HIGHLIGHTS:

- Staked 14,104 acres of claims, increasing scale of Long Valley project by 750% to 15,965 acres

- District scale land package covers all deep-rooted fault structures of similar genesis to the Hilton Creek fault, the primary ‘conduit’ for current Long Valley epithermal gold/silver deposit

- Expanded near surface oxide gold exploration targets through both geophysics and prospecting of new and existing claims

- Mapped widespread alteration indicative of Long Valley epithermal gold/silver mineralization on new claims

- Drill program permitting in progress with drilling expected to start in H1 2021

KORE’s CEO Scott Trebilcock stated: “Once again KORE, as it did at Imperial and the South Cariboo, has consolidated district scale exploration potential for a 100% owned gold project. The additional 14,104 acres of royalty-free claims at Long Valley increases project scale by 750%, and opens up a whole new set of shallow oxide and potential feeder structure growth targets. Our team was in the field earlier this year and identified eight new oxide drill targets by sampling and mapping outcrop and alteration which are now fully captured in KORE’s claim area.”

Mr. Trebilcock continued, “Long Valley is a well preserved low sulphidation gold/silver system, similar to Kinross Gold’s Round Mountain deposit in Nevada. We look forward to drill testing the highest priority growth targets with permits expected in the first half of 2021.”

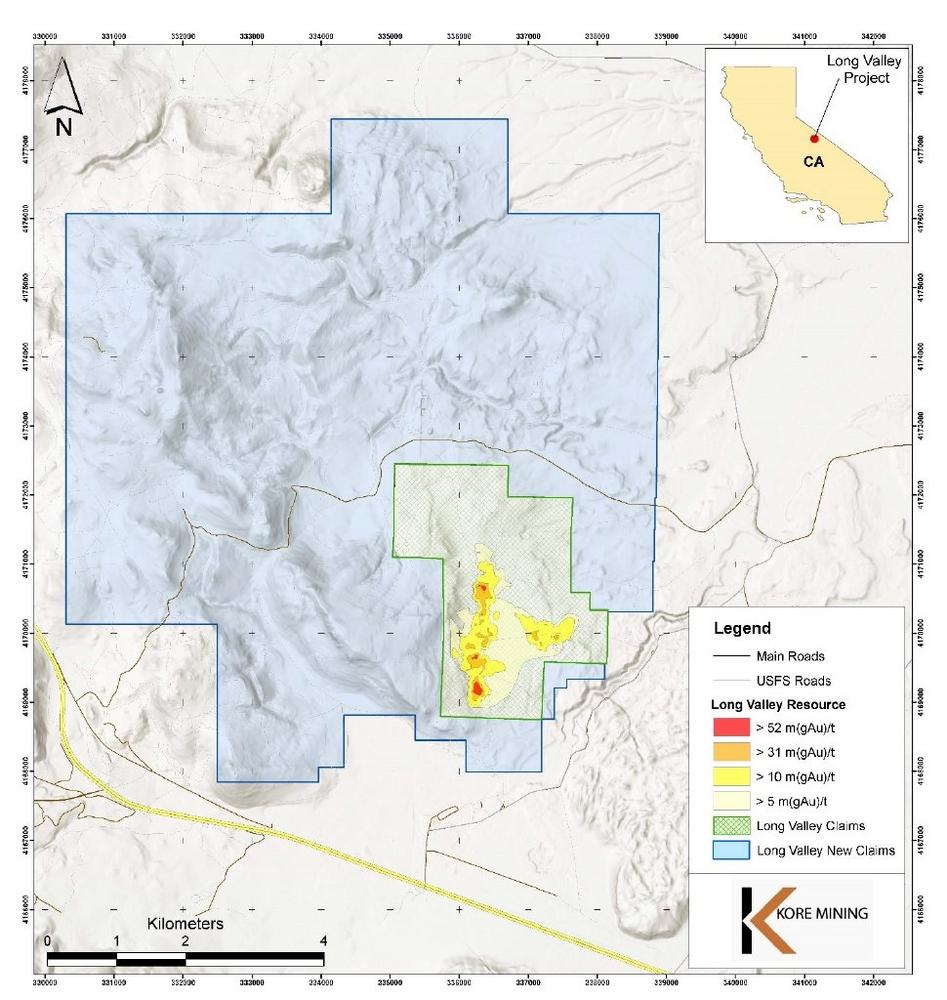

Figure 1 maps the old and new claims with outlines of the current Long Valley resource.

NEXT STEPS

KORE plans to drill-test the highest priority oxide and sulphide targets. KORE is currently permitting drill pads with drilling planned for H1 2021, subject to our regulator, the US Forest Service, permitting timelines.

There is a clear opportunity to grow shallow oxide mineralization as the system remains open in all directions and can be further expanded with new discoveries along separate parallel structures. The new claims host multiple, discrete drill targets as well as the potential to contain yet unrecognized mineralized structures. Additional mineralization could extend mine life, reduce capital intensity and generate higher project economic returns modelled in the positive PEA announced October 27, 2020. An updated summary of oxide expansion targets is included in Figure 2.

Additionally, as a fully intact epithermal deposit with a large at surface footprint, Long Valley has the potential for high-grade sulphides in the underlying feeder structures. Discovering high-grade sulphides would open up additional development pathways for the Project, such as underground mining and milling of mineralization. A summary of sulphide expansion targets, interpreted feeder structures, is included in Figure 2.

Additional details of the Long Valley exploration targets are in KORE news releases dated January 30, 2020 and March 24, 2020.

ABOUT LONG VALLEY GOLD DEPOSIT

Long Valley is 100% owned epithermal gold project located in Mono County California. The Long Valley deposit is an intact epithermal gold deposit with a large 2.5 km by 2 km oxide gold footprint.

The Long Valley deposit is an intact low sulphidation epithermal gold/silver deposit, hosted within a melange of fine to coarse volcanogenic sedimentary lithologies. Mineralization at Long Valley has developed due to a combination of deep-rooted fault structures and a resurgence of rhyolite within an active caldera. The Hilton Creek Fault structure transects and served as a fluid conduit for interaction with the underlying hydrothermal system, while the rhyolite resurgence caused brittle fracturing of sediments and created voids or traps for mineralization and gold deposition. The combination of these factors yields strongly altered kaolin and quartz-hematite zones that are the primary host for gold mineralization.

The Hilton Creek Fault remains underexplored on-strike north and south and several parallel structures have been defined using geophysics, the eastern one hosting some of the current mineral resource and the western one being unexplored. Long Valley is therefore open to new oxide discoveries in all directions. More details on the deposit geology and exploration potential can be found in KORE’s January 30, 2020 and March 24, 2020 news releases.

Other Matters

KORE has retained SRC Swiss Resource Capital AG (“SRC”) to provide investor relation services in Europe for the Company for a term of twelve months and renewable quarterly thereafter, for monthly fee of CHF$5,000. In addition, the Company has granted 200,000 stock options exercisable at $1.34 per share with a five year term and vesting in stages pursuant to the requirements of the TSX Venture Exchange. Included in this grant of options is 100,000 stock options to SRC and 75,000 to Kin Communications. All options have been granted pursuant to the Company’s stock option plan, and subject to compliance with all applicable laws and the rules (and approval) of the TSX Venture Exchange.

ABOUT KORE

KORE is 100% owner of a portfolio of advanced gold exploration and development assets in California and British Columbia. KORE is supported by strategic investor Eric Sprott who recently invested $7.0 million, bringing his total ownership to 26%. KORE management and Board are aligned with shareholders, owning an additional 38% of the basic shares outstanding. KORE is actively developing its Imperial Gold project and is aggressively exploring across its portfolio of assets.

Further information on the Long Valley project and KORE can be found on the Company’s website at www.koremining.com or by contacting us as info@koremining.com or by telephone at (888) 407-5450.

Technical information with respect to the Project contained in this news release has been reviewed and approved by Marc Leduc, P.Eng, who is KORE’s COO and is the qualified person under National Instrument 43-101 responsible for the technical matters of this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects", “intends”, “indicates” and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the future plans and objectives of the Company are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to: the results of the PEA, including future Project opportunities, , the projected NPV, , permit timelines, and the ability to obtain the requisite permits, the market and future price of and demand for gold, , and the ongoing ability to work cooperatively with stakeholders, including the all levels of government. Such forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information.

Such factors include, among others: risks related to exploration and development activities at the Company’s projects, and factors relating to whether or not mineralization extraction will be commercially viable; risks related to mining operations and the hazards and risks normally encountered in the exploration, development and production of minerals, such as unusual and unexpected geological formations, rock falls, seismic activity, flooding and other conditions involved in the extraction and removal of materials; uncertainties regarding regulatory matters, including obtaining permits and complying with laws and regulations governing exploration, development, production, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, site safety and other matters, and the potential for existing laws and regulations to be amended or more stringently implemented by the relevant authorities; uncertainties regarding estimating mineral resources, which estimates may require revision (either up or down) based on actual production experience; risks relating to fluctuating metals prices and the ability to operate the Company’s projects at a profit in the event of declining metals prices and the need to reassess feasibility of a particular project that estimated resources will be recovered or that they will be recovered at the rates estimated; risks related to title to the Company’s properties, including the risk that the Company’s title may be challenged or impugned by third parties; the ability of the Company to access necessary resources, including mining equipment and crews, on a timely basis and at reasonable cost; competition within the mining industry for the discovery and acquisition of properties from other mining companies, many of which have greater financial, technical and other resources than the Company, for, among other things, the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel; access to suitable infrastructure, such as roads, energy and water supplies in the vicinity of the Company’s properties; and risks related to the stage of the Company’s development, including risks relating to limited financial resources, limited availability of additional financing and potential dilution to existing shareholders; reliance on its management and key personnel; inability to obtain adequate or any insurance; exposure to litigation or similar claims; currently unprofitable operations; risks regarding the ability of the Company and its management to manage growth; and potential conflicts of interest.

In addition to the above summary, additional risks and uncertainties are described in the “Risks” section of the Company’s management discussion and analysis for the year ended December 31, 2019 prepared as of April 27, 2020 available under the Company’s issuer profile on www.sedar.com.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

There is no certainty that all or any part of the mineral resource will be converted into mineral reserve. It is uncertain if further exploration will allow improving the classification of the Indicated or Inferred mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()