- Organic revenue growth of 13% in Q2 builds on strong Q1 performance

- Good momentum and strong order intake provide good visibility for second half

- Firmly on track to deliver double digit revenue growth with high single-digit growth in adj. EBITDA and adj. EPS in FY2022

- Broad range of measures implemented to manage inflationary impacts and to ensure supply security

Gerresheimer AG, a leading provider of healthcare & beauty solutions and drug delivery systems for pharma, biotech and cosmetics, reaffirms its guidance for its financial year 2022 after delivering a solid second quarter in line with plan. This rounded off the best first half performance with organic revenue growth of 15.7%. Adjusted EBITDA grew by 7.3%. “I am particularly pleased with the strong performance we have delivered in the first half of the year, which is further evidence of our successful transformation into a solution provider and system integrator with higher, sustainable and profitable growth”, said Dietmar Siemssen, CEO of Gerresheimer AG. “We continue to successfully navigate the challenges of the inflationary environment utilising its benefits from long-term energy supply agreements, hedges against energy price increases and its pricing power. We are seeing strong demand from our customers across our entire portfolio and are on track for another record year in 2022 as well as delivering for our mid-term guidance.” Gerresheimer reaffirms its guidance for its financial year 2022 with double-digit organic revenue growth and high single-digit organic growth in adjusted EBITDA and adjusted EPS.

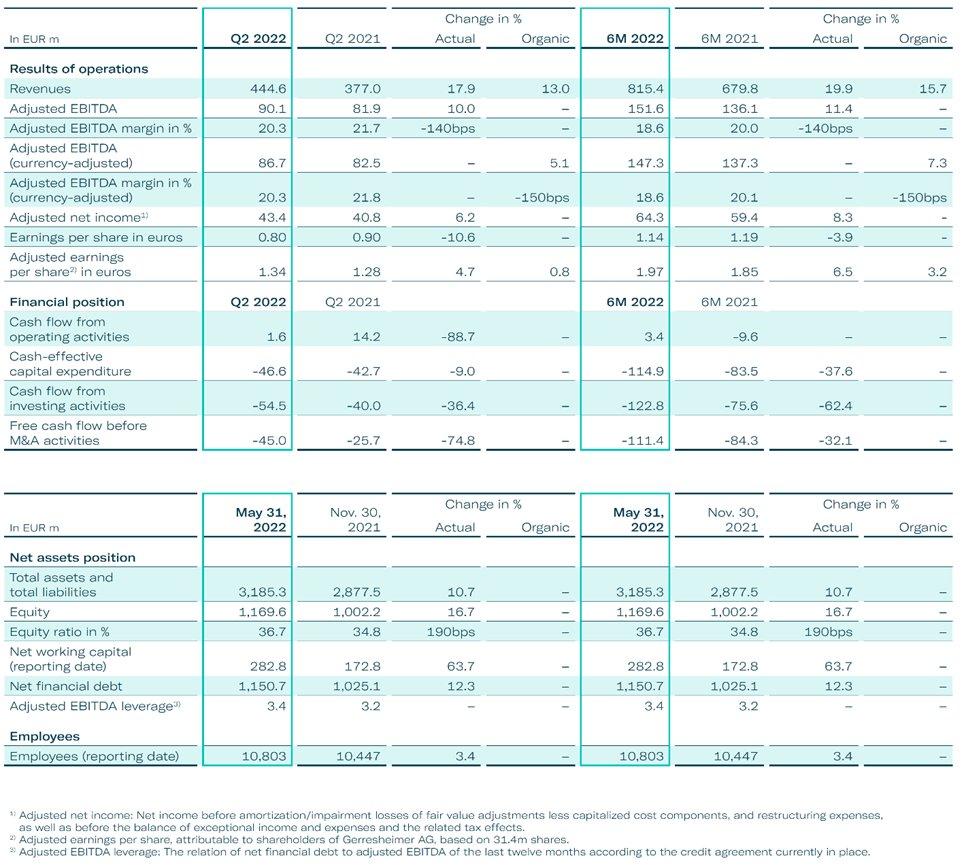

In the second quarter of its 2022 financial year, Gerresheimer generated revenues of EUR 445m, representing an organic growth of 13%. The focus on investing in key growth drivers, such as High Value Solutions in pharma and beauty, regional expansion and contract manufacturing, is delivering results with sustainable, profitable growth across all divisions. Revenue growth was also supported by the current dynamic pricing environment, with contractual pass-through and sustainable price increases. Adjusted EBITDA rose to EUR 90m, an organic increase of 5.1%. Adjusted earnings per share (EPS) increased from EUR 1.28 to EUR 1.34.

Gerresheimer has been implementing a broad range of measures to manage inflationary impacts and to ensure continuity of supply of its system critical solutions and services. This includes long-term supply agreements, hedging contracts against energy price increases and passing on price increases. Looking forward, Gerresheimer will further improve its energy mix through the rigorous implementation of its sustainability strategy.

Gerresheimer also rearranged its financial position to support the execution of its strategy. In addition to the EUR 150m promissory note issued in November 2021, the company signed a three-year EUR 150m revolving credit facility on July 1, which addresses its refinancing requirements for 2022 in the amount of EUR 306m, securing improved terms with enhanced flexibility.

The Primary Packaging Glass Division showed impressive organic growth of 19.4%. This was driven by strong demand for both tubular and molded glass with a particular focus on High Value Solutions such as Gx® ELITE Glass. Adjusted EBITDA rose organically by 8.3% and was in particular influenced by higher energy cost.

Plastics & Devices Division revenues grew organically by 8.0%, again benefitting from pass-through effects. Following a strong comparable period, the syringes business was restrained by phasing effects. Adjusted EBITDA decreased organically by 4.2%, impacted especially by temporary unfavorable product mix effects, mainly due to the phasing in syringes.

Gerresheimer Advanced Technologies Division (GAT) continues to lay the foundations for its future growth. In the second quarter, Gerresheimer entered into strategic participations with Portal Instruments Inc to develop a needle-free autoinjector and with Adamant Health Oy to revolutionize the treatment of Parkinson’s disease.

Guidance for FY 2022 (For group level, FXN):

- Organic revenue growth: at least 10%

- Organic adjusted EBITDA growth: high single-digit

- Adjusted EPS growth: high single-digit

Mid-term Guidance (For group level, FXN)

- Organic revenue growth: high single-digit

- Organic adjusted EBITDA margin: of 23-25%

- Adjusted EPS growth: at least 10% p.a.

The report is available here:

https://www.gerresheimer.com/en/company/investor-relations/reports

Gerresheimer is the global partner for pharmaceutics, biotech, healthcare, and cosmetics with a very broad product range for pharmaceutical and cosmetic packaging solutions and drug delivery systems. The company is an innovative solution provider from concept to delivery of the end product. Gerresheimer achieves its ambitious goals through a high level of innovative strength, industrial competence and concentration on quality and customer focus. In developing innovative and sustainable solutions, Gerresheimer relies on a comprehensive international network with numerous innovation and production centers in Europe, America and Asia. Gerresheimer produces close to its customers worldwide with around 11,000 employees and generated annual revenues in 2021 of around EUR 1.5b. With its products and solutions, Gerresheimer plays an essential role in people’s health and well-being.

Gerresheimer AG

Klaus-Bungert-Straße 4

40468 Düsseldorf

Telefon: +49 (211) 6181-00

Telefax: +49 (211) 6181-295

http://www.gerresheimer.de

Telefon: +49 (211) 6181-220

E-Mail: carolin.nadilo@gerresheimer.com

Group Senior Director Marketing & Communication

Telefon: +49 (211) 6181-250

E-Mail: ueli.utzinger@gerresheimer.com

Senior Manager Group Communication

Telefon: +49 (211) 6181-246

Fax: +49 (211) 6181-241

E-Mail: m.stolzenwald@gerresheimer.com

![]()