HIGHLIGHTS

- Infinity increases ownership from 50% to 75% of the San Jose Lithium Project

- Infinity and the Project are now well positioned to attract strategic investment

- Movement from lithium carbonate to lithium hydroxide pathway has driven renegotiation of the JV – positive outcome optimally aligns project and partners

- Local JV partner to receive reimbursement for previous expenditure and for transfer payments (this totals €1 million in staged payments until mid-2020)

- Local JV partner retains preferred contractor rights ensuring alignment of goals and focus on project development

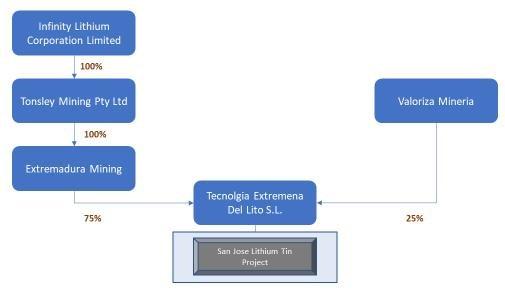

Infinity Lithium Corporation Limited (ASX:INF) (‘Infinity’, or ‘the Company’) http://www.commodity-tv.net/c/search_adv/?v=298809 is pleased to advise it has successfully completed a renegotiation of the San Jose Lithium Project (‘San Jose, or ‘the Project’) Joint Venture (‘JV’) agreement with local partner Valoriza Mineria S.A. (‘Valoriza Mineria’) resulting in the immediate acquisition of a further 25% in the JV entity Tecnolgia Extremena Del Lito S.L. (‘TEL’).

Infinity’s CEO and Managing Director, Ryan Parkin commented “Infinity is delighted to announce the progression of project ownership to 75% as we enter a period of increasing engagement of potential strategic partners and move towards the delivery of the San Jose Lithium Project pre-feasibility study. European lithium-ion battery supply chain developments have recently accelerated. The ability to continue to align our goals to work collaboratively with our JV partners in progressing commercial discussions with key European and other industry participants provides immediate value to the Project. The resulting acceleration in project ownership reflects the alignment of the Project towards lithium hydroxide opportunities and the relevance of that product in one of the world’s largest electric vehicle markets”.

Commercial Terms:

As previously announced, under the original JV agreement (ASX announcement 14 June 2016) with Valoriza Mineria, Infinity was able to earn-in to a 75% interest through the delivery of a feasibility study on lithium carbonate production with an agreed budget of €2.5 million. Valoriza Mineria was the preferred contractor for all works within the feasibility study and had completed some work including land access, public relations, and environmental base line studies. The revised JV agreement terms now enables Infinity to assume 75% interest in the Project with the immediate payment of €250,000 and additional ongoing payment commitments totalling €750,000 payable within 14 months or by 13 May 2020.

The key commercial terms of the renegotiated JV agreement are contained in the Appendices of this announcement.

Strategic Importance of San Jose in the European LIB Supply Chain:

As the Company has advised, the lithium market is increasingly demanding lithium hydroxide to supply the growing lithium-ion battery (‘LIB’) industry. San Jose is extremely well placed geographically to satisfy increasing European demand for battery grade lithium hydroxide and address increasingly important supply chain sustainability and carbon emission requirements. Additionally, it benefits via its potential ability to deliver lithium hydroxide or other lithium battery chemicals directly from hard rock lithium resources without having to go through an intermediate lithium carbonate production stage.

The fully integrated San Jose Lithium Project, located in the Extremadura region of Spain, retains increasing strategic importance in the context of burgeoning lithium-ion battery investment in the European Union (‘EU’) and the United Kingdom (‘UK’). The recently attended European Battery Association EBA250 conference in Brussels (ASX announcement 1 February 2019) noted the significant focus on raw materials and chemical processing capabilities in Europe, and the significant gap in the availability of lithium chemicals within Europe in its current environment.

Maros Sefcovic (Vice President of the European Commission) recently noted that mines are opening or re-opening and that the EC “have also identified a gap linked to Europe’s refining capabilities for lithium. We clearly have to cover this gap… because the demand for processed refined lithium will be quite big in Europe, so it makes sense to have lithium refining capacities here…. It’s only logical that we should have the whole value chain in Europe”.

The EC, through Mr Sefcovic, continue to progress addressing this key component essential for the European EV industry and the importance to consider both regularity and financial assistance “We are ready to discuss not only the regulatory aspects of course but also financial assistance – be it under the Important Projects of Common European Interest (IPCEI) or under Public Private Partnerships with the European Investment Bank (EIB).”

A further consideration is the increasing importance of the environmental sustainability of supply and the carbon footprint of all aspects of the supply chain in the production of European EV (ASX announcement 12 March 2019). San Jose is not only ideally located within the EU and thus logical advantages in the carbon footprint in terms of transportation and freight, it further benefits from the availability of key reagents in the industrial production process that are readily available within Spain.

APPENDIX 1: KEY COMMERCIAL TERMS

- Immediate transfer of 25% interest whereby €250,000 is paid upon execution of the amended JV agreement, resulting in the immediate transfer of shares in TEL to Infinity’s wholly owned Spanish subsidiary Extremadura Mining S.A.

- Ongoing additional staged payment commitments totalling €750,000 payable within 14 months or by 13 May 2020. Therefore, the total payment amounts payable in consideration of 25% project interest in TEL through the immediate and subsequent staged payments amounts to €1,000,000.

- Infinity retains the right to forgo subsequent staged payments, revert to 50% project interest and earn-in to 75% through the delivery of a lithium chemicals feasibility study. The delivery of the feasibility study would be required within 18 months of Infinity’s election and notification provided to Valoriza Mineria to forgo subsequent staged payments. Infinity retains the right to extend the delivery of the feasibility study for a further 12 months through payment of €100,000 in the event that the feasibility study was not delivered within the initial 18 month period.

- The Agreement contains a mechanism in which project ownership can be increased to 100% by either a Put or Call Option held between parties. The Option has an exercise value of €10 million and lapses upon project development. The Put Option is only valid upon the Decision to Mine and the majority is payable from project sales revenue.

- Valoriza Mineria to continue as preferred contractor through their globally recognised civil engineering and construction entities, continue to provide services in environmental, hydrological, social and in-country liaison.

APPENDIX 2: OWNERSHIP INTEREST IN TEL RETAINED BY SPANISH ENTITIES – STRONG ONGOING PARTNERSHIP BETWEEN EXTREMADURA MINING & VALORIZA MINERIA

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

CEO, Managing Director

Telefon: +61 (429) 228-857

E-Mail: rparkin@infinitylithium.com

Namcomm Consulting – Principal

Telefon: +61 (424) 823-100

E-Mail: nick@namcomm.com.au