The precious metal that promises a safe haven is first and foremost gold. Silver is less attractive for investors. It is clear that a weakening economy has an impact on the prices of industrial metals. This also affects silver, as about half of it is used as an industrial metal. One positive aspect for the precious metal is the fact that it is in deficit. And things are not so bad for silver as an industrial raw material. After all, industrial demand has repeatedly reached new record highs in 2021, 2022 and 2023. This should continue this year.

After all, demand for silver in photovoltaic technology is still on the rise. A silver deficit of around 176 million ounces is estimated for this year, which is no small figure. Global silver mine production is forecast to grow by four percent in 2024. This would then be 843 million ounces of silver. At the same time, however, silver production from zinc mines could decrease. This is because mines may be shut down due to weak zinc prices. The amount of recycled silver is also expected to decrease in 2024, according to estimates.

The fundamentals for silver are therefore positive across the board, and there could still be some bargains to be had. As soon as the Fed cuts interest rates as expected, silver investments and thus the price of the precious metal are likely to recover. Investors should therefore not only keep an eye on the big brother gold, but also on silver.

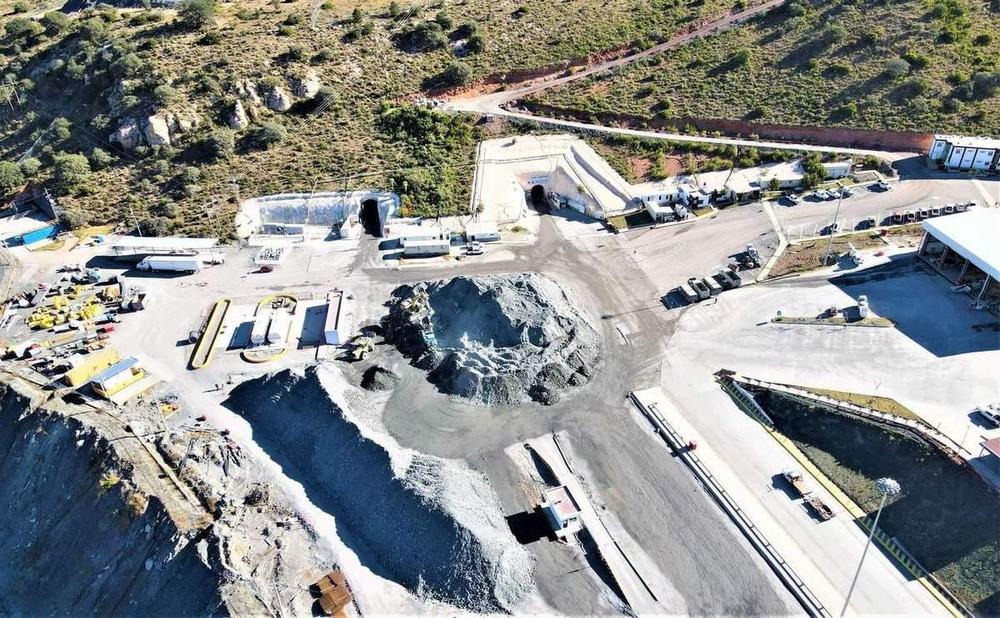

MAG Silver – https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ – focuses on silver. The company has a 44% stake in the Juanicipio property in Mexico. This produced 4.5 million ounces of silver and more than 10,000 ounces of gold in the fourth quarter. MAG Silver also owns 100 percent of a silver project in the Abitibi area in Canada and one in Utah.

Sierra Madre Gold and Silver – https://www.commodity-tv.com/ondemand/companies/profil/sierra-madre-gold-silver/ – has three projects in Mexico. The La Guitarra mine is to be revitalized.

Current company information and press releases from Sierra Madre Gold and Silver (- https://www.resource-capital.ch/en/companies/sierra-madre-gold-and-silver-ltd/ -) and MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()