Ari Sussman, Executive Chairman commented: “Confirming that Olympus and Apollo are in fact one much larger combined system (Apollo) is pleasing and opens the door for expanded future exciting scenarios in terms of mineral endowment growth and development opportunities. We have two rigs focused on Apollo presently and will now look to expand the system northwards past its known limits while continuing to focus on defining and growing higher grade subzones within the existing block model. I remain steadfastly confident that aggressive exploration efforts at the Guayabales Project will evolve into a large-scale precious metal rich camp that will scale both in terms of future metal endowment and production profile.”

Highlights (see Table 1 and Figures 1-4)

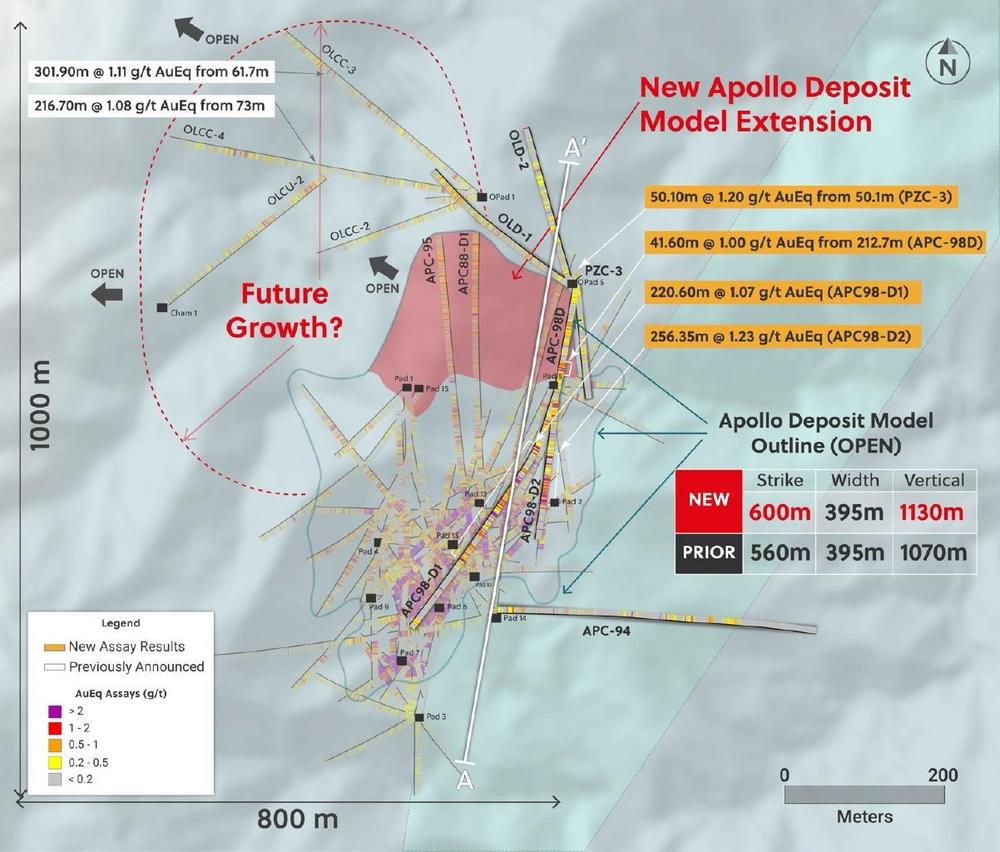

- Drill holes PZC-3, mother hole APC98-D and its series of subset directional drill holes, collared from Opad-5 approximately 400 metres laterally to the north of the current Apollo model and within the Olympus target area, intersected multiple shallow mineralized brecciated porphyry fingers commencing from approximately 25 metres below surface and continuing southwards to the northern edge of the previously defined Apollo system. This is the first time that shallow brecciated porphyry mineralization has been discovered outside of the outcropping portion of the Apollo model some 400 metres to the southwest.

- As a result of discovering that mineralization is connected between Olympus and Apollo, the area covering both systems has now been integrated into a single large and expanded Apollo system measuring approximately 1,000 metres by 800 metres and open for further growth. Gold dominant plus silver, copper and tungsten metal systems in this large area, are hosted in three superimposed mineralization styles which include stockwork and brecciated porphyries plus overprinting and multi-directional trending, late-stage precious metal rich sheeted porphyry veinlets (“CBM Veins”).

- New assay result highlights from holes connecting Olympus and Apollo (now known collectively as Apollo) from Opad-5 include:

- 60 metres @ 1.07 g/t gold equivalent from 145.30 metres (APC98-D1) including:

- 20 metres @ 1.86 g/t gold equivalent from 195.35 metres

- 35 metres @ 1.23 g/t gold equivalent from 30.60 metres (APC98-D2) including:

- 90 metres @ 1.76 g/t gold equivalent from 117.10 metres and,

- 90 metres @ 3.11 g/t gold equivalent from 163.00 metres and,

- 65 metres @ 1.95 g/t gold equivalent from 185.30 metres

- 10 metres @ 1.20 g/t gold equivalent from 95.95 metres (PZC-3) including:

- 05 metres @ 2.06 g/t gold equivalent from 95.5 metres

- The revised Apollo model, covering the portion of the mineralization that has been wire-framed, now covers a significantly expanded volume measuring up to 600 metres of strike by 395 metres of width by 1,130 metres vertical and remains open for expansion in most directions. Mineralization at Apollo daylights at surface (i.e. 271 metres @ 3.43 g/t AuEq from 0 metres depth in APC-43; see press release dated April 11, 2023) and has been drilled up to 1,130 metres below surface (i.e. 202 metres @ 2.16 g/t AuEq at 1,130 metres depth in APC88-D1; see press release dated January 30, 2024). The internal model only encompasses the southern portion of the newly discovered and integrated system with plans now in place to aggressively expand Apollo in a northerly direction while continuing to target high-grade subzones within the wireframed portion of the system.

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag (g/t) x 0.014 x 0.88) + (Cu (%) x 1.47 x 0.90) + (Mo (%) x 7.41 x 0.85) + (WO3 (%) x 5.47 x 0.72) utilizing metal prices of Cu – US$3.95/lb, Ag – US$25/oz, Mo – US$20/lb , WO3 – US$32,500/t and Au – US$1,850/oz and recovery rates of 97% for Au, 88% for Ag, 85% for Mo, 72% for WO3 and 90% for Cu. Recovery rate assumptions for metals are based on metallurgical results announced on October 17, 2023, and April 11, 2024. The recovery rate assumption for molybdenum is speculative as limited metallurgical work has been completed to date on this metal. True widths are unknown, and grades are uncut.

Exploratory hole APC-94 was drilled due east from Pad-14 on the eastern side of the model for Apollo and intersected only the low-grade and peripheral halo zone hosting some individual, sporadic and moderate grade veinlets. APC-96 was drilled at a too shallow of an angle from Opad-5 to the south and as a result drilled above the interpreted mineralized zone in this area.

Hole OLD-1 was drilled from OPad5 and was unfortunately drilled too far to the north of the mineralized trend and as a result only intercepted mineralization on the outer margin and/or outside the zone. However, the hole did cut multiple zones of modest mineralization over significant distance with the shallowest intercept beginning at 118.55 metres down hole and the deepest at 1,192.80 metres downhole. Hole OLD-2 was drilled at a shallow angle to test a small in soil precious metal anomaly and failed to intersect any significant mineralization other than two individual CBM veins.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective is a copper, silver, gold and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold-tungsten Apollo porphyry system. The Company’s 2024 objective is to expand the Apollo system, step out along strike to expand the recently discovered Trap system and make a new discovery at either the Tower or X targets or Plutus targets.

Management, insiders, a strategic investor and close family and friends own nearly 50% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the NYSE under the trading symbol “CNL”, on the TSX under the trading symbol “CNL”, on the FSE under the trading symbol “GG1”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at ALS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) on X

Follow Collective Mining (@CollectiveMini1) on X, (Collective Mining) on LinkedIn, and (@collectivemining) on Instagram

Investors and Media

Paul Begin, Chief Financial Officer

p.begin@collectivemining.com

+1 (416) 451-2727

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” and “forward-looking information” within the meaning of applicable securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the commencement of trading on the NYSE American, the ceasing of trading on the OTCQX, the anticipated advancement of mineral properties or programs; future operations; future recovery metal recovery rates; future growth potential of Collective; and future development plans.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events including final listing mechanics and the direction of our business. Management believes that these assumptions are reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; conclusions of future economic evaluations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, precious and base metals or certain other commodities; fluctuations in currency markets; change in national and local government, legislation, taxation, controls regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formation pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties, as well as those risk factors discussed or referred to in the annual information form of the Company dated March 27, 2024. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and there may be other factors that cause results not to be anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()