Highlights

- Ongoing till sampling and prospecting up-ice from 5km x 4km gold anomaly at Opinaca

- Additional till sampling and prospecting near Opinaca lithium anomaly

- Field mapping and lithium prospecting at Ontario and Prince Albert Lake, Saskatchewan

- Radiometric survey at White Metal uranium/lithium property in Saskatchewan

“2023 was a company building year for Targa, where our focus was on acquiring assets and building a strong corporate and technical team,” commented Cameron Tymstra, CEO. “For 2024, our focus is squarely set on discovery making. The lion’s share of our exploration budget this year is dedicated to two phases of work at Opinaca, where last year’s till sampling uncovered a very large gold anomaly in the centre of the project and additional gold and lithium anomalies to the east. Our plans are to continue the till sample grid to identify the heads of the gold and lithium till trains and put boots on the ground to prospect for boulders and mineralized outcrop up-ice from these anomalies. Targa’s goal this summer is to identify drill targets for either a winter or summer 2025 drill program. We will also be initiating prospecting programs on our other lithium assets in Ontario and Saskatchewan.”

Opinaca Exploration Program

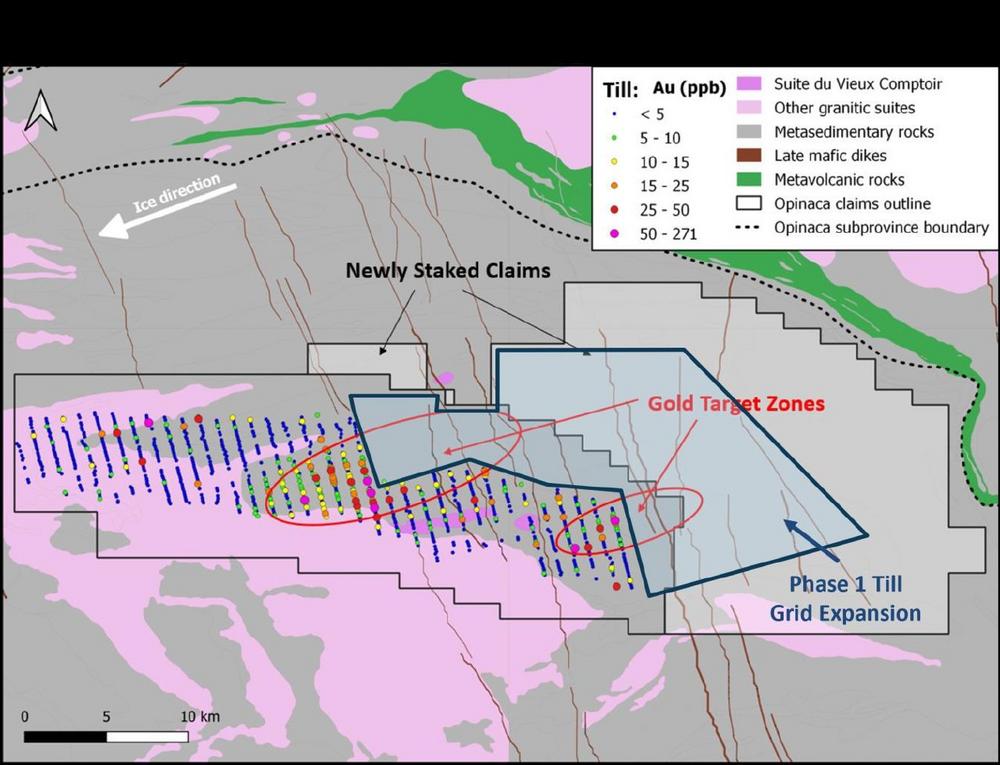

Work during summer of 2024 at the Opinaca project in Quebec will take place in two phases, with the team at Kenorland Minerals acting as project operators. The primary goals of the program are to narrow down the search area of the possible bedrock source locations in Phase 1 and to identify potential drill targets during Phase 2.

Phase 1

Beginning in June, the first phase of work will consist of collecting approximately 2,000 till samples, continuing the 2023 sample grid program up-ice (east-northeast) from the gold and lithium anomalies discovered last year. Samples will continue to be taken 150m apart along lines with a 1km spacing. Targa’s in-house technical team will also be in the field during till sampling to prospect for boulders and outcrop up-ice from the anomalies and in the vicinity of peraluminous pegmatites discovered last year. Phase 1 is expected to take approximately 2-3 weeks.

Phase 2

Scheduled for the second half of August, the second phase of work will consist of infill till sampling at a 150m by 250m spacing in the areas identified in Phase 1 as the heads of the till trains. More detailed mapping and outcrop prospecting will continue in these areas with a goal of defining a possible bedrock source for both the orogenic gold and lithium pegmatite targets.

Saskatchewan Exploration Programs

White Metal Uranium/Lithium Project

Located northwest of the town of Stony Rapids, work at White Metal will consist of a radiometric survey in the spring to identify potential uranium targets across the property. Follow up work on the ground is scheduled for July/August. Historic work on the adjacent Fontaine Lake project owned by Fulcrum Metals has returned multiple surface samples over 1% U3O8 (source: Fulcrum Metals website). Targa’s geology team will also be following up on pegmatites noted in historic work on the White Metal project with anomalous lithium values to assess the potential for LCT-type pegmatites on the property.

Prince Albert Lake Project

Located northeast of the town of Stony Rapids, the project sits approximately 4km northeast of a high-grade lithium boulder discovered in 2004, a sample of which returned 3470ppm Li, 3380ppm Rb and 530ppm Cs (Saskatchewan Mineral Deposit Index #3176). In addition to the presence of lithium-enriched boulders in the area, a lake sediment sample with an anomalous cesium value sits within the Prince Albert Project. Targa’s geology team will spend several days boulder prospecting and mapping along a metavolcanic/metasedimentary belt that runs through the middle of the project to look for possible boulders coming from LCT-type pegmatites.

Ontario Exploration Program

The Company’s geology team will be conducting prospecting and sampling activities on all five of Targa’s Ontario mineral properties in May.

At the Slim Jim property, which was expanded to 11,560ha last year, the ground crew will be following up on samples taken in 2023 from peraluminous pegmatites, including one which returned >2,500ppm Nb. The team will also be investigating areas further to the east within the project boundaries via helicopter that were not accessible by road last year. This area has multiple small lakes with sediment samples carrying elevated lithium, cesium, rubidium, and tantalum values and is within several kilometers of a peraluminous granitic intrusion.

Work at Sky Lake will include follow up sampling on peraluminous pegmatites containing beryl, tourmaline, and columbite identified during the 2023 season.

Targa and its project operators actively engage and consult with local communities and First Nations in all of the Company’s project areas prior to the commencement of field activities.

Issuance of Incentive Options

The Company’s board of directors has approved the issuance of 3,991,000 incentive options to Company management, directors, and consultants. The options have an exercise price of $0.12 and a term of five years and will vest immediately. The Options were granted pursuant to the Company’s incentive stock option plan and are subject to regulatory approval.

Shanghai Option Agreement

The Company has decided not to continue pursuing the option on the Shanghai property, originally signed on October 6, 2021. The Company has given notification to the property vendor.

About the Opinaca Project

The Opinaca Project is located in the James Bay region of Quebec, approximately 40km south of Patriot Battery Metals’ Corvette lithium discovery, 45km south of the all-season Trans-Taiga Road and 120km northwest of the Renard Diamond Mine. The Opinaca Project covers 85,267 contiguous hectares of the Opinaca geological sub-province, dominantly a metasedimentary region with neoarchean-aged igneous intrusions including of the Vieux Comptoir suite of granites. Till sampling in 2023 uncovered a 5km x 4 km gold/arsenic/tungsten anomaly in the center of the project as well as a higher-grade gold and lithium anomaly to the east.

Qualified Person

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Adrian Lupascu M. Sc. P.Geo., Exploration Manager of Targa Exploration Corp., who is a “qualified person” within the meaning of National Instrument 43 -101- Standards of Disclosure for Mineral Projects.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s properties.

About Targa

Targa Exploration Corp. (CSE: TEX | FRA: V6Y | OTCQB: TRGEF) is a Canadian lithium exploration company engaged in the acquisition, exploration, and development of lithium and gold mineral properties with headquarters in Vancouver, British Columbia. Targa’s project portfolio consists of fifteen projects in the provinces of Quebec, Ontario, Manitoba, and Saskatchewan and covers over 400,000 hectares of prospective ground, most of which has never been explored previously for lithium or gold.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Cameron Tymstra, CEO and President

Tel: 416-668-1495

Email: cameron@targaexploration.com

Website: www.targaexploration.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: the exploration and development of the Company’s properties.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Targa, future growth potential for Targa and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of lithium and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Targa’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Targa’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Targa has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: price volatility of lithium and other metals; risks associated with the conduct of the Company’s mineral exploration activities in Canada; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Targa’s management discussion and analysis and other public disclosure documents. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Targa has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Targa does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()