au) in the Company’s latest resource estimate (RPA 2019). One of the objectives for the Company’s four drill-holes this winter at the Nika Zone is to define the near-surface expression of the higher-grade 2018 discovery hole.

- Porphyry Zone: The 3km by 1km Porphyry Zone contains 136,000 indicated pit-constrained ounces (4.4 Mt @ 0.95 g/t Au) and 1,378,000 inferred pit-constrained ounces (47.9 Mt @ 0.90 g/t Au). There are multiple areas within this broad zone of mineralisation where higher grade mineralisation exists. Five of the seven drill-holes completed at the Porphyry Zone during the Company’s winter 2020 campaign were designed to test areas prospective for higher than zone-average grades within the top 150 metres from surface.

Matthew Hornor, Maple Gold’s President and CEO, commented: “We were fortunate to complete nearly 4,400 metres before local shutdowns took effect. We are also very fortunate during this pandemic and economic uncertainty in the markets to have a dedicated team willing to take less cash every month while working hard on multiple strategies with a commitment to build value and position the Company for strong performance in the quarters ahead.”

The Company’s VP, Exploration, Fred Speidel, added: “We have been very pleased with the IP results from our winter surveys, as they have supported existing target concepts and supported new regional targets that are now drill-ready with permits in place. While we wait for new assay results from our winter drilling campaign our team is preparing for further IP surveys to start as soon as exploration work recommences in the province.”

The Company’s winter 2020 geophysics program was very successful, demonstrating that the sulphide bearing system at the 531 Zone is wide open in multiple directions, while also outlining the start of a new chargeability anomaly further north in an area with no drilling over 600m (see press release March 16, 2020), which appears to relate to the WNW extension of the higher grade Main Zone. The infill IP grid completed 3.5-6.4km to the northeast of the known deposits was also successful in detailing a 1,500m long chargeability target, including a >400m target area with highest chargeability (see press release April 8, 2020), interpreted to represent a Vezza-like target. The Company has several additional exploration targets across its 350+ km² property that warrant additional IP surveys to define new drill targets, with some of this work likely to commence during Q2.

The Company is currently operating with a minimum of personnel at site, principally for care and maintenance purposes. With the reactivation of mining activities in the Province of Quebec, assay laboratories have also reopened, so the Company will be shipping remaining core samples as soon as possible. Assays are expected to be received periodically over the next ~2 months and will be released once they are verified and interpreted.

Corporate Adjustments, Reduction in Overheads and Stock Option Grant

The Company continuously looks at ways to reduce corporate and project site overheads. Initiatives implemented recently have included the consolidation of certain management roles, specifically in the Vancouver office and the Company is finalizing arrangements to reduce its camp size at site which will reduce monthly camp costs by approximately 50%.

In an early response to Covid-19 the Company’s senior management team is working for 50% pay during Q2 2020. This will be re-evaluated on June 30, 2020 as part of the Company’s quarterly review and assessment of overhead costs.

The Company continuously evaluates the various Federal and Provincial programs that have been announced for applicability. The Company has applied for the Canada Emergency Business Account $40,000 interest free loan. The Company is engaged with its commercial landlord to take advantage of the Canada Emergency Commercial Rent Assistance which will lower rent for our corporate office by 75% for April, May and June 2020. The Minister of Energy and Natural Resources of Quebec announced the postponement for one year of the requirement to carry out field work for the renewal of a claim, a simple and effective measure that will help Maple Gold.

The Company has granted incentive stock options to certain directors, officers, employees and consultants of the Company as part of its annual option grant and in part as consideration for the continued commitment of its team members that have accepted reduced pay during Q2 2020 and to support a shared vision and team focus on building value in a rising gold market. The Company has granted 9,975,000 options that are exercisable at a price of $0.10. The options have a 5-year term and vest one-third immediately, one-third 12 months from the date of grant and one-third 24 months from the date of grant until the options are fully vested. The Company’s Stock Option Plan governs these incentive options, as well as the terms and conditions of their exercise, which is in accordance with policies of the TSX Venture Exchange.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc, P. Geo., Vice-President Exploration, of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this news release through his direct participation in the work.

Quality assurance (QA) and quality control (QC)

Maple Gold implements strict quality assurance (QA) and quality control (QC) protocols at Douay covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drill hole surveying; core transport to the Douay camp; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to ALS laboratory; sample preparation for assaying; and analysis, recording and final statistical vetting of results. For a complete description of protocols, please visit the company’s QA/QC page on its website.

About Maple Gold

Maple Gold is an advanced gold exploration and development company focused on defining a district-scale gold project in one of the world’s premier mining jurisdictions. The Company’s ~355 km² Douay Gold Project is located along the Casa Berardi Deformation Zone (55 km of strike) within the prolific Abitibi Greenstone Belt in northern Quebec, Canada. The Project benefits from excellent infrastructure and has an established gold resource that remains open in multiple directions. For more information please visit www.maplegoldmines.com.

Forward Looking Statements:

This news release contains “forward-looking information" and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about the prospective mineral potential of the Porphyry Zone, the potential for significant mineralisation from other drilling in the referenced drill program and the completion of the drill program. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding timing and completion of the private placement. When used herein, words such as “anticipate”, “will”, “intend” and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are based on certain estimates, expectations, analysis and opinions that management believed reasonable at the time they were made or in certain cases, on third party expert opinions. Such forward-looking statements involve known and unknown risks, and uncertainties and other factors that may cause our actual events, results, performance or achievements to be materially different from any future events, results, performance, or achievements expressed or implied by such forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()