Highlights:

- Soil sampling has identified significant extensions of the sub-cropping mineralized copper-silver shale horizon at Tabalosos East, which now extends over 24 kilometres of strike;

- The soil survey confirms both the continuity of previously reported high grade copper mineralization at Tabalosos East which included outcrop mineralization of up to 2.0 metres @ 4.9% copper and 62 g/t silver as well as infilling and significantly extending previous reported soil sample results to the north and west;

- The area is covered by dense jungle vegetation and in parts relatively steep topography. It is estimated that <1% of the bedrock outcrops;

- A total of 2,090 sites have been soil sampled. Additional infill and extension of the area is ongoing given the success of the technique;

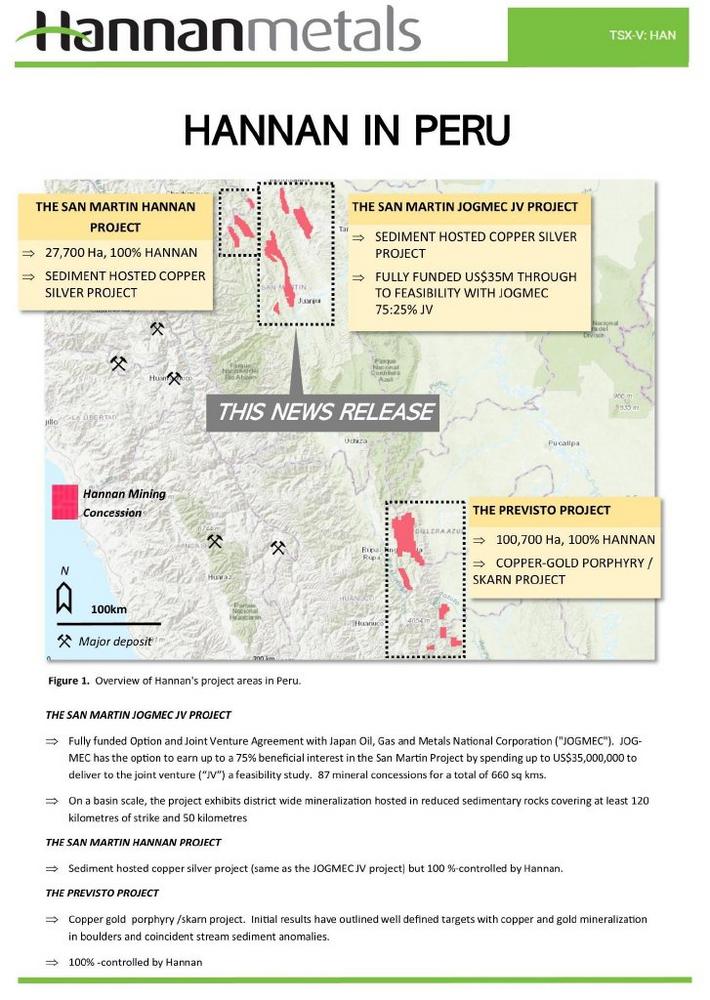

- Tabalosos East is located within a 24 sq km area, which is a small subset of the 815 sq km area Hannan is exploring in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC");

- Next steps are to extend the soil survey to the west and south where scout lines have identified new soil anomalies and commence trench sampling the soil anomalies by hand to expose sub cropping mineralization;

- Permitting to undertake advanced exploration work within Tabalosos East, including diamond drilling, are ongoing with Environmental Impact Statement (Declaración de Impacto Ambiental, or "DIA") baseline studies underway with support of the local communities at Tabalosos East;

Michael Hudson, CEO, states, "These results continue to demonstrate the scale and increased understanding of the continuity of the Company’s vast sediment-hosted copper-silver project in Peru. Although these data confirm the continuity of mineralization over 24 km at Tabalosos East, the area tested represents less than 3% of the total tenured area in joint venture with JOGMEC. The soil sampling technique, utilizing both in-situ and pressed pallet pXRF analysis directly in the field, is working very effectively to test these large areas rigorously, rapidly and cost effectively. We continue to work with the support of the local communities, and environmental permitting for drill planning continues.”

Hannan is rapidly advancing the Tabalosos East target and demonstrating scale and continuity of copper-silver mineralization over 24 kilometres of combined strike, within a 6 kilometre by 4 kilometre area (Figure 2). Three geological teams with more than 10 local assistants and guides are systematically sampling traverses across the densely vegetated jungle. Soil anomalies vary between 20 to 3,811 ppm copper with background ranging from below detection limit to 20 ppm copper. The program consists of approximately 36-line kilometers of survey lines covering an area measuring 6 kilometres by 3 kilometres. The main survey lines are spaced at 250-metre centres running east-west, with shorter infill survey lines spaced at 150-metre centres. Soil samples were collected every 20 metres along each of the survey lines. Approximately 2,090 samples to date have been collected and assayed.

Future work during the dry season at Tabalosos East will focus on continued systematic soil sampling, trenching, and sampling of key soil anomalies and detailed geological mapping to aid in the definition of drill targets.

About the San Martin JOGMEC JV Project (Copper-Silver, Peru, 88 mining concessions for 660 sq km)

On November 30, 2020 Hannan announced that it had signed a binding letter agreement for a significant Option and Joint Venture Agreement (the “Agreement”) with JOGMEC. Under the Agreement, JOGMEC has the option to earn up to a 75% beneficial interest in the San Martin Project by spending up to US$35,000,000 to deliver to the joint venture (“JV”) a feasibility study.

The Agreement grants JOGMEC the option to earn an initial 51% ownership interest by funding US$8,000,000 in project expenditures at San Martin over a four-year period, subject to acceleration at JOGMEC’s discretion.

JOGMEC, at its election, can then earn:

- an additional 16% interest for a total 67% ownership interest by achieving either a prefeasibility study or funding a further US$12,000,000 in project expenditures in amounts of at least US$1,000,000 per annum (for a US$20,000,000 total expenditure); and,

- subject to owning a 67% interest, a further 8% interest for a total 75% ownership interest by achieving either a feasibility study or funding a further US$15,000,000 in project expenditures in amounts of at least US$1,000,000 per annum (for a US$35,000,000 total expenditure).

Should JOGMEC not proceed to a prefeasibility study or spend US$20,000,000 in total, Hannan shall have the right to purchase from JOGMEC for the sum of US$1, a two percent (2%) Participating Interest, whereby Hannan’s Participating Interest will be increased to fifty-one percent (51%) and JOGMEC’s Participating Interest will be reduced to forty-nine percent (49%).

At the completion of a feasibility study, JOGMEC has the right to either:

- purchase up to an additional ten percent (10%) Participating Interest from Hannan Metals (for a total 85% maximum capped Participating Interest) at fair value as determined in accordance with internationally recognized professional standards by an agreed upon independent third-party valuator; or

- receive up to an additional ten percent (10%) Participating Interest from Hannan (for a total 85% maximum capped Participating Interest) in consideration of JOGMEC’s agreement to fund development of the project, by loan carrying Hannan until the San Martin Project generates positive cash flow.

After US$35,000,000 has been spent by JOGMEC and before a feasibility study has been achieved, both parties will fund expenditures pro rata or dilute via a standard industry dilution formula. If the Participating Interest in the Joint Venture of any party is diluted to less than 5% then that party’s Participating Interest will be automatically converted to a 2.0% net smelter royalty (“NSR”), and the other party may at any time purchase 1.0% of the 2.0% NSR for a cash payment of US$1,000,000. Hannan will manage exploration at least until JOGMEC earns a 51% interest, after which the majority participant interest holder will be entitled to act as the operator of the joint venture. Initial exploration activities will focus on the collection of the geological, geophysical, and geochemical datasets in the JV project areas.

Sediment-hosted stratiform copper-silver deposits are among the two most important copper sources in the world, the other being copper porphyries. They are also a major producer of silver. According to the World Silver Survey 2020 KGHM Polska Miedz’s (“KGHM”) three copper-silver sediment-hosted mines in Poland are the leading silver producer in the world with 40.2Moz produced in 2019. This is almost twice the production of the second largest producing mine. The Polish mines are also the sixth largest global copper miner and in 2018, KGHM produced 30.3 Mt of ore at a grade of 1.49% copper and 48.6 g/t silver from a mineralized zone that averages 0.4 to 5.5 metres thickness.

Technical Background

All soil samples were collected by Hannan geologists using an in-house protocol for soil sampling in jungle areas. The samples were subsequently analyzed with a portable XRF deploying a protocol developed by Hannan for the San Martin project. The method is designed to minimize risk of contamination and ground disturbance. In most cases the sample media is the “B-horizon” of the soil profile. Only 100g of sample material is collected from each site. From the soil sample a pellet is being produced which is dried and analyzed by a portable XRF (pXRF). Certified reference material, blanks and field duplicates are routinely added to monitor the quality of the pXRF data. In addition, 10% of all samples are submitted to ALS in Lima for 4-acid ICP-MS analysis to check the quality of the pXRF data.

Channel samples are considered representative of the in-situ mineralization samples and sample widths quoted approximate the true width of mineralization, while grab samples are selective by nature and are unlikely to represent average grades on the property.

About Hannan Metals Limited (TSXV:HAN) (OTCPK: HANNF)

Hannan Metals Limited is a natural resources and exploration company developing sustainable resources of metal needed to meet the transition to a low carbon economy. Over the last decade, the team behind Hannan has forged a long and successful record of discovering, financing, and advancing mineral projects in Europe and Peru. Hannan is a top ten in-country explorer by area in Peru.

Mr. Michael Hudson FAusIMM, Hannan’s Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

On behalf of the Board,

"Michael Hudson"

Michael Hudson, Chairman & CEO

Further Information

www.hannanmetals.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez, Corporate Secretary,

+1 (604) 685 9316, info@hannanmetals.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Forward Looking Statements. Certain disclosure contained in this news release may constitute forward-looking information or forward-looking statements, within the meaning of Canadian securities laws. These statements may relate to this news release and other matters identified in the Company’s public filings. In making the forward-looking statements the Company has applied certain factors and assumptions that are based on the Company’s current beliefs as well as assumptions made by and information currently available to the Company. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. These risks and uncertainties include but are not limited to: the political environment in which the Company operates continuing to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; planned work programs; permitting; and community relations. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()