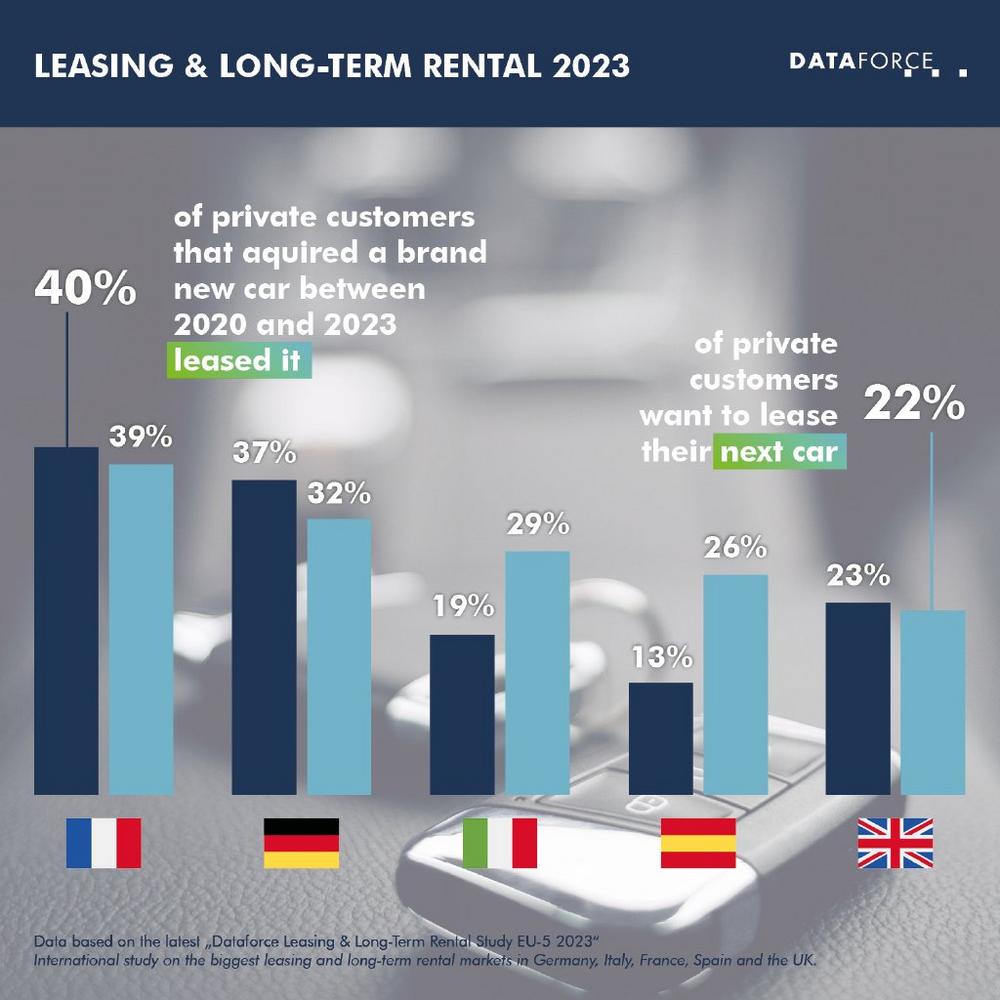

But how many new cars are actually being leased, rented or subscribed presently and in the future? What are the main factors for customers to decide on a financing model and how satisfied are they with their choice and the individual offers of their financing and mobility provider?

Dataforce investigated these and other questions in the "Leasing/Long-Term Rental Study 2023". The study covers the 5 major European markets, (Germany, France, Italy, Spain & United Kingdom). The data is based on detailed new registration data and around 5,000 interviews with fleet managers and private new car drivers.

Leasing shares in fleets and the private market

Vehicle ownership is still important for private customers. However, since leased vehicles are renewed much more frequently, they already account for one third of all new registrations. Especially for electric cars, buyers want to keep up with technological progress and change their cars more often.

The fleet market is growing across Europe and is taking more and more share from the private market. In companies, only about 20% of cars are bought or financed by credit, the rest is acquired through leasing, long-term rental or car subscriptions and medium-term rental contracts.

Leasing customers are less satisfied than car buyers

The results on customer satisfaction are surprising in view of the increasing share of leasing. Here the vehicle purchase is ahead. Among fleet managers, 55% are very satisfied with vehicle purchase as their procurement method, but only 44% with leasing or long-term rental. British fleet managers in particular are critical of leasing.

The discrepancy between purchasing and leasing is even wider in the private market. 69% of private new car buyers are very satisfied with their financing method, but only 57% of leasing customers. For Long-Term Rental, which is very popular in Italy, Spain and France, the percentage of very satisfied customers falls to 47%.

Provider rating: Hyundai Capital leads among companies, Arval among private customers

There is a fierce competition in the leasing market. In addition to the manufacturer-dependent providers, large international leasing companies and regional providers compete for the favour of leasing customers. In the meantime, all providers also have tailored offers for private customers and small businesses.

The best leasing provider from the fleet managers‘ point of view is Hyundai Capital, which handles the leasing business for Hyundai and Kia, among others. Second place goes to Alphabet, a non-captive provider, followed closely by Volkswagen Financial Services.

The ratings of private customers differ from this. Arval has the highest customer satisfaction score, followed by Kinto (Toyota Leasing) and again Volkswagen Financial Services.

Please find more information on the website: Leasing / Long-term rental study EU-5 2023

DATAFORCE – Wir zählen Autos.

As a leading market research company, we bring transparency to the European automotive market. Independent – with over 25 years of experience – we set standards and make markets comparable.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()