Highlights:

- Hole AP-23-292

- 1 metres @ 8.3 grams per tonne (g/t) gold including;

- 2 metres @ 11.0 g/t gold

- Hole AP-23-291

- 5 metres @ 5.4g/t gold including;

- 5 metres @ 11.0 g/t gold including;

- 0 metres @ 48.5 g/t gold

- These first drill results confirm our drilling thesis, which we believe will lead to a larger and higher grade core within the Ana Paula deposit

Heliostar Metals Ltd. (TSX.V: HSTR, OTCQX: HSTXF, FRA: RGG1) – https://www.commodity-tv.com/ondemand/companies/profil/heliostar-metals-ltd/ – (“Heliostar” or the “Company” – ) is pleased to report its first drill results from the Ana Paula project in Mexico. These two holes are the first drilled into the property by Heliostar, with the on-going drill program targeting the High Grade Panel at the core of Ana Paula that Heliostar believes has the potential to host a high margin, underground gold mine development opportunity.

Heliostar CEO, Charles Funk, commented, “We are thrilled with the first holes at Ana Paula. Drill results like this are rare anywhere in the world. Ana Paula’s high grade and consistently wide intervals of gold mineralization demonstrate the underground mine potential. Heliostar will continue the 16-24 hole program designed to increase the Ana Paula resource, with a focus on infill and expansion of the High Grade Panel. Both holes exceeded expectations based on the current resource model. Hole AP-23-291 is particularly encouraging as it returned a 30% increase relative to the current resource model, at a >5 g/t cut-off grade. This builds confidence that infill drilling can increase ounces and potentially lift the overall grade of the deposit.”

Ana Paula is an advanced gold project with an open pit mine permit, a prefeasibility study1 and over US$75M in recent exploration and development expenditures. These results are the first in a re-scoping of the asset with a view to underground mining. The re-scoping program includes drilling, underground mine design, geometallurgical optimization studies and a resource update, all of which will be delivered in 2023. The company believes this program will deliver a technically simpler and materially improved Net Present Value (NPV) for the project.

Drill Details

The Company’s drill program centres on resource and reserve growth, a key priority of the effort to re-evaluate the project as a high-grade underground mine. The Company expects the drilling data will improve resource estimation and allow the Company to evaluate potential expansion of the High Grade Panel. In addition, the drilling also generates the geotechnical data required for engineering evaluations and metallurgical test work for flow sheet optimization.

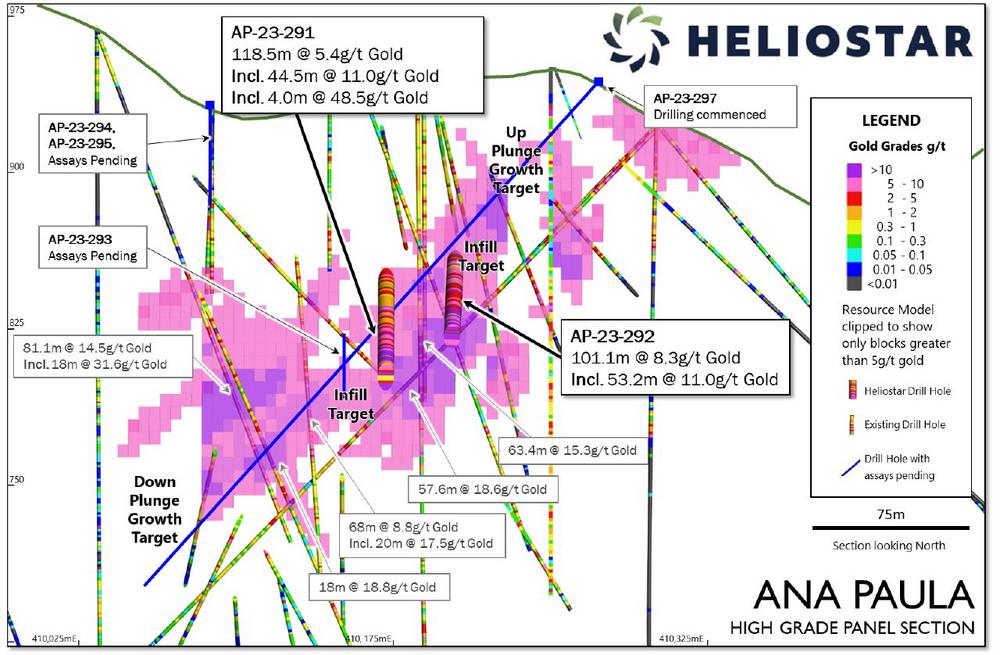

Presently, the High Grade Panel is approximately 250 metres long by 100 metres high by 60 metres thick. It begins at surface and plunges 40 to 45 degrees to the west. Previous operators’ drill holes across the panel returned intercepts including 63.4 metres at 15.3 g/t gold and 57.6 metres at 18.6 g/t gold. The panel is hosted primarily in a polymictic breccia unit, although it extends outward into the surrounding granodiorite and limestone. Gold mineralization is directly associated with the proportion of sulphide minerals in the rock. This provides a valuable visual key to the presence of gold mineralization.

There are two key opportunities to increase the resource, reserve, and grade of the High Grade Panel. Firstly, volume increase is possible both up- and down-dip of the current plunging mineralized panel (Figure 1). Secondly, the High Grade Panel is inadequately defined by historic drilling. The High Grade Panel contains areas of closer spaced drilling, less than 25 metres apart, and other gaps with greater than 40 metre spacing. In these greater than 40 metre gaps, despite consistent geology and mineralization in the nearby holes, the resource model has conservatively reduced the grade with increasing distance from data points (Figure 1). The two infill holes reported here, particularly hole AP-23-291, demonstrate this upside, with a significant increase in high grade (greater than >5 g/t) than predicted by the resource model.

Drill Results

Drill holes AP-23-291 and AP-23-292 (Heliostar has continued the historic drill hole naming conventions) targeted the east and west margins of the greater than 10 g/t gold core of the High Grade Panel. The goal was to infill gaps in the drilling and expand areas of existing high-grade. Holes have been oriented perpendicular to the strike of the polymictic breccia. These holes are designed to grow the resource and improve the resolution of the north and south boundaries of mineralization.

The drilling program utilized PQ-sized core to provide larger sample volumes for metallurgical testing.

Results from both drill holes show the grade, consistency, and widths that typify Ana Paula. Hole AP-23-292 intersected 101.12 metres at 8.35 g/t gold including 53.2 metres at 11.0 g/t. Hole AP-23-291 intersected 118.55 metres at 5.4 g/t gold including 44.5 metres at 11.0 g/t. These holes improve the drill data resolution and should grow the resource, due to the grades and width of the gold encountered.

Gold mineralization is remarkably consistent within the High Grade Panel. The 53.2 metre interval at 11.0 g/t gold in hole AP-23-292 contains only 1 sample out of 56 with less than 2 g/t gold. The 44.5 metre interval at 11.0 g/t gold in hole AP-23-291 contains only 6 samples out of 48 with less than 2 g/t gold.

As gold mineralization is widespread and disseminated in nature, estimating representative true dimensions from the drill results can be done in multiple directions. Vertically, the true height of the intercepts is estimated in the range of 60-80% of the drill intervals and in a north-south direction the true width is in the range of 30-50% of the drilled intervals. Holes were drilled from north to south, into the hillside to reduce the total drill metres required for each intercept (Figure 2).

Drill Results Impact

The potential impact of the drill results on future resource models can be demonstrated by comparing the current results to the existing model (as reported in the 2023 prefeasibility study1). Drilling that outperforms (i.e., is higher grade or wider than) the model may be expected to improve the grade and size of future resource and reserve estimates. Using a 5 g/t cut-off grade provides a useful benchmark to the most financially impactful ounces in an underground mining scenario.

At a 5 g/t cutoff, hole AP-23-291 has a 30% increase when compared to an expected intercept calculated from the existing resource model. Using the same criteria, AP-23-292 has a 2% increase compared to the expected intercept from the resource model.

Drill Progress

Drilling is ongoing, with six holes completed to date. Hole AP-23-293 is approximately 20 metres west of hole AP-23-291 and has returned a similar length interval with strong sulphide mineralization. Holes AP-23-294, AP-23-295 and AP-23-296 (not shown in Figure 1 as it is off-section toward the north) were completed shallower and further west than AP-23-293 and intercepted narrower zones of mineralization as expected at the top and above the High Grade Panel. The drill rig has been moved and commenced testing the up-dip growth target with hole AP-23-297 (See Figure 1 for locations).

Quality Assurance / Quality Control

Core samples were shipped to ALS Limited in Santiago Queretaro, Queretaro for sample preparation and for analysis at the ALS Laboratories in North Vancouver. The ALS Queretaro and North Vancouver facilities are ISO/IEC 17025 certified. Gold was assayed by 30-gram fire assay with atomic absorption spectroscopy finish and overlimits were analysed by 50g fire assay with gravimetric finish.

Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Statement of Qualified Person

Stewart Harris, P.Geo., a Qualified Person, as such term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Historical information contained in this news release cannot be relied upon as Stewart Harris has not prepared nor verified such information.

About Heliostar Metals Ltd.

Heliostar is a junior mining company with a portfolio of high-grade gold projects in Mexico and Alaska.

The Company is focused on developing the 100% owned Ana Paula Project in Guerrero, Mexico. In addition, Heliostar is working with the Mexican federal and local government to permit the San Antonio Gold Project in Baja Sur, Mexico. The Company continues efforts to explore the Unga Gold Project in Alaska, United States of America.

The Ana Paula Project deposit contains proven and probable mineral reserves of 1,081,000 ounces of gold at 2.38 grams per tonne (“g/t”) gold and 2,547,000 ounces of silver at 5.61 g/t silver. Ana Paula hosts measured and indicated resources of 1,468,800 ounces of gold at 2.16 g/t gold and 3,600,000 ounces of silver at 5.3 g/t silver. The asset is permitted for open-pit mining and contains significant existing infrastructure including a portal and a 412-metre-long decline.

References

- An updated prefeasibility study titled “Ana Paula Project NI 43-101 Technical Report Preliminary Feasibility Study Update” was filed on SEDAR on April 6, 2023, with an effective date of February 28, 2023, prepared for the Company by Daniel H. Neff, PE, Art S. Ibrado, PhD, PE, Richard K. Zimmerman, RG, SME-RM, Craig Gibson, PhD, CPG, Andrew Kelly, P.Eng., Gordon Zurowski, P.Eng., Paul Daigle, P.Geo., Gilberto Dominguez, PE and James A. Cremeens, PE, PG.

For additional information please contact:

Charles Funk

Chief Executive Officer

Heliostar Metals Limited

Email: charles.funk@heliostarmetals.com

Rob Grey

Investor Relations Manager

Heliostar Metals Limited

Email: rob.grey@heliostarmetals.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the exploration, development, and production at the Company’s properties; permitting at the San Antonio project; the release of exploration results; and future resource and reserve estimates.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of metals; no escalation in the severity of public health crises or ongoing military conflicts; costs of exploration and development; the estimated costs of development of exploration projects; and the Company’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect the Company’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company’s mining activities in foreign jurisdictions; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding exploration and mining activities; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises, ongoing military conflicts and general economic factors to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in the Company’s public disclosure documents. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()