Highlights:

- Two core holes have been completed to-date on the Joss high grade gold target as part of Revival Gold’s 2021 drilling program;

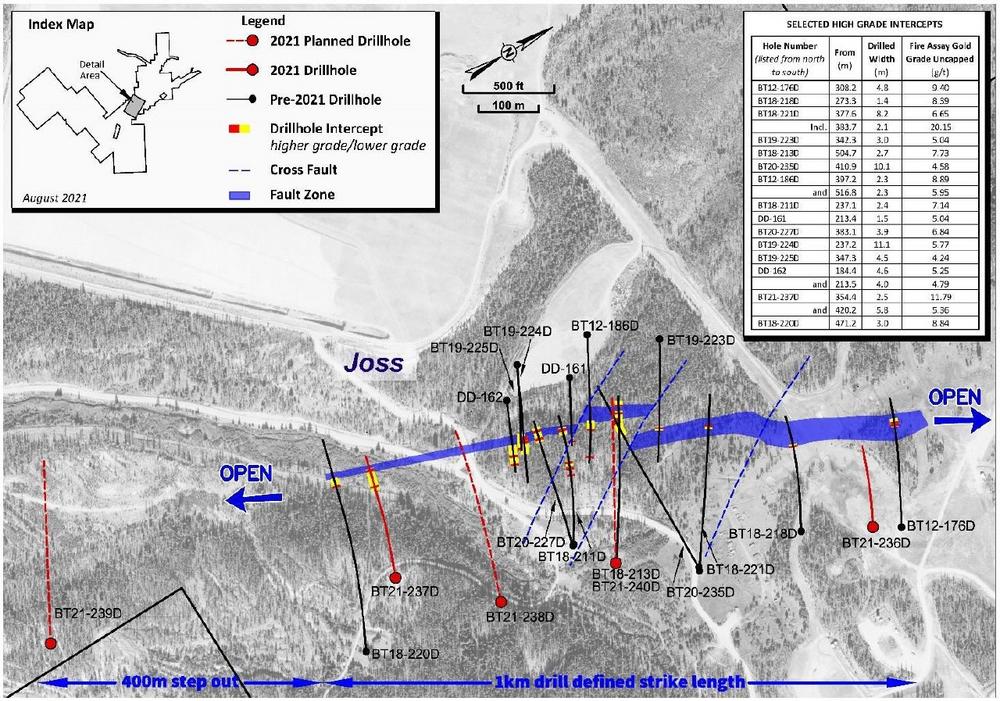

- BT21-237D intersected a wide, strongly mineralized interval of67 g/t gold over 84.6 meters including 11.79 g/t gold over 2.5 meters and 5.36 g/t gold over 5.8 meters1;

- BT21-238D, along strike approximately 150 meters north of BT21-237D, intersected what appears to be a similar stockwork, also hosted by the Proterozoic Yellowjacket Formation. Assays results are pending;

- A third hole, BT21-236D, was abandoned due to difficult drilling conditions short of the target and a fourth hole, BT21-239D, is currently in progress about 400-meters south on strike of the southern most drillhole to date at Joss. About 1,500 meters of this year’s planned 2,500-meter drilling program at Joss have been completed since the start of drilling in June;

- A second drill rig arrived at the project this week to accelerate the pace of drilling at Beartrack-Arnett. The rig is being mobilized to the Haidee heap leach gold target area, where an additional 2,500 meters of drilling, including geotechnical, hydrological and approximately ten exploration core holes, are planned for this season.

1 Drilled widths; true widths are unknown at this time.

“High-grade gold mineralization is exactly what we were hoping to find at Joss and today’s results from BT21-237D continue to demonstrate the significant scale and high-grade potential of this area at Beartrack-Arnett. We are now underway on a large step-out drill hole and expect further assay results from Joss by early September. Work has also commenced at Haidee where we have potential to add near surface leachable resources and optimize engineering factors for our phase one mine restart plan. Last year’s drilling at Haidee revealed the extension of stacked mineralized structures up-dip to the north-east and we are excited to get back into this area to further test the potential,” said Hugh Agro, Revival Gold, President & CEO.

Details:

Detailed results for the drill hole released today are presented in the table below: [PDF]

Contained within the broader mineralized intersection in BT21-237D are several intervals of higher-grade mineralization. The mineralized interval in drill hole BT21-237D is broader, with more high-grade mineralization than that encountered in drill hole BT20-220D, which is located approximately 60 meters to the south along the Panther Creek Shear Zone. BT18-220D intersected 38.8 meters averaging 1.79 g/t gold including 3.0 meters of 8.84 g/t gold (see press release dated December 4th, 2018).

Drill hole BT21-236D intersected weakly anomalous gold mineralization before being abandoned because of difficult drilling conditions short of the target zone at a depth of 223 meters. Samples from drill hole BT21-238D have been submitted to ALS Geochemistry for assay, while drilling on hole BT21-239D is underway.

Figure 1 below is a plan view of the Joss target area showing the approximate locations for the five holes to be drilled as part of the 2021 exploration program (including those for which results were released today).

Drilling at Haidee this summer will consist of 2,500 meters of engineering and exploration core drilling to augment and expand on the current Haidee Mineral Resource with the objective to increase mine life for the first phase restart of gold production from Beartrack-Arnett. Figure 2 below illustrates the location of this year’s planned engineering and exploration drill holes at Haidee.

Haidee hosts a December 2020 Indicated Mineral Resource of 2.5 million tonnes grading 0.65 g/t gold for 52,000 ounces gold and an Inferred Mineral Resource of 8.2 million tonnes grading 0.55 g/t gold for 144,000 ounces gold. The deposit remains open in all directions. A recent computer modeling and machine learning initiative (“AI”) conducted for the Company by Mira Geoscience Inc. highlighted a cluster of targets encompassed within a four-kilometer diameter around the current Mineral Resource at Haidee. Most of these targets have yet to be drill tested. Figure 3 below describes the target areas of interest based on Mira’s AI analysis.

In 2020, after initiating the December 2020 Mineral Resource estimate, Revival Gold completed 23 infill and exploration core holes at Haidee all of which intersected oxide gold mineralization close to surface. Drilling highlights included 0.93 g/t gold over 28.3 meters and 0.86 g/t gold over 48.5 meters. These results together with drilling results from this year will be incorporated into an updated Mineral Resources estimated targeted for completion in Q1 2022.

Qualified Person

Steven T. Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., is the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold Inc. is a growth-focused gold exploration and development company. The Company is advancing the Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing gold mine in Idaho. A Preliminary Economic Assessment has been completed for a first phase restart of heap leach operations to produce 72,000 ounces of gold per year over an initial seven-year mine life at an AISC of $1,057 per ounce of gold. Meanwhile, exploration continues, focused on expanding the current Indicated Mineral Resource of 36.6 million tonnes at 1.15 g/t gold containing 1.36 million ounces of gold and Inferred Mineral Resource of 47.1 million tonnes at 1.08 g/t gold containing 1.64 million ounces of gold. The mineralized trend at Beartrack extends for over five kilometers and is open on strike and at depth. Mineralization at Arnett is open in all directions.

For further details, including key assumptions, parameters and methods used to estimate the Mineral Resources, and data verification, please see the Company’s NI 43-101 compliant technical report titled, “Preliminary Economic Assessment of the Heap Leach Operation on the Beartrack Arnett Gold Project, Lemhi County, Idaho, USA – NI 43-101 Technical Report”, dated December 17th, 2020.

Revival Gold has approximately 71.2 million shares outstanding and had an estimated cash balance of C$6 million on June 30th, 2021. Additional disclosure including the Company’s financial statements, technical reports, news releases and other information can be obtained at www.revival-gold.com or on SEDAR at www.sedar.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. Technical information in this news release has been reviewed and approved by Steven T. Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., a Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

This News Release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company, or management, expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, the Company’s ability to predict or counteract the potential impact of COVID-19 coronavirus on factors relevant to the Company’s business, failure to identify additional mineral resources, failure to convert estimated mineral resources to reserves with more advanced studies, the inability to eventually complete a feasibility study which could support a production decision, the preliminary nature of metallurgical test results may not be representative of the deposit as a whole, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Swiss Resource Capital AG

E-Mail: info@resource-capital.ch

President & CEO

Telefon: +1 (416) 366-4100

E-Mail: info@revival-gold.com

![]()