Drill Results

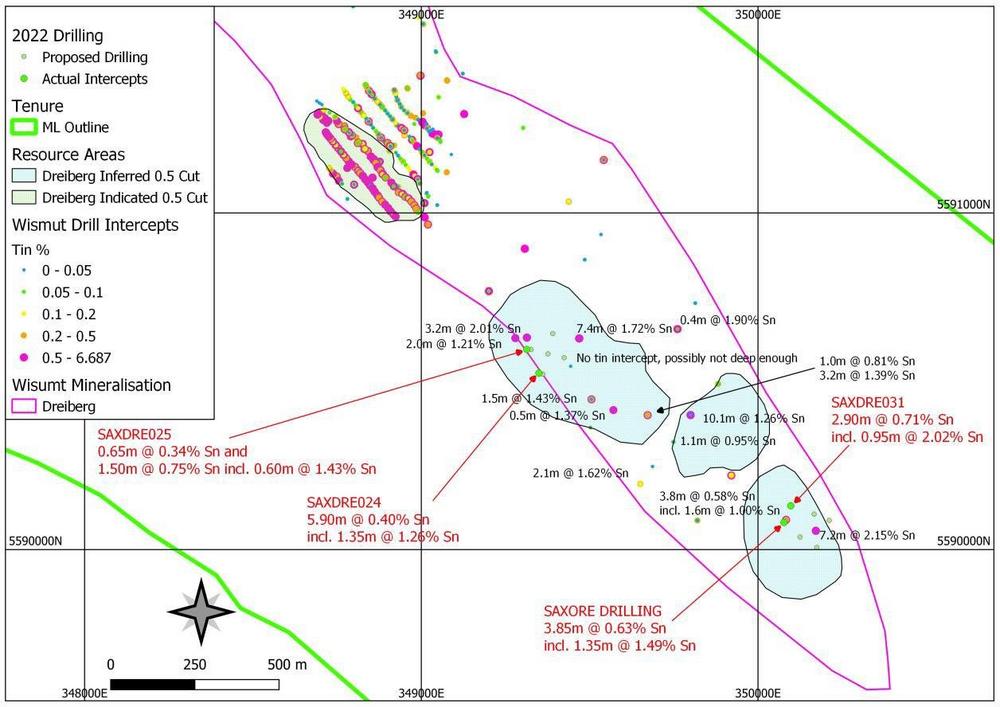

First Tin has received positive results from the second two deep drillholes undertaken as part of the drill programme into the deep Dreiberg mineralisation. This programme is designed to add Indicated Resources to its Tellerhäuser Project in Germany by confirming the continuity of mineralisation previously identified by Wismut during 1970s and early 1980s. Wismut previously intersected high grade tin mineralisation at depth, along strike from the known Indicated Resources at the Dreiberg seam (Figure 1).

The two areas tested are at depths of between 800m and 900m below surface and between 3,000m and 4,000m along strike from the Hämmerlein Indicated Resource area and 1,000m to 1,500m along strike from the Dreiberg Indicated Resource area. Both drillholes intersected the targeted skarn horizon and returned the following significant downhole intercepts:

• Drillhole SAXDRE24:

o 5.90m skarn from 810.3m downhole grading 0.40% Sn, 0.74% Zn, 43.0ppm In, 5.9g/t Ag

▪ Including (0.5% Sn lower cut-off): 1.35m @ 1.26% Sn, 2.16% Zn, 130.3ppm In, 20.0g/t Ag from 811.6m downhole

• Drillhole SAXDRE31:

o 2.90m skarn from 877.2m downhole grading 0.71% Sn, 0.48% Zn, 56.4ppm In, 6.5g/t Ag

▪ Including (0.5% Sn lower cut-off): 0.95m @ 2.02% Sn, 1.39% Zn, 163.0ppm In, 18.7g/t Ag from 877.7m downhole

As reported in December 2022, First Tin’s previous two holes also intersected the targeted skarn zone. Together, they have successfully shown the skarn horizon is present, continuous, and tin mineralised as suggested by the previous Wismut drilling. This suggests that the skarn horizon is continuous for at least 1.5km southeast of the Indicated Resources at Dreiberg and is open to the southeast.

Importantly, the tin assays were as expected from the location of the intercepts. The other metals, in particular zinc, indium and silver were all as good as, or better than, expected.

The “20” series holes are located approximately 500m southeast of, and roughly along strike from, the Indicated Resources at Dreiberg (Figure 1). They targeted mineralisation identified by three previous drillholes completed by the SDAG Wismut joint venture (between the Russian and East German governments) in the early 1980s. These returned intercepts of:

- 4m @ 1.72% Sn

- 2m @ 2.01% Sn and 2.0m @ 1.21% Sn

- 9m @ 1.57% Sn

Both drillholes intersected the skarn horizon and returned intercepts of:

- 9m @ 0.40% Sn (incl. 1.4m @ 1.26% Sn)

- 65m @ 0.34% Sn and 1.5m @ 0.75% Sn (incl. 0.6m @ 1.43% Sn)

These holes have successfully confirmed both the location and thickness of the skarn and the tenor of tin and associated metals mineralisation.

The “30” series holes are located approximately 1,500m southeast of the Indicated Resources at Dreiberg and approximately 850m south of the “20” series holes. They were designed to target mineralisation outlined by two previous Wismut drillholes that had returned intercepts of:

- 2m @ 2.15% Sn

- 8m @ 0.58% Sn (incl. 1.6m @ 1.00% Sn)

Due to difficulties encountered during drilling, both of the planned drillholes hit the skarn horizon off-target (65m to 70m away from target locations, see Figure 1) and hence did not accurately test the historical high grade intercepts. However, the drillholes still intersected the targeted skarn horizon and returned significant tin intercepts including:

- 90m @ 0.71% Sn (incl. 0.95m @ 2.02% Sn)

- 85m @ 0.63% Sn (incl. 1.35m @ 1.49% Sn)

DFS Update

Due to the slow operational performance of the Company’s original drilling contractor, and their inability to intersect the target zones in a controlled manner at predefined positions, the current contract has been terminated.

First Tin is in the process of identifying a new contractor to take over the Dreiberg drill programme, with the current intention that the new contractor will drill the holes using RC to depths of between 300m and 500m and then to convert to diamond drilling to test the target horizon. The next Dreiberg hole (the fifth drilled by First Tin) is scheduled to commence in Q2 2023 and, should this prove successful, the programme may be expanded to define additional Indicated Resources in the Dreiberg area.

This drilling delay has put the proposed drilling programme behind schedule by around six months, which has in turn put the revised resource estimate back by around the same time. As such, it is now not anticipated that the DFS at First Tin’s Tellerhäuser asset will be completed by the end of 2023 as previously expected. Depending on how the new contractor performs, the DFS is now targeted to be completed in 2024.

However, the Board is pleased to highlight that the drilling to date has obtained enough drill core to undertake mineral processing test work from Dreiberg with half of the core from the drillholes being sent to ALS in Burnie, Australia. This will be the first mineral processing testwork conducted on Dreiberg mineralisation in over 40 years and will be useful as variability testwork for the project as a whole.

Additional Historic Drilling Data

A further positive outcome is that a considerable amount of additional historic drilling data has recently been located for the Tellerhäuser project area. This new data came from previously unseen old Wismut uranium exploration drillholes as well as some assay data that had not previously been able to be located from three different archives in Freiberg. Following granting of the Mining Licence in 2021, Saxore was able to request additional data, in particular drillholes targeting uranium mineralisation, that were also assayed for tin and other metals.

All of this data is currently being added to the main database and should result in a more robust resource model and may lead to additional resource tonnes being added very cost effectively. The additional identified data represents an equivalent of around 3,500m of core drilling from surface, 4,500m of core drilling from underground and a number of other channel samples. Based on the new data from the Tellerhäuser drilling programme, plus the additional historical data recently received, the Company expects to publish an updated JORC compliant Resource Statement for Tellerhäuser in June/July 2023.

While waiting for additional drilling results to be returned and while the new historical drilling data is being analysed, the DFS will continue to progress and will focus on the areas of mineral processing as well as investigating optimal mining methods, mine access and environmental studies. All these activities are well financed until end of 2023. A potential adjusted and extended drilling programme for Tellerhäuser based on the results of the updated Resource Statement may require further funding beyond the existing budget.

First Tin CEO Thomas Buenger said, “It is highly encouraging that the results from these four drillholes confirm continuity of higher grade mineralisation previously identified by Wismut over 40 years ago.

The holes all intersected significant skarn mineralisation and suggest the skarn is continuous and mineralisation is consistent.

“It is unfortunate that the drilling contractor was unable to achieve the desired accuracy, however we are hopeful that this can be achieved by the new contractor and look forward to reporting additional results as they become available.

“The identification of significant additional data not previously available to us is an excellent outcome and could potentially add resources at a significant cost saving to drilling our own holes. These new developments, however, mean that we are now behind the previous schedule for our DFS and it is considered unlikely that we will be able to complete the study in 2023 as we previously expected. We are still progressing those parts of the study that are not dependent on the new drill data being added to the database, so that we can finalise the DFS as soon as we can – most probably now in 2024 rather than in 2023. However, with the forthcoming tin deficit expected to be of a long term nature, our project is still well aligned to provide critical supply to meet demand.”

Enquiries:

First Tin

Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Axaule Shukanayeva / Molly Gretton 07900 248 213

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()