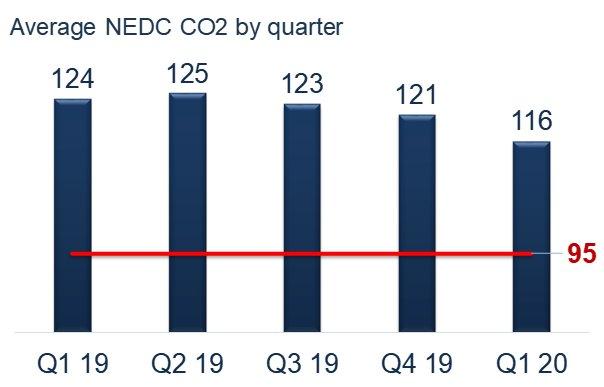

The first quarter shows a reduction of -5% vs. Q4 2019

The general drivers for this effect can be summarized as follows:

1. Electrification: Increase of Plug-In vehicles and full electric vehicles. Partly market demand, but also driven by the sheer amount of new entries in the market, such as the Peugeot 208 EV and Ford Kuga Plug-in.

2. Improvement of existing engines or introduction of new engines in the line up

3. OEMs steering sales mix towards low CO2 versions within their line up

What did not happen, is a move to smaller segments or away from SUVs. Versus last year there have been virtually almost no moves.

However, we see that in the largest 5 vehicle segments, that all of those contribute to the decline of CO2.

And then, what happened in Ireland and the Netherlands, the CO2 increased?

In Ireland, Q4 showed a onetime decrease of CO2. Versus full 2019, the drop is -6% in the first quarter of the year. And in the Netherlands, there was a huge push of EV’s in Q4 in order to capitalise on the tax benefits. Throughout this year, this will likely even out, as it did in 2016 and 2018.

Is it enough?

Well, it is not going to be easy. Despite the drop, which is the largest since 2009, there remains a gap of 21 grams in Q1. That is too much and will have to be compensated during the rest of the year.

3 measures can help improve the situation as is below:

– In 2020 the 5% most emitting cars will be taken out of the calculation

– Super-credit system, where EV’s will be counted twice.

– CO2 threshold is on average 95 grams, but unique for every OEM. The final CO2 target is going to depend on the average weight of the fleet. The higher the weight relative to the average, the higher the target.

All in all

It is unlikely that all brands will manage to avoid penalties. The appetite for SUV’s remains largely intact, fuel prices are at record lows, the supply of batteries is uncertain and launches of new technology do not always go smoothly. Putting huge fines on manufacturers during this moment of crisis, is yet to be seen though, and we may also see them shopping at other low CO2 manufacturers, like Tesla, looking for some CO2 credits.

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-329

E-Mail: julian.degroot@dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()