There are interesting shifts in the silver stocks. The reasons are under consideration.

Observers are already speculating about the reason for the turnover of physical silver in COMEX-approved silver warehouses. A continuing supply shortage of the precious metal could be the background. The fundamental trend in the silver market (the inventory shifts) probably underpins the very good long-term silver forecast. Indeed, the movement of physical silver into and out of COMEX-approved silver warehouses is unusually high. In one week alone, for example, 5.7 million ounces of silver were moved in the warehouses, an incredibly high amount. And if you extrapolate this amount to the year, we are talking about just under 300 million ounces of silver, or about one-third of the global silver production from the year 2022. Rumors are now swirling about the frequency and the extraordinary volume.

Also, this strong inventory activity is unique to silver; it is unprecedented and has been going on for years. For some analysts, it is evidence of a tightening silver shortage. This could come from the fact that industrial demand is increasing. Think solar panels and the electronics sector. Also, stronger investor demand could be the reason. Whatever the reason, or reasons, it is getting harder to find physical silver. Investors should watch silver just as they watch gold. By the way, when storing physical silver, you need 80 times the storage space compared to gold for the same value.

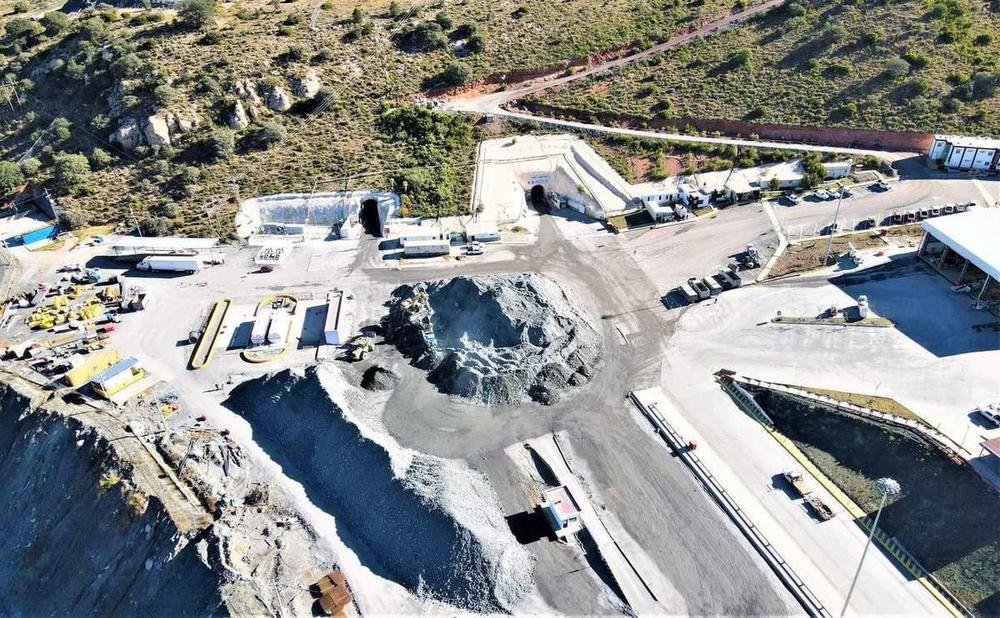

No stock problems are caused by the stocks of companies that also have silver in their projects, for example MAG Silver – https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ . The company has an interest in the Juanicipio project in Mexico (44 percent), and commercial production has started. MAG Silver also has stakes in other projects in the USA and Canada.

Chesapeake Gold – https://www.commodity-tv.com/ondemand/companies/profil/chesapeake-gold-corp/ – is engaged in the discovery, acquisition and development of large gold-silver properties in North and South America. The prospective flagship Metates project in Durango contains gold, silver and zinc and scores with very good drill results.

Current corporate information and press releases from MAG Silver (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()