HIGHLIGHTS

Kada Gold Project, Guinea

- RC drilling at the Massan Prospect has located significant northern and eastern extensions to the multiple, broad gold mineralised zones that comprise the Maiden Inferred Mineral Resource Estimate (MRE) area (930,000oz gold[1]), with results including:

– KRC117: 45m @ 0.7g/t gold from 50m

– KRC132: 43m @ 1.2g/t gold from 107m, including 9m @ 3.4g/t gold

- Initial drilling at the Bereko Prospect, 7km north of the MRE area along the Kada Gold Corridor, has discovered highly encouraging shallow oxide gold mineralisation in multiple zones, with results including:

– KRC092: 10m @ 5.6g/t gold from 5m, including 2m @ 18.9g/t gold

– KRC095: 11m @ 6.3g/t gold from 43m, including 2m @ 30.6g/t gold

– KRC099: 27m @ 1.2g/t gold from 27m

- Oxide gold zones at Bereko remain open to the north and south, and at depth.

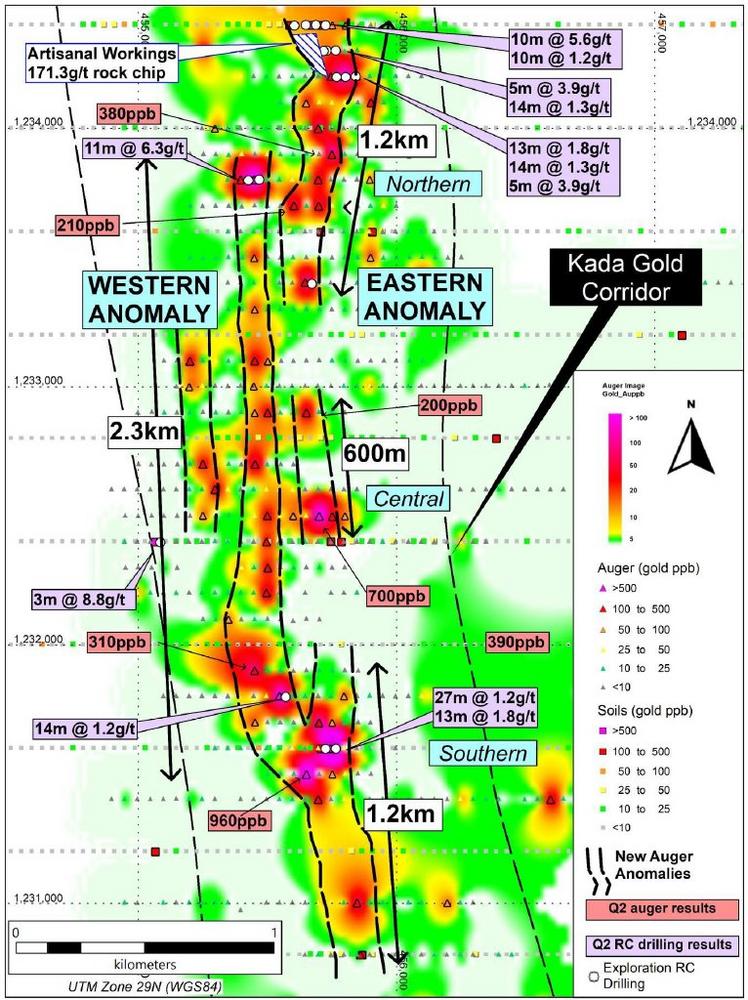

- Infill auger drilling at Bereko (218 holes for 1,990m) returned results up to 960ppb gold and confirmed several parallel north-south trending bedrock gold anomalies that have a combined strike length of more than 5.5km.

- Golden Rim will use IP/ground magnetics geophysical survey results, now due in August, and the infill auger drilling results to plan follow-up RC drilling, initially expected to be conducted at Bereko.

Divestment of Kouri Gold Project, Burkina Faso

- Binding agreement to divest Burkina Faso gold assets (Kouri and Babonga gold projects) for US$15.5 million (~A$22.3 million) in four staged cash payments over 12 months.

Option and JV Agreement with Teck for Loreto Copper Project, Chile

- Option and Joint Venture Agreement executed with Teck Resources Chile Limitada (Teck Chile), a subsidiary of Teck Resources, over the Loreto Copper Project, Chile.

- Teck to earn up to 75% interest in Loreto via US$0.6 million (A$0.8M) in cash payments and spending US$17 million (~A$23M) on exploration

Corporate

- Successful completion of Placement, raising a total of $5.3 million (before costs) to advance Kada exploration.

KADA GOLD PROJECT, GUINEA

RC Drilling

During the quarter, Golden Rim completed a 57-hole (5,428m) reverse circulation (RC) drilling program at Kada, comprising exploration drill holes designed to test auger gold anomalies predominantly along the Kada Gold Corridor and outside the MRE area as well as three infill holes (444m) completed within the MRE area (Figures 1, 2 & 4). Significant results from this drilling (Bereko and Massan prospects) are discussed in the following sections of this report.

Bereko Prospect

Golden Rim completed 17 holes at Bereko (KRC085 – KRC099, KRC107, KRC111), 7km north of the MRE. Results returned shallow oxide gold intersections in multiple zones at Bereko that extend over 2.5km (Figure 1).

Best gold intersection from these holes (0.3g/t gold cut-off include):

- KRC085: 5m @ 3.9g/t gold from 16m, including 2m @ 9.4g/t gold

- KRC086: 14m @ 1.3g/t gold from 27m, including 1m @ 14.0g/t gold

- KRC087: 4m @ 3.1g/t gold from 42m

- KRC088: 8m @ 0.8g/t gold from 11m

13m @ 1.8g/t gold from 42m

- KRC089: 8m @ 1.3g/t gold from 60m, including 1m @ 8.0g/t gold

- KRC090: 10m @ 1.2g/t gold from 28m

- KRC092: 10m @ 5.6g/t gold from 5m, including 2m @ 18.9g/t gold

- KRC095: 11m @ 6.3g/t gold from 43m, including 2m @ 30.6g/t gold

- KRC096: 3m @ 8.8g/t gold from 64m

- KRC097: 14m @ 1.2g/t gold from 55m, including 3m @ 3.9g/t gold

- KRC098: 13m @ 1.8g/t gold from 21m

- KRC099: 13m @ 1.1g/t gold from 0m

27m @ 1.2g/t gold from 27m

- KRC107: 19m @ 0.6g/t gold from 24m

[1] ASX Announcement: Kada Maiden Mineral Resource 930koz Gold dated 3 March 2022.

Massan Prospect

North of the 930,000oz MRE area, Golden Rim received assays for seven holes (KRC114-KRC120) completed at Massan (Figure 2). The best new gold intersections include:

- KRC114: 19m @ 0.5g/t gold from 46m

- KRC117: 14m @ 0.8g/t gold from 0m

45m @ 0.7g/t gold from 50m.

East of the MRE area, Golden Rim received assays for three holes (KRC121, KRC131, KRC132) (Figure 2). The best new gold intersections include:

- KRC131: 10m @ 2.5g/t gold from 92m

6m @ 2.4g/t gold from 132m (hole ended in mineralisation)

- KRC132: 6m @ 2.4g/t gold from 17m, including 2m @ 6.5g/t gold

43m @ 1.2g/t gold from 107m, including 9m @ 3.4g/t gold (hole ended in mineralisation).

Golden Rim received assays for three infill holes (KRC133 – KRC135) drilled within the MRE area (Figure 2). The best new gold intersections include:

- KRC133: 15m @ 1.8g/t gold from 0m, including 3m @ 4.6g/t gold

13m @ 1.5g/t gold from 75m, including 3m @ 5.0g/t gold

15m @ 1.2g/t gold from 141m (hole ended in mineralisation)

- KRC134: 17m @ 1.7g/t gold from 0m

- KRC135: 9m @ 1.3g/t gold from 96m.

Increased Interest in Kada Gold Project

During the previous quarter, Golden Rim achieved its second earn-in interest of an additional 26% interest in the Kada Gold Project, having satisfied the requirements of its second earn-in interest requirements by sole funding expenditure of not less than US$4million within 24 months of acquisition. Documentation was submitted to the Kada joint venture partner in early April and Golden Rim’s interest in Kada is now 51%.

At the same time, Golden Rim also exercised its right to an additional 24% interest of the project, for a total 75% interest. To achieve this interest, the Company is required to fund the preparation of a Definitive Feasibility Study for Kada.

Bereko Infill Auger Drilling

Golden Rim completed an infill auger drilling program at Bereko during the quarter, with 218 holes for 1,990m drilled on 100m x 50m to infill first-pass 200m x 50m spaced auger drilling. The auger holes were vertical in orientation with an average depth of 9m. Drilling was designed to penetrate the shallow laterite cover to obtain a bottom of hole sample in each hole of the weathered bedrock (saprolite) beneath for gold analysis.

Results from the infill auger drilling were highly encouraging with the delineation of several parallel, north-south-trending bedrock gold anomalies (Western and Eastern anomalies) with a combined strike length of more than 5.5km (Figure 1). These extensive and coherent gold anomalies extend from areas where Golden Rim’s recent initial RC drilling discovered high-grade and/or broad zones of oxide gold mineralisation, with intersections that include 11m @ 6.3g/t gold, 10m @ 5.6g/t gold and 27m @ 1.2g/t gold. This oxide gold mineralisation remains open to the north and south, and at depth.

These newly defined auger gold anomalies provide exceptional target areas for Golden Rim to identify further strike extensions to this highly significant oxide gold mineralisation.

The main bedrock gold auger anomalies at Bereko are described below:

- Western Anomaly

The Western Anomaly is the most coherent at Bereko and extends for 2.3km (Figure 1). Peak auger gold results include 960ppb gold, 830ppb gold and 720ppb gold. Towards the south, the Western Anomaly seems to coalesce with the Eastern Anomaly.

Very limited RC drilling has been conducted along the Western Anomaly. In the northern portion of the anomaly, Golden Rim achieved a highly significant oxide gold intersection of 11m @ 6.3g/t gold from 43m, including 2m @ 30.6g/t gold in KRC095. This is the best drill gold intercept obtained at Bereko to date. There is then no RC drilling along the Western Anomaly for 2km until hole KRC097, which returned 14m @ 1.2g/t gold from 55m in the southern portion of the anomaly.

To the west of the Western Anomaly, auger drilling has also outlined a smaller, parallel anomaly that extends for 800m. The infill auger drilling returned multiple results >100ppb gold. This anomaly has no RC drilling to date and will be a target for further investigation.

- Eastern Anomaly

The Eastern Anomaly is not as continuous and seems to comprise three zones (Northern, Central and Southern) which are possibly separated by faulting (Figure 1).

In the Northern Zone, a highly coherent and strong anomaly extending for 1.2km delivered a peak auger gold result of 580ppb gold. The anomaly encompasses an area of artisanal mining on stockwork veins in bedrock beneath the shallow laterite cover which have returned rock-chip samples results up to 171.3g/t gold. Golden Rim has concentrated RC drilling to date around the artisanal mining area, which returned encouraging oxide gold intersections including 10m @ 5.6g/t gold from 5m in KRC092 and 13m @ 1.8g/t gold from 21m in KRC098. The most coherent portion of the anomaly extends 900m south of the artisanal mining area and has not yet been tested by RC drilling. New auger results up to 380ppb gold were obtained from this southern extension to the gold anomaly.

The Central Zone extends for 600m and has a peak auger result of 700ppb gold. No RC drilling has been conducted within this zone to date.

The Southern Zone is the broadest area of bedrock gold anomalism outlined by the auger drilling at Bereko. It extends for 1.2km and has a peak auger gold result of 2,720ppb gold. To date, Golden Rim has drilled two RC holes within this area and each one has intersected significant oxide mineralisation, including 27m @ 1.2g/t gold from 27m in KRC099 and 13m @ 1.8g/t gold from 21m in KRC098 (Figure 3). This oxide mineralisation remains open along strike and at depth. Infill auger drilling both north and south of this RC drilling returned highly anomalous new gold results (up to 960ppb and 390ppb gold). These areas are to be tested in the next RC drilling program for extensions to the oxide gold mineralisation.

Progress and Next Steps at Kada

Golden Rim extended its IP and ground magnetics geophysical survey at Bereko and Massan, with three dipole-dipole IP lines (total of 3.6-line km) now planned for Massan. The survey is expected to be completed in August.

Golden Rim will use results of its RC and auger drilling programs as well as the geophysical survey to guide further exploration at Kada during 2022, including planning further drilling to follow up the highly encouraging initial drilling results received from Bereko and around the MRE area at Massan.

AGREEMENT TO SELL BURKINA FASO GOLD ASSETS

During the quarter, Golden Rim executed a binding agreement to sell 100% of its Kouri and Babonga gold projects in Burkina Faso, West Africa for total consideration of US$15.5 million (~A$22.3M) to private Burkinabé mining company BAOR SARL (BAOR).

The transaction is not subject to shareholder approval. Under the agreement, BAOR will pay Golden Rim via four staged cash payments over 12 months, with the first payment of US$600,000 due within 15 business days and the second payment of US$5.4 million due within 30 days, with two more payments to follow. However, BAOR advised of a delay regarding the first two payments, which are now both due 3 August 2022, with simple interest of 8% payable on outstanding amounts.

At Kouri, Golden Rim discovered and has outlined an Indicated and Inferred Mineral Resource of 50Mt at 1.3g/t gold for 2Moz[1].

LORETO COPPER PROJECT, CHILE

During the quarter, Golden Rim executed an Option and Joint Venture Agreement with Teck Resources Chile Limitada (Teck Chile), a subsidiary of Teck Resources Limited (Teck), on its 100%-owned Loreto Copper Project (Loreto). Loreto comprises mineral concessions that have been separated from the Company’s Paguanta Silver-Lead-Zinc-Copper Project (Paguanta) in northern Chile.

The Loreto mineral concessions are 100% owned by Golden Rim and extend over an area of 16.0km2. These concessions cover the Loreto porphyry copper target and prior to the agreement with Teck Chile, they formed part of the Paguanta Project. The remainder of Paguanta mineral concessions extend over 39.2km2 and comprise the Paguanta Joint Venture between Golden Rim (75% interest) and Chilean company, Costa Rica Dos (25% interest).

Golden Rim has granted Teck Chile an option to acquire a 55% interest in Loreto (the “First Option”) by incurring an aggregate of US$5,000,000 in expenditures on Loreto and making US$600,000 in cash payments to Golden Rim.

If Teck Chile exercises the First Option, Teck Chile has a further option to acquire an additional 20% interest in Loreto, by incurring an additional US$12,000,000 in expenditures over the ensuing four-year period (the “Second Option”).

Provided that Teck Chile exercises the First Option, a corporate joint venture (the “Joint Venture”) will be formed between Teck Chile and Golden Rim. Each party shall then fund its pro-rata share of future expenditures on Loreto through equity contributions to the Joint Venture or incur dilution. If a party’s shareholding interest in the Joint Venture is diluted below 10%, its shareholding interest will be converted to a 1.0% NSR royalty. The party with the majority interest shall be the “Operator” of the Joint Venture.

PAGUANTA COPPER-ZINC-SILVER-LEAD PROJECT, CHILE

The Paguanta Copper-Silver-Lead-Zinc Project remains on care and maintenance, no field exploration was conducted during the quarter.

Golden Rim has been seeking a divestment of Paguanta and is considering alternatives for realising value for shareholders.

BUSINESS DEVELOPMENT

The Company is reviewing and investigating various new business development opportunities, including advanced mineral project opportunities across the African continent. All potential opportunity processes the Company is engaged in remain incomplete, and are subject to full technical, legal and economic due diligence and/or documentation. Whilst some processes are more advanced than others, there is no guarantee that the Company will be able to successfully conclude a transaction. The Company cautions investors that there is no certainty any transaction will proceed.

CORPORATE

Details of the Company’s mining and exploration activities for the quarter are set out above under each project heading. There were no further material developments and/or material changes in those activities. The Company did not undertake or incur any expenditure on any substantive mining production and development activities during the quarter.

Summary of Expenditure

Payments for exploration and evaluation mainly comprised drilling program costs at the Kada Gold Project in Guinea.

Payments to related parties of the entity and their associates relates to Directors fees and salaries (including superannuation and taxation) paid to/for Directors and their associates during the quarter.

Share Placement

A total of 10,460,330 fully paid ordinary shares (New Shares) in the Company were issued at an issue price of $0.078 per share pursuant to Tranche 2 of the Strategic Placement, as announced on 17 March 2022, completing both tranches of the Placement, raising a total of $5.3 million (before costs) (Placement). The Placement was made to qualified, institutional, sophisticated and professional investors.

As part of the Placement, the Company issued attaching unlisted options on a one option for every three New Shares issued in the Placement, with each option exercisable at $0.12 expiring 24 months from date of issue. Tranche 2 of the Placement and attaching Placement options were approved by shareholders on 10 May 2022.

Golden Rim is using proceeds from the Placement to advance the flagship Kada Gold Project in West Africa including reverse circulation drilling along the 15km Kada Gold Corridor to test multiple target areas highlighted in recent auger drilling, an Induced Polarisation (IP) / ground magnetics geophysical survey and auger drilling of additional regional targets in the coming months. The Placement also provides working capital.

Change of Auditor

Following a competitive tender process, the Board of Directors resolved to appoint HLB Mann Judd as auditor of Golden Rim Resources Limited. Deloitte Touche Tohmatsu received ASIC consent to resign as the auditor of Golden Rim. The decision to appoint HLB Mann Judd is subject to ratification by shareholders at the next Annual General Meeting.

Contact Information:

Golden Rim Resources Ltd

ABN 39 006 710 774

Craig Mackay

Managing Director

+61 3 8677 0829

craig@goldenrim.com.au

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

This announcement was authorised for release by the Board of Golden Rim Resources Ltd.

ABOUT GOLDEN RIM RESOURCES

Golden Rim Resources Limited is an ASX listed exploration company with a portfolio of advanced minerals projects in Guinea and Burkina Faso, West Africa and in Chile, South America.

The Company’s flagship project is the advanced Kada Gold Project in eastern Guinea. Guinea remains one of the most under-explored countries in West Africa. Golden Rim has outlined a maiden Inferred Mineral Resource of 25.5Mt at 1.1g/t gold for 930Koz[2], the majority of which is shallow oxide-transitional gold mineralisation. Golden Rim is focussed on growing the Mineral Resource. Most of the 200km2 project area remains poorly explored and there is considerable upside for the discovery of additional oxide gold mineralisation.

The Company discovered and has outlined an Indicated and Inferred Mineral Resource of 50Mt at 1.3g/t gold for 2Moz[3] at the Kouri Gold Project, located in north-east Burkina Faso. Kouri covers 325km2 of highly prospective Birimian greenstones. Exploration has successfully located several high-grade gold shoots. Golden Rim recently signed an agreement with BAOR SARL to sell Kouri.

In northern Chile, Golden Rim has the Paguanta Copper and Silver-Lead-Zinc Project. Historically a silver mine, the Company has outlined a Measured, Indicated and Inferred Mineral Resource of 2.4Mt at 88g/t silver, 5.0% zinc and 1.4% lead for 6.8Moz silver, 265Mlb zinc and 74Mlb lead[4] at the Patricia Prospect. The Mineral Resource remains open.

At the adjacent Loreto Copper Project in Chile, Golden Rim has signed an Option and Joint Venture agreement with Teck Chile whereby Teck Chile can acquire up to a 75% interest in the project.

ASX:GMR

Market Capitalisation: A$17.6 million

Shares on Issue: 314 million

T + 61 3 8677 0829 | E info@goldenrim.com.au | goldenrim.com.au

[1] ASX announcement: Kouri Mineral Resource Increases by 43% Increase to 2 million ounces gold, dated 26 October 2020 (Total Mineral Resource includes: Indicated Mineral Resource of 7Mt at 1.4g/t gold and Inferred Mineral Resource of 43Mt at 1.2g/t gold)

[2] ASX Announcement: Kada Maiden Mineral Resource 930koz Gold dated 3 March 2022.

[3] ASX Announcement: Kouri Mineral Resource Increases by 43% to 2 Million ounces Gold dated 26 October 2020 (Total Mineral Resource includes: Indicated Mineral Resource of 7Mt at 1.4g/t gold and Inferred Mineral Resource of 43Mt at 1.2g/t gold).

[4] ASX Announcement: New Resource Estimation for Paguanta dated 30 May 2017 (Total Mineral Resource includes: Measured Mineral Resource of 0.41Mt at 5.5% zinc, 1.8% lead, 88g/t silver, 0.3g/t gold; Indicated Mineral Resource of 0.61Mt at 5.1% zinc, 1.8% lead, 120g/t silver, 0.3g/t gold; Inferred Mineral Resource of 1.3Mt at 4.8% zinc, 1.1% lead, 75g/t silver, 0.3g/t gold).

END NOTES

- The information contained in this announcement related to the Company’s past exploration results is extracted from, or was set out in, the following ASX announcements which are referred to in this Quarterly Activities Report:

- The report released 11 May 2022, Drilling outside Kada MRE delivers more oxide gold

- The report released 19 May 2022, Golden Rim hits shallow high-grade oxide gold at Bereko

- The report released 25 May 2022, GMR Commences Infill Auger Drilling at Bereko Gold Prospects

- The report released 21 June 2022, GMR hits 43m @ 1.2g/t Au outside Kada Mineral Resource

- The report released 14 July 2022, Extensive additional oxide gold target areas at Bereko.

Competent Persons Statements

The information in this report relating to previous exploration results and Mineral Resources are extracted from the announcements above. These reports are available on the Company’s website (www.goldenrim.com.au). The Company confirms that it is not aware of any new information or data that materially affects the information included in these announcements and, in the case of the Mineral Resource estimate, that all material assumptions and technical parameters underpinning estimate continue to apply and have not materially changed.

The information in this report that relates to exploration results is based on information compiled by Craig Mackay, a Competent Person, who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Mackay is a full-time employee of the Company and has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Mackay consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to the Mineral Resources have been compiled under the supervision of Ms. Hollie-Amber Fursey who is a full-time employee of RPM and a Registered Member of the Australian Institute of Geoscientists. Ms. Fursey has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that she has undertaken to qualify as a Competent Person as defined in the JORC Code. Ms Fursey consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

Forward Looking Statements

Certain statements in this document are or maybe “forward-looking statements” and represent Golden Rim’s intentions, projections, expectations or beliefs concerning among other things, future exploration activities. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of Golden Rim, and which may cause Golden Rim’s actual performance in future periods to differ materially from any express or implied estimates or projections. Nothing in this document is a promise or representation as to the future. Statements or assumptions in this document as to future matters may prove to be incorrect and differences may be material. Golden Rim does not make any representation or warranty as to the accuracy of such statements or assumptions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()