“We value the strong relationship with Newmont and are confident that this transaction is a positive outcome for both companies,” commented Tim Clark, CEO of Fury. “Our team has historically ranked the ESJV as one of our more prolific targets for discovery. As such, we are excited to now have 100% ownership as we expect this to provide a clearer pathway for more exploration and potential upside in returns for our investors from this project consolidation and investment in Sirios.”

Éléonore South Project

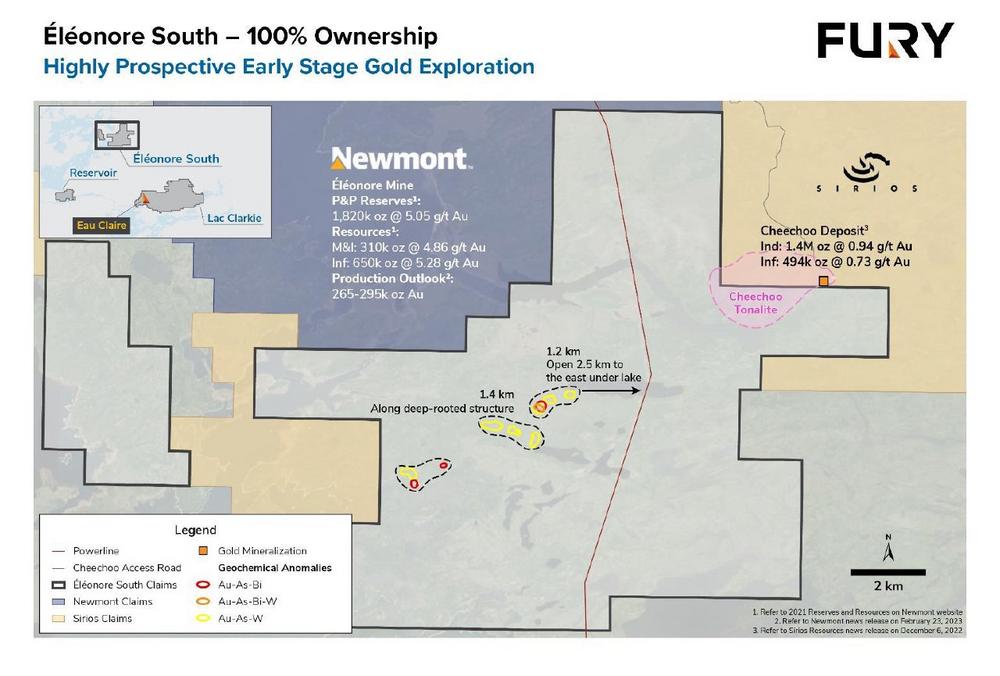

The Éléonore South project is strategically located in an area of prolific gold mineralization with Newmont’s Éléonore Mine to the north and Sirios’ Cheechoo deposit to the east (Figure 1). Prospecting to date has identified two distinct styles of mineralization within the project, structurally controlled quartz veins hosted within sedimentary rocks similar to the high-grade mineralization observed at the Éléonore Mine as well as intrusion-related disseminated gold mineralization similar to that seen at the low-grade bulk tonnage Cheechoo deposit with higher grade potential as seen at the JT and Moni prospects on the project (Table 1 and Figure 2).

Numerous gold in-till anomalies remain undrilled throughout the project (Figures 1 and 2) and will be a focus for Fury. The bulk of the untested gold anomalies are similar in characteristics to the Cheechoo style of mineralization. The JT and Moni prospects represent a potential higher-grade style of intrusion related gold mineralization with historical drilling intercepting 53.25 metres (m) of 4.22 g/t gold (Au); 6.0m of 49.50 g/t Au and 23.8m of 3.08 g/t Au (Figure 2). Several of the noted drill intercepts have not been followed up on and remain open.

“Given the calibre of gold anomalies that we see at Éléonore South paired with the access to infrastructure and excellent address, we are looking forward to exploring the project in 2024. The project is surrounded by over 4.5 million ounces of gold in two distinct mineralization styles which speaks to the overall strength of the regional gold system indicative of the exploration potential. Our team is excited to apply Fury’s systematic and disciplined exploration approach to Éléonore South,” stated Bryan Atkinson, P.Geol., SVP Exploration of Fury.

Historical JT and Moni Drilling

Analytical samples were taken by sawing BTW diameter core into equal halves on site and sent one of the halves to ALS Lab in Rouyn-Noranda, Val d’Or, QC, and Sudbury, ON for preparation and analysis. All samples are assayed using 50 g nominal weight fire assay with atomic absorption finish (Au-AA24) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where Au-AA24 results were greater than 3 ppm Au the assay were repeated with 50 g nominal weight fire assay with gravimetric finish (Au-GRA22). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy and precision in a large majority of standards assayed. True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

David Rivard, P.Geo, Exploration Manager at Fury, is a "qualified person" within the meaning of Canadian mineral projects disclosure standards instrument 43-101 and has reviewed and approved the technical disclosures in this press release.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a well-financed Canadian-focused exploration company positioned in two prolific mining regions across Canada and holds a 59.5 million common share position in Dolly Varden Silver Corp (22% of issued shares). Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

For further information on Fury Gold Mines Limited, please contact:

Margaux Villalpando, Manager Investor Relations

Tel: (844) 601-0841

Email: info@furygoldmines.com

Website: www.furygoldmines.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Forward-Looking Statements and Additional Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements" within the meaning of applicable securities laws, which statements relate to the future exploration operations of the Company and may include other statements that are not historical facts. Forward-looking statements contained in this release primarily relate to statements that suggest that the completion of the buy-out between Fury and Newmont will be completed on schedule or at all.

Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no certainty that such assumptions and expectations will prove to be materially correct. Mineral exploration is a high-risk enterprise.

Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2022 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedarplus.ca and the Company’s Annual Report available at www.sec.gov. Readers should not place heavy reliance on forward-looking information, which is inherently uncertain.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()