- “Larkin Gold Zone” – New broad, high-grade gold discovery south of Alpha Island Fault2.:

- BE30-003: 2 g/t over 3.9 m

- BE30-004: 3 g/t over 15.8 m

- BE30-007: 9 g/t over 11.0 m

- BE30-010: 3 g/t over 3.5 m

- BE30-011: 4 g/t over 8.9 m

- Wall Sample (BD40ACCLHW_002): 0 g/t over 14.4 m, including 22.7 g/t over 2.6 m

- “30C Nickel Trough” – First new nickel discovery at Beta Hunt in 13 years2:

o BE30-007: 3.8% Ni over 2.3 m

o BE30-009: 7.7% Ni over 1.3 m

o BE30-010: 8.6% Ni over 1.0 m

- Result show downhole thickness. True thickness cannot be estimated with available information

- Tables showing complete results and drill hole locations can be found at the end of this news release.

- Increased Exploration Budget – As a result of drilling success year to date and the multiple high quality exploration targets at both Western Australian operations, the 2020 exploration budget has been increased by ~50% to A$15M from the previous A$9.5-A$10M

Karora Resources Inc. (TSX: KRR) ("Karora" or the “Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/ ) is pleased to announce the discovery of new high-grade gold and nickel zones – the Larkin Gold Zone and 30C Nickel Trough – at its Beta Hunt Mine. The new discoveries are located south of the Alpha Island Fault in what is interpreted to be the southern extension of the Western Flanks shear zone.

The new discoveries were the result of drilling targeting an interpreted trough position known as the “30C” at the ultramafic / basalt contact south of the Alpha Island Fault. These types of shear related trough positions have historically been known to host high-grade nickel mineralization at Beta Hunt and are frequently in close proximity to shear hosted gold mineralization in the underlying basalt. The new high grade gold mineralization discovery, now named the Larkin Gold Zone (“Larkin”), sits approximately 5 to 10 metres below the 30C nickel basalt / ultramafic contact which is further confirmation of the relationship between gold and nickel occurrences at Beta Hunt.

Karora is also pleased to announce that, as a result of strong successes year to date in its 2020 exploration program, the consolidated Western Australia full year 2020 exploration expenditures will be increased to A$15 million. The increased budget will be entirely funded from internal cash flows and represents an approximate 50% increase from previous 2020 guidance of A$9.5 to A$10 million (see Karora news release dated January 23, 2020).

Paul Andre Huet, Chairman & CEO, commented: "With two exploration drills now turning underground at Beta Hunt, I am extremely pleased to announce that we are seeing early successes following the delays and precautions associated with COVID-19. The discovery of the new Larkin High Grade Gold Zone, located below the new 30C nickel discovery, is a strong validation of our exploration model at Beta Hunt and we are very excited to continue testing the interpretation across the zone.

At the new Larkin High Grade Gold Zone, drilling has returned some outstanding gold mineralization results both in drill core and channel samples taken from underground development in the zone. For example, wall sample BD40ACCLHW_002 returned 5.0 g/t over 14.4 metres, including a 2.6 metre interval grading 22.7 g/t.

This gold mineralization discovery appears to be the fault offset continuation of the Western Flanks shear zone and is open both at depth and along strike to the southeast. At this stage the Larkin gold mineralization is interpreted to occur over a 400 metre strike length. We plan to follow-up on the drilling in this zone over the remainder of 2020.

Adding to our nickel drilling success announced earlier this week, the 30C high grade nickel discovery above the Larkin Zone continues to highlight the excellent potential to add to the Beta Hunt nickel resource and for nickel to be an increasingly important by-product credit at Beta Hunt.”

Larkin Gold Zone Discovery

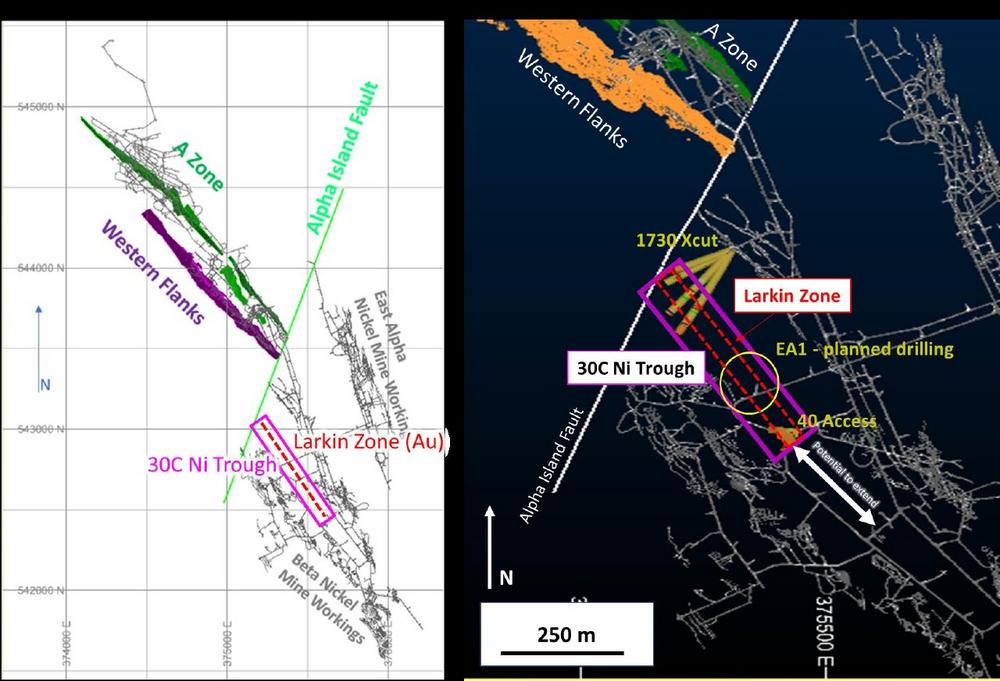

Drilling (1,239 metres in 14 holes) targeting the 30C nickel trough has intersected high grade gold mineralization below the 30C nickel basalt/ultramafic contact. The mineralization is similar in style to the A Zone and Western Flanks deposits north of the Alpha Island Fault and was intersected from the two drill positions shown in Figure 1 (1730 X-cut and 40 Access).

The new discovery is interpreted as the faulted southern offset of the Western Flanks zone which has a Measured and Indicated Mineral Resource of 710,000 ounces (see Technical Report on the Western Australian Operations – Eastern Goldfields: Beta Hunt Mine (Kambalda) and Higginsville Gold Operations (Higginsville), dated February 6, 2020). This result also puts into focus the potential for additional offsets associated with the A Zone and Fletcher Zones south of the Alpha Island Fault. These positions, south of the Fault, are untested and represent significant future growth opportunities for Beta Hunt (see Karora Resources Technical Report, February 6, 2020 available for download under Karora Resources profile on Sedar.com). Significant drill results include:

40 Access1.

- BE30-002: 11.9 g/t over 3.0 m

- BE30-003: 8.2 g/t over 3.9 m

- BE30-004: 3.3 g/t over 15.8 m

- BE30-007: 3.9 g/t over 11.0 m

- BE30-009: 2.4 g/t over 9.3 m

- BE30-010: 15.3 g/t over 3.5 m

- BE30-011: 7.4 g/t over 8.9 m

1730 X-cut1.

- BE30-022: 3.1 g/t over 10.1 m and 22.9g/t over 1.3 m

- BE30-024: 14.7 g/t over 2.3 m

- BE30-026: 2.5 g/t over 5 m

- Downhole thickness. True thickness cannot be estimated with available information

30C Nickel Trough

Drilling targeting the ultramafic/basalt contact in the interpreted trough position intersected nickel sulphide mineralization, both massive and the matrix texture typical of adjacent mined nickel troughs (Figure 2). Drilling was conducted from the 40 access and 1730 X-cuts with results indicating potential for a mineralized trough over 400 metres of strike and 25 metres wide (Figures 1 and 4). There is further potential to extend the trough 300 metres south for a total strike length of 700 metres (Figure 1). Drill intersection highlights are listed below:

40 Access1.

- BE30-001: 2.1% Ni over 2.4 m

- BE30-002: 3.7% Ni over 0.8 m

- BE30-007: 3.8% Ni over 2.3 m

- BE30-009: 7.7% Ni over 1.3 m

- BE30-010: 6% Ni over 1.0 m

1730 X cut1.

- BE30-023: 2.9% Ni over 1.0 m

- BE30-026: 2.4% Ni over 2.2 m

- Downhole thickness. True thickness cannot be estimated with available information

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

All drill core sampling is conducted by Karora personnel. Samples for gold analysis are shipped to SGS Mineral Services of Kalgoorlie for preparation and assaying by 50 gram fire assay analytical method. All gold diamond drilling samples submitted for assay include at least one blank and one Certified Reference Material (“CRM”) per batch, plus one CRM or blank every 20 samples. In samples with observed visible gold mineralization, a coarse blank is inserted after the visible gold mineralization to serve as both a coarse flush to prevent contamination of subsequent samples and a test for gold smearing from one sample to the next which may have resulted from inadequate cleaning of the crusher and pulveriser. The lab is also required to undertake a minimum of 1 in 20 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm. Wall samples are collected as rock chips using a G-pick along a horizontal sample traverse. All rock chip samples are submitted with at least one CRM (standard) every 20 samples. Samples for nickel analysis are shipped to SGS Australia Mineral Services of Kalgoorlie for preparation. Pulps are then shipped to Perth for assaying. The analytical technique is ICP41Q, a four acid digest ICP-AES package. Assays recorded above the upper detection limit (25,000ppm Ni) are re-analyzed using the same technique with a greater dilution (ICP43B). All samples submitted for nickel assay include at least one Certified Reference Material (CRM) per batch, with a minimum of one CRM per 20 samples. Where problems have been identified in QAQC checks, Karora personnel and the SGS laboratory staff have actively pursued and corrected the issues as standard procedure.

About Karora Resources

Karora is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from Karora’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold mineral resource and reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial historical gold resource and highly prospective land package totaling approximately 1,800 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value. Karora’s common shares trade on the TSX under the symbol KRR. Karora shares also trade on the OTCQX market under the symbol KRRGD.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the potential of the Beta Hunt Mine, Higginsville Gold Operation and Spargos Reward Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

In Europe:

Swiss Resource Capital AG

Jochen Staiger

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()