As recently reported, previous crush, jig and spiral test results confirmed the premise that the cassiterite (SnO2 – tin ore mineral) is easily liberated at a coarse crush size and that a good quality pre-concentrate can be obtained using very simple gravity separation techniques.

Using coarse gravity techniques only (i.e. no fine tin recovery) and a processing route that consists only of crushing, jigs, spirals, grinding and shaking tables, followed by standard tin dressing techniques including finer grinding and sulphide flotation, it has been demonstrated that 55-58% of the total tin is recovered into a plus 56% Sn, low impurity tin concentrate. An additional 5-6% recovery is possible from a fine tin circuit.

Due to the simplicity of the coarse tin only circuit, this processing flow sheet has now been chosen as the most viable option for the DFS, with the possible addition of a fine tin recovery circuit and/or supplementary crushing options being investigated as part of future optimisation work to further increase recovery rates. Ongoing recovery studies on lower-grade samples are also currently in progress, designed to obtain a good grade-recovery curve for use in the DFS, which we aim to complete during Q1 2024. These results will be announced when received.

Summary

- A combined conventional and VSI crushing product containing 82% of the tin in 46% of the mass in the -2.8 mm fraction, was sent to ALS in Burnie for gravity processing testwork.

- The -2.8 mm product was screened at 0.4 mm, with the coarse fraction going to jigs and the fine fraction to spirals.

- The jigs recovered 83% of the tin in the feed (32% of total tin) into a concentrate grading 1.21% Sn. This concentrate (7% of initial mass) was crushed/ground from 2.8 mm to 0.3 mm.

- The spirals recovered 67% of the tin in the feed (29% of total tin) into a concentrate grading 4.57% Sn.

- A re-grind of the rougher spiral tail (17% of initial mass) from 0.40mm to 0.15mm, followed by a scavenger spiral, recovered an additional 40% of the feed tin (6% of total tin) into a concentrate grading 0.62% Sn.

- The jig concentrates and the two spiral concentrates were then combined into a single concentrate grading 1.66% Sn containing 67% of the total tin in 8% of the initial mass.

- This concentrate was subsequently treated by locked cycle grinding and tabling to produce a concentrate grading 16.4% Sn containing 56% of the total tin in 0.6% of the mass.

- Clean-up of this concentrate by grinding to 0.15mm and floating off the sulphides returned a cleaner concentrate grading 56.2% Sn containing 55% of the tin in 0.20% of the mass.

- Recycling of the plus 53 µm tails from the lock cycle test work could add an additional 1-3% recovery overall to the coarse tin circuit. This could be improved even further via recycling all plus 38µm material.

- The main losses of tin result from the initial crushing stage (15% grading 0.07% Sn), the spiral tail (9% grading 0.10% Sn) and the shaking table tail (12% grading 0.29% Sn). This tin is mainly deported into the fine fractions (<38 µm). Further work to refine these steps and increase recovery is proposed.

- A fines circuit consisting of cyclone de-sliming, Falcon separation, MGS separation and cassiterite flotation has been shown to recover an additional 5-6% of the fine tin to a 13% Sn concentrate that may be able to be blended back into the coarse tin concentrate, taking total tin recovery to between 58% and 63% albeit additional work is required to optimise and improve the grade and quality of the concentrate to allow it to be used as a blend

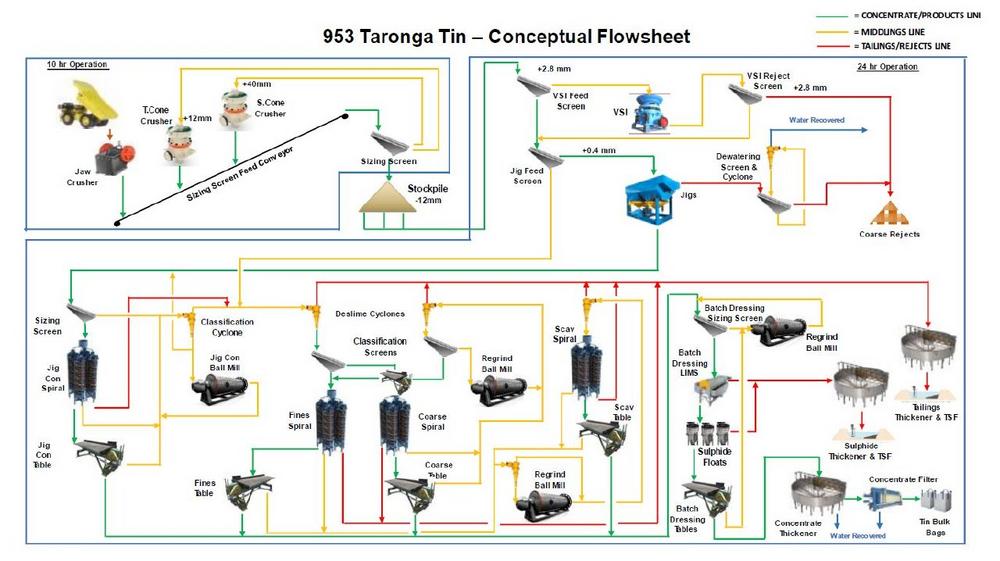

Based on the results of this test work, a simple processing facility has been designed consisting of (Figure 1):

- A conventional 3-stage crushing circuit consisting of a jaw and 2 cones. This will operate only during daylight hours (10 hours per day) in order to take advantage of a proposed solar farm that will significantly reduce electricity costs.

- Screening at 2.8mm.

- Vertical impact crushers (VSI) that will operate 24 hours per day to recover additional tin from the crusher oversize stockpile. This will again be screened at 2.8mm, with oversize going directly to a proposed co-disposal tailings storage facility.

- Screening of the re-combined -2.8mm crushed fraction at 0.4mm, with oversize going to jigs and undersize to spirals.

- The jig concentrate will be screened and the oversize material crushed/ground (<5% of initial mass) to 0.3 mm. Undersize will be cleaned up with a spiral-table combination. Jig tails will go directly to the proposed co-disposal tailings storage facility.

- The spiral middlings will be ground in a ball/rod mill to 0.15mm followed by scavenger spiral concentration. The tails from this will go directly to the proposed co-disposal tailings storage facility. The concentrate will be cleaned up with a spiral-table combination and combined with the other jig/spiral concentrates.

- Table concentrates from the jigs and spiral circuits will be ground to 0.15mm prior to processing through magnetic separators and sulphide flotation. Magnetic and sulphide concentrates will be pumped to a thickener and then to a dedicated sulphide storage facility.

- Further dressing may be undertaken in the dressing shed to increase concentrate tin grade and remove more impurities if required.

Figure 1 shows the current simplified flowchart for the proposed mill design.

First Tin CEO Thomas Buenger said: “This processing testwork has identified a clear path forward to produce a saleable tin concentrate from the Taronga tin deposit using very simple, cheap, off the shelf mineral processing equipment such as jigs, spirals and shaking tables. A good quality concentrate can be produced at reasonable recovery rates using very simple equipment, resulting in lower capital and operating costs.

“These results also show that recoveries can be boosted by recovering tin from the fine fraction (<38µm) using more complex and sophisticated high G force gravity separation techniques as well as via cassiterite flotation. We look forward to announcing further optimisations at this asset in the coming months.”

The project is owned by First Tin’s 100% owned Australian subsidiary, Taronga Mines Pty Ltd (“TMPL”).

Enquiries:

First Tin

Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Molly Gretton

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()