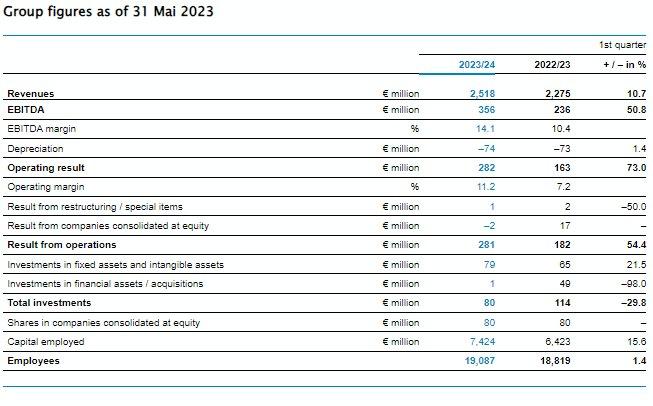

Group EBITDA climbed significantly to EUR 356 (previous year: 236) million.

The consolidated group operating result improved significantly to EUR 282 (previous year: 163) million. A significant decline in the CropEnergies segment and a moderate decline in the starch segment were offset by a significant increase in all other segments.

Sugar segment’s sales revenues up significantly

The sugar segment’s revenues rose significantly to EUR 924 (previous year: 727) million. The increase was achieved despite declining volumes as a result of the poor 2022 harvest, with significantly higher sales revenues.

The operating result improved significantly to EUR 169 (previous year: 1) million. The strong rise in costs, particularly for raw materials and energy, was offset by higher prices since the end of the last fiscal year.

2023 beet cultivation

Südzucker Group’s beet cultivation area in 2023 was up 7.9 percent year-on-year to about 350,100 (previous year: 324,500) hectares. The months of March and April 2023 saw cool and wet weather in almost all regions. As a result, beet sowing did not really begin until the end of March, but had to be interrupted repeatedly due to rainfall. Consequently, it lasted for several weeks and could not be completed until the end of April/beginning of May – around three to five weeks later than in the previous year.

Special products segment reports significantly improved results

The special products segment’s revenues of EUR 611 (previous year: 515) million were significantly higher than the previous year’s figure. The main driver of this positive development was substantially higher prices, while volumes showed a mixed trend.

The operating result climbed significantly to EUR 52 (previous year: 30) million. The main growth drivers here were higher margins overall. In the first quarter, our efforts to cover the negative impact of a significant increase in raw material, packaging and energy costs through higher selling prices were more effective.

High raw material costs impact CropEnergies segment

Revenues in the CropEnergies segment dropped significantly to EUR 289 (previous year: 377) million. In addition to a clearly lower sales volume due to scheduled maintenance shutdowns, the marked fall in ethanol prices also contributed to this development.

The operating result followed the sales and revenue development and remained at EUR 14 (previous year: 87) million in the period under review, significantly below the exceptionally strong quarter of the previous year. While CropEnergies was still able to benefit from the positive effects of early price hedging for raw materials in the same quarter of the previous year, the interim price increase on the markets is now also reflected in net raw material costs. Higher by-product revenues were also unable to fully compensate for significantly higher raw material costs, and higher net raw material costs had a negative impact.

Stable starch segment

The starch segment’s revenues remained stable at EUR 293 (previous year: 295) million. The significant overall increase in sales volumes largely offset the substantial decline in volumes.

However, operating result declined moderately to EUR 23 (previous year: 25) million in the reporting period. Overall, significantly higher raw material and energy costs, lower volumes and higher other costs could not be fully offset by substantial price increases.

Fruit segment posts positive performance in results

The fruit segment’s revenues of EUR 401 (previous year: 361) million were significantly higher than last year. The increase in revenues was price-driven for both fruit preparations and fruit juice concentrates. The slight decline in volumes for fruit preparations and the significant drop in sales volumes for fruit juice concentrates could be offset.

At EUR 24 (previous year: 20) million, the operating result also significantly exceeded the previous year’s level. The profit contribution from fruit preparations was up despite a slight decline in volumes and higher costs due to significantly higher margins. The profit contribution from fruit juice concentrates also improved. Higher prices more than offset higher costs and the clear downturn in sales volumes.

Forecast for operating result for fiscal 2023/24 raised again

The Ukraine war, which has continued from the start of fiscal year 2022/23 to the present day, has generally intensified the already existing high volatility in the target markets and price increases in the procurement markets, particularly in the raw materials and energy sectors. Despite currently lower volatility, the economic and financial ramifications, the security of supply and the duration of this temporary exceptional situation – with a view to the full 2023/24 fiscal year – remain difficult to assess.

The Group outlook for the 2023/24 fiscal year was first published on 15 December 2022, and increased on 18 April 2023. Now it will be raised again in this quarterly statement. Südzucker continues to expect group revenues of EUR 10.4 to 10.9 (2022/23: 9.5) billion. The sugar, special products and starch segments‘ revenues are forecast to increase significantly, while the fruit segment’s revenues are anticipated to increase moderately. The CropEnergies segment’s revenues are likely to be at the prior year’s level.

The consolidated group operating result is now expected to range between EUR 850 and 950 (previous forecast: 725 to 875; 2022/23: 704) million. The operating result forecast for the sugar segment is increased to a range between EUR 500 and 600 (previous forecast: 400 to 500; 2022/23: 230) million, with the other segments‘ forecasts remaining unchanged. The special products segment’s operating result is expected to rise again significantly (2022/23: EUR 102 million). The CropEnergies segment’s operating result is still expected to range between EUR 95 and 145 (2022/23: 251) million, and the starch segment’s operating result is also forecast to be significantly lower than last year (2022/23: EUR 70 million). Südzucker is forecasting an operating result for the fruit segment at the prior year’s level (2022/23: EUR 51 million).

Group EBITDA is now expected to range between about EUR 1.2 and 1.4 (previous forecast: 1.1 to 1.3; 2022/23: 1.1) billion.

Südzucker continues to expect a moderate increase in capital employed. Based on the above-mentioned improvement in operating results, a significant increase in ROCE (2022/23: 9.9 percent) is still expected.

Südzucker AG

Theodor-Heuss-Anlage 12

68165 Mannheim

Telefon: +49 (621) 421-0

Telefax: +49 (621) 421-425

http://www.suedzucker.de

Pressesprecher

Telefon: +49 (621) 421-205

Fax: +49 (621) 421-425

E-Mail: dominik.risser@suedzucker.de

![]()