The Company’s initial MRE on the Con Mine option Property is comprised of an underground mineral resource of 109,000 gold ounces in the Indicated category and 432,000 ounces of gold in the Inferred category (see Table below). In addition, the Company has 1.2 Moz inferred resources (see March 31, 2021 Technical Report) on their adjacent 100% owned YCG property. This extensive land package is close to the City of Yellowknife with all its extensive existing infrastructure.

Mineral Resource Estimate Highlights

Con Mine Option Property initial MRE:

- Underground Indicated Mineral Resource of 0.45million tonnes averaging 7.55 g/t for 109,000 ounces of contained gold

- Underground Inferred Mineral Resource of 2.0 million tonnes averaging 6.74 g/t for 432,000 ounces of contained gold

Chairman and CEO, Gerald Panneton, commented, “This initial mineral resource estimate (MRE) on the Con Mine Option Property represents a measuring stick of our progress toward satisfying one of the requirements of the option agreement with Newmont, namely delineating a potential of a minimum of 1.5 million ounces of gold in all categories. This initial MRE confirms the significant high-grade potential of this project as it remains open for further expansion in all directions, and along its 6-kilometre-long structure. The Con Mine produced more than 5 million ounces of high-grade gold (16 g/t Au) from the Campbell Shear structure on 2 kilometres of strike length alone. We strongly believe that additional drilling along strike and at depth will continue to expand the current MRE, as all the surface drilling so far has been very successful. The Company has spent approximately $6.2 million for an approximate cost of $12 per ounce of gold to date.”

Mr. Panneton further commented, “We look forward to continuing our drilling program on the Campbell Shear with the goal of advancing the project towards an economic study and bringing further value to our shareholders by discovering more multi-million ounces deposits on our projects.”

Mineral Resource Estimate

This initial Con Mine Option Property MRE incorporates a total of 41 diamond drill holes totaling 21,019 metres, completed by Gold Terra from September 2020 to June 2022 and all existing historic holes drilled before 2003, as interpreted by Gold Terra. The Yellorex Indicated resource was drilled on 25 to 50-metre spacing, between surface and 300 metres, and remains open at depth.

This MRE on the Con Mine Option Property demonstrates the success and progress of Gold Terra’s recent drilling programs toward satisfying the minimum 1.5 million ounces of gold requirement in all resource categories, under the option agreement with subsidiaries of Newmont Corporation (see details below under Option to Acquire the Con Mine Property).

The table below shows the MRE for the Con Mine Option Property and the Company’s adjacent YCG Project, which was reported in the March 16, 2021 news release and subsequent Technical Report dated March 31, 2021. The Company has not updated the YCG MRE with the positive results from the 2022 winter drilling program of 6,011 metres in the Mispickel area, part of the Northbelt block. More drilling is required on these multiple high-grade mineralized structures located only 20 kilometres north of the City of Yellowknife.

Mineral Resource Estimate: Con Mine Option Property (Effective date of September 2, 2022) and YCG Project (Effective date of March 14, 2021):

(1) The current Indicated and Inferred mineral resource was estimated by Allan Armitage, Ph.D., P. Geo., (“Armitage” or the “Author”) of SGS Geological Services. Armitage is an independent Qualified Person as defined by NI 43-101 and is responsible for the MRE. The effective date of the mineral resource estimate is September 2, 2022.

(2) Armitage conducted a site visit to the Property on August 15, 2022.

(3) The classification of the current Mineral Resource Estimate into Inferred is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves

(4) All figures are rounded to reflect the relative accuracy of the estimate.

(5) All Resources are presented undiluted and in situ, constrained by 3D wireframe models within broader shear zone models, and are considered to have reasonable prospects for eventual economic extraction.

(6) Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(7) Resource modelling, based on historic and recent drilling, was completed by Gold Terra geologists and reviewed by Armitage. Minor revisions were made based on the review.

(8) It is envisioned that the Yellorex-Kam (Campbell Shear) deposits may be mined using lower cost underground bulk mining methods. A selected base case cut-off grade of 3.5 g/t Au is used to determine the underground mineral resource.

(9) Values in this table reported above and below the base case cut-off grade should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of cut-off grade.

(10) High grade capping was done on 1.0 m composite data. A capping value of 28 g/t Au was applied.

(11) A Specific gravity value of 2.80 was determined based on physical specific gravity test work from other similar deposits on the Property.

(12) Gold was estimated for the Yellorex-Kam deposits using the the inverse distance cubed (ID3) interpolation method. Blocks within each mineralized domain were interpolated using only composites assigned to that domain.

(13) The base case cut-off grade is based on a gold price of US$1,750 per ounce, a gold recovery of 92%, processing and G&A cost of $US63.00 per tonne milled, and a mining cost of $US98.00 for underground. The cut-off grade should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

(14) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues

(15) Armitage is not aware of any known mining, processing, metallurgical, environmental, infrastructure, economic, permitting, legal, title, taxation, socio-political, or marketing issues, or any other relevant factors that could materially affect the current MRE.

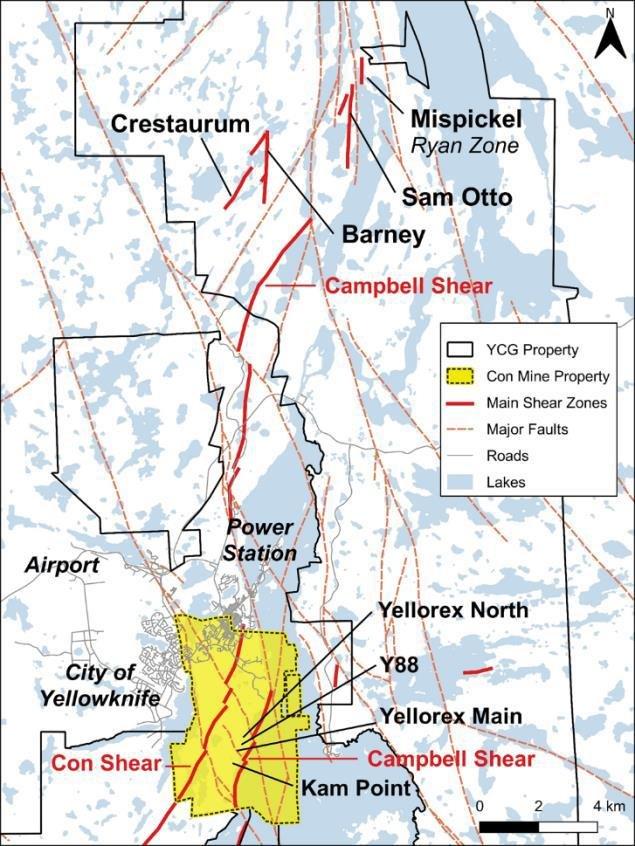

The MRE on the Con Mine Option Property includes three gold deposits – Yellorex Main, Yellorex North, and Kam Point (Figures 1 and 2). The MRE on the YCG Project includes four gold deposits – Sam Otto, Mispickel, Crestaurum and Barney (Figure 1).

Potential to Increase Mineral Resources on the Con Mine Option Property

The Yellowknife gold camp was developed along the Campbell Shear, a significant structure on the belt and host to the Giant and Con gold mines which produced a combined 14 million ounces of gold. The Company’s strategy is to continue drilling on the Campbell Shear at depth and south of the Con Mine to further increase the mineral resources. The exploration potential along the Campbell Shear south of the Con Mine is shown in Figure 3.

The Company is planning a winter 2023 drilling program which will include testing all zones mentioned in the initial MRE at depth and along strike, south of the Mine. If budget permits, the Company also will be testing the Campbell shear at depth of up to 2000 metres below surface.

SGS used Geovia Gems software to construct mineralized wireframes for each zone and then interpolated tonnage and grade into block models constrained by the mineralized wireframes and used inverse distance squared (ID2) or inverse distance cubed (ID3) interpolation. Appropriate interpolation parameters were generated for each deposit based on the mineralization style and geometry.

Option to Acquire the Con Mine Property (Con Mine Option Property)

Gold Terra entered into a definitive option agreement (the "Option Agreement") with Newmont Canada FN Holdings ULC ("Newmont FN") and Miramar Northern Mining Ltd. ("MNML"), both wholly owned subsidiaries of Newmont Corporation, which grants Gold Terra the option, upon meeting certain minimum requirements, to purchase MNML from Newmont FN (the "Transaction"), which includes 100% of all the assets, mineral leases, Crown mineral claims, and surface rights comprising the Con Mine, as well as the areas immediately adjacent to the Con Mine, as shown in Exhibit A (the "Con Mine Option Property" (see November 22, 2021 news release).

Under the Option Agreement, Gold Terra has agreed to incur a minimum of $8.0 million in exploration expenditures over a period of four (4) years, which will include all exploration expenditures incurred to date under the initial Exploration Agreement. Gold Terra has also agreed to complete a mineral resource estimate containing a minimum of 1.5 million ounces in all categories, consisting of a minimum of 40% of a measured and indicated resource and not more than a 60% inferred resource; obtain all necessary regulatory approvals for the purchase and transfer of MNML’s assets and liabilities to Gold Terra; and post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing. The closing of the Transaction will then be completed with Gold Terra making a final cash payment of $8.0 million.

NI 43-101 Technical Report

A NI 43-101 Technical Report disclosing the MRE for the Con Mine Option Property will be filed on SEDAR (www.sedar.com) within 45 days.

Qualified Persons

The MRE for Con Mine Option Property and YCG Project was prepared by Dr. Allan Armitage, P.Geo. from SGS, an Independent Qualified Person as defined under NI 43-101.

Dr. Allan Armitage and Joe Campbell, P. Geo., Chief Operating Officer for Gold Terra, a Qualified Person within the meaning of NI 43-101, have reviewed and approved the technical information contained in this news release.

Technical Information and Quality Control Procedures

Gold Terra’s drilling programs are monitored through the implementation of a quality assurance and quality control (QA/QC) program. The drill core (NQ size) is logged and sample intervals for assay are selected by Gold Terra’s geologists. In general, the sampling intervals vary from half-a-metre to one-metre in length depending on the geology and mineralization observed. The drill core samples are cut by diamond saw at Gold Terra’s core facilities in Yellowknife. Half of the core sample is left in the core box and stored in a dedicated core storage facility in Yellowknife. The other half-core samples are transported in securely sealed bags by Gold Terra personnel to ALS Limited (“ALS”) preparation laboratory in Yellowknife. After sample preparation, samples are shipped to ALS Vancouver facility for gold and a complete digestion four acid ICP analysis for 33 elements. Gold assays of >3 g/t are re-assayed on a 30-gram split by fire assay with a gravimetric finish. ALS is a certified and accredited laboratory service operating to ISO 17025 standards. ALS routinely inserts certified gold standards, blanks and pulp duplicates, and results of all QC samples are reported. Gold Terra inserts certified standards and blanks into the sample stream as a check on laboratory QC.

In addition to traditional assay methods, Gold Terra also carries out a variety of spectrometry tests on selected core and rock samples to determine the associated mineral characterization and the gold deportment within the mineralized zones.

About Gold Terra

The YCG project encompasses 800 sq. km of contiguous land immediately north, south and east of the City of Yellowknife in the Northwest Territories. Through a series of acquisitions, Gold Terra controls one of the six major high-grade gold camps in Canada. Being within 10 kilometers of the City of Yellowknife, the YCG is close to vital infrastructure, including all-season roads, air transportation, service providers, hydro-electric power, and skilled tradespeople. Gold Terra is currently focusing its drilling on the prolific Campbell shear, where 14 Moz of gold has been produced, and most recently on the Con Mine Option claims immediately south of the past producing Con Mine (1938-2003).

The YCG lies on the prolific Yellowknife greenstone belt, covering nearly 70 kilometers of strike length along the main mineralized shear system that host the former-producing high-grade Con and Giant gold mines. The Company’s exploration programs have successfully identified significant zones of gold mineralization and multiple targets that remain to be tested which reinforces the Company’s objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

Visit our website at www.goldterracorp.com.

For more information, please contact:

Gerald Panneton, Chairman & CEO

[email=gpanneton@goldterracorp.com%0d]gpanneton@goldterracorp.com[/email]

Mara Strazdins, Manager of Investor Relations

Phone: 1-778-897-1590 | 604-689-1749 ext 102

strazdins@goldterracorp.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information Concerning Estimates of Mineral Resources

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Therefore, investors are cautioned not to assume that all or any part of an Inferred Mineral Resource could ever be mined economically. It cannot be assumed that all or any part of “Measured Mineral Resources,” “Indicated Mineral Resources,” or “Inferred Mineral Resources” will ever be upgraded to a higher category. The Mineral Resource estimates contained herein may be subject to legal, political, environmental or other risks that could materially affect the potential development of such mineral resources. Refer to the Technical Report, once filed, for more information with respect to the key assumptions, parameters, methods and risks of determination associated with the foregoing.

Cautionary Note to United States Investors

The Company prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to Mineral Resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended ("CIM Standards"). The U.S. Securities and Exchange Commission (the "SEC") has adopted amendments effective February 25, 2019 (the "SEC Modernization Rules") to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934. As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources", which are defined in substantially similar terms to the corresponding CIM Standards. In addition, the SEC has amended its definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" to be substantially similar to the corresponding CIM Standards.

U.S. investors are cautioned that while the foregoing terms are "substantially similar" to corresponding definitions under the CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any Mineral Resources that the Company may report as "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" under NI 43-101 would be the same had the Company prepared the Mineral Resource estimates under the standards adopted under the SEC Modernization Rules. In accordance with Canadian securities laws, estimates of "Inferred Mineral Resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Cautionary Note Regarding Forward-Looking Information

Certain statements made and information contained in this news release constitute "forward-looking information" within the meaning of applicable securities legislation ("forward-looking information"). Generally, this forward-looking information can, but not always, be identified by use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events, conditions or results "will", "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotations thereof.

All statements other than statements of historical fact may be forward-looking information. Forward-looking information is necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information. In particular, this news release contains forward-looking information regarding the current drilling on the Campbell Shear, potentially adding ounces to the Company’s current YCG mineral resource, and the Company’s objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

There can be no assurance that such statements will prove to be accurate, as the Company’s actual results and future events could differ materially from those anticipated in this forward-looking information as a result of the factors discussed in the "Risk Factors" section in the Company’s most recent MD&A and annual information form available under the Company’s profile at www.sedar.com.

Although the Company has attempted to identify important factors that would cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All of the forward-looking information contained in this news release is qualified by these cautionary statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof. Except as required under applicable securities legislation and regulations applicable to the Company, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()