Highlights:

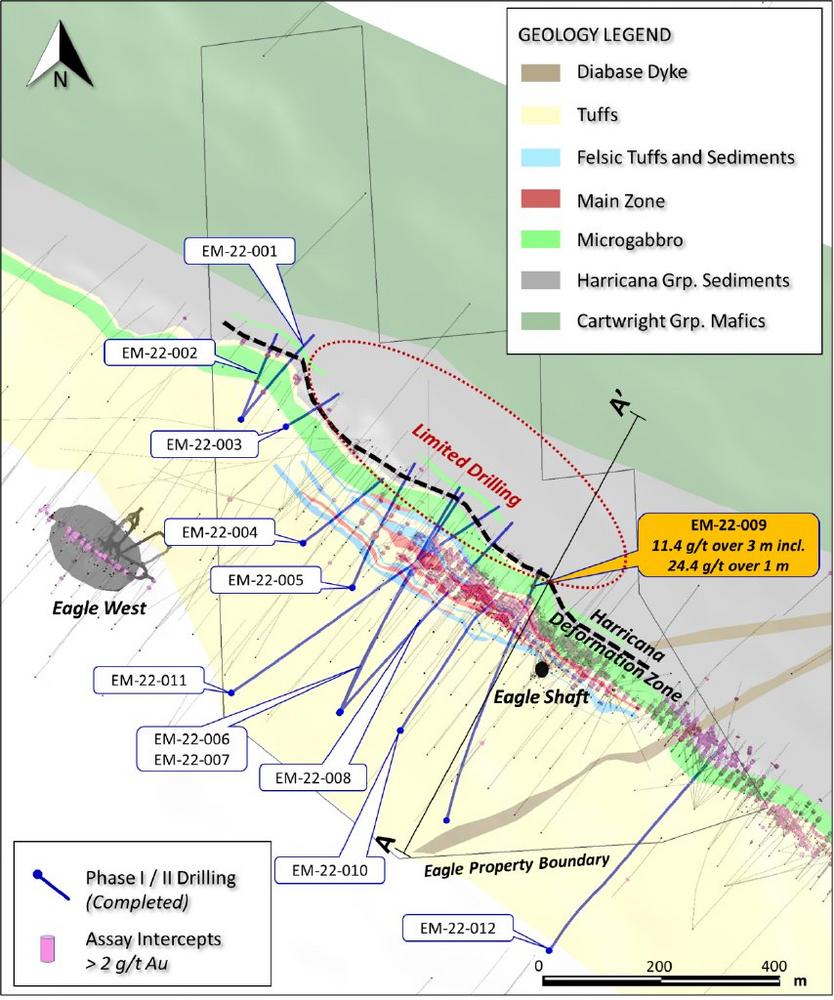

- Drill hole EM-22-009 intersected 4 grams per tonne gold ("g/t Au") over 3 m, including 24.4 g/t Au over 1 m, to the north of the modeled main Eagle-Telbel mine horizon in the hanging wall microgabbro (see Figure 1 for drill hole locations)

- The new EM-22-009 intercept and other notable high-grade historical intercepts hosted in the same microgabbro unit (including hole 16-77: 26.7 g/t Au over 2.5 m and hole 16-71: 26.4 g/t over 1.4 m within 14.3 g/t over 2.9 m) all point to the potential significance of this favourable structural-stratigraphic target

- Limited historical drilling in the hanging wall (see Figure 1) was not typically assayed for gold as previous operators were not focused on this mineralization style and target type

- The Company has drilled ~16,450 m out of approximately 30,000 m planned in 2022 across its Québec project portfolio; Eagle assays have now been reported for ~5,400 m (representing 59% of completed Eagle drilling)

“These initial Phase II assays include the best result thus far from our 2022 drilling at Eagle and the location of the intercept holds great significance for our exploration targeting going forward, including Phase III drilling later this year,” stated Matthew Hornor, President and CEO of Maple Gold. “While core cutting has recently been impacted by electrical issues at site, we are implementing temporary and permanent solutions to improve efficiency and we expect the assay backlog to ease in the coming weeks. I am also delighted to welcome Kiran in his expanded role with the Company and we look forward to his experience as we navigate through our strategic and corporate finance initiatives.”

Interpretation and Summary of Results

The highlighted intercept in EM-22-009 is located to the north of the main modeled Eagle mine horizon in the hanging wall microgabbro. There is limited historical drilling in the hanging wall at Eagle and drill holes were not typically assayed for gold as previous operators were not focused on this mineralization style and favourable structural-stratigraphic target type. The new EM-22-009 intercept and other notable high-grade historical intercepts hosted in the same microgabbro unit (see Figure 2) are further indications of additional styles of gold mineralization at Eagle beyond the known Eagle-Telbel style mined historically and suggest multiple gold events that may provide for broader gold distribution than previously interpreted.

The EM-22-009 intercept is significant because these results are not found within the broadly conformable horizon mined at Eagle in the past, but instead within a microgabbro some distance to the north, which is characterized by an increase in intensity of alteration and deformation associated with a quartz-carbonate-pyrite vein zone (see Plates 1 and 2), which the Company’s geologists believe is structurally-controlled and therefore inconsistent with the syn-volcanic exhalative style of mineralization used as a predictive model in the past. Thus, in addition to pursuing favorable stratigraphic horizons (syn-volcanic exhalative gold mineralization), it is now justifiable to pursue superimposed structural targets (orogenic gold mineralization) as well.

The Company’s Phase I/II drilling at Eagle has confirmed that in addition to the conformable semi-massive pyrite horizon mined historically at Eagle-Telbel, multiple additional zones which may or may not be conformable, overlapping with the Harricana Deformation Zone, are also prospective. This includes not only the microgabbro interval, but also the Harricana Group sediments still further to the north. The Harricana Group sediments to Cartwright Group basalts contact may represent a further, largely untested target (see Figure 2).

Phase III drilling at Eagle, which is expected to commence in Q4/2022, will follow-up not only on the best results of the first two drilling phases, but also on the results of previous downhole electromagnetic ("EM") surveys, on ranked airborne EM targets from the recently competed Mag-EM survey (see news from July 19, 2022), and on a recently completed high-resolution drone magnetic survey.

Operational Update

Due to recent electrical issues at site, the Company has faced challenges with its core saws resulting in a temporary backlog of assay results. The Company has contracted third-party core cutting providers to secure its immediate needs, has procured standby equipment, and is making necessary upgrades to ensure long-term efficiencies and redundancies so that similar problems are avoided in the future.

Executive Appointment

Maple Gold is pleased to announce the appointment of Kiran Patankar as Chief Financial Officer of the Company replacing Gregg Orr. Mr. Patankar has held the position of Senior Vice President, Growth Strategy with the Company since 2021 and will continue to apply his skills and experience to the execution of corporate strategy and evaluation of strategic initiatives. He is an accomplished mining executive with more than 15 years of progressively senior investment banking and public company executive experience including responsibility for executing M&A and corporate finance transactions totaling more than $3 billion, project evaluation and development, contract negotiation, stakeholder engagement and corporate governance. Mr. Patankar holds a Master of Business Administration (MBA) from the Yale School of Management and a Bachelor of Science (BS) in Geological Engineering from the Colorado School of Mines.

Option Issuance

The Company has approved the grant to certain employees and officers of stock options ("Options") to purchase an aggregate of 1,050,000 common shares of the Company at an exercise price of $0.26 per common share. The Options have a 5-year term and vest 1/3 immediately, 1/3 in 12 months and 1/3 in 24 months from the date of grant until fully vested.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

Quality Assurance (QA) and Quality Control (QC)

The Company implements strict Quality Assurance ("QA") and Quality Control ("QC") protocols at Eagle covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drillhole surveying; core transport; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to the Val d’Or, Québec AGAT laboratory; sample preparation for assaying; and analysis, recording and final statistical vetting of results. For a complete description of protocols, please visit the Company’s QA/QC webpage at www.maplegoldmines.com.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Québec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit www.maplegoldmines.com.

Forward Looking Statements:

This press release contains "forward-looking information" and "forward-looking statements" (collectively referred to as "forward-looking statements") within the meaning of applicable Canadian securities legislation in Canada, including statements about exploration work and results from current and future work programs. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()