About one year after COVID-19 has spread in Europe vaccination campaigns are in progress and the estimation is that most restrictions can be lifted around the summer months. Meanwhile, we are going through the third wave of dealership closures which raises the question how much impact these lockdowns have on the car market.

Methodology

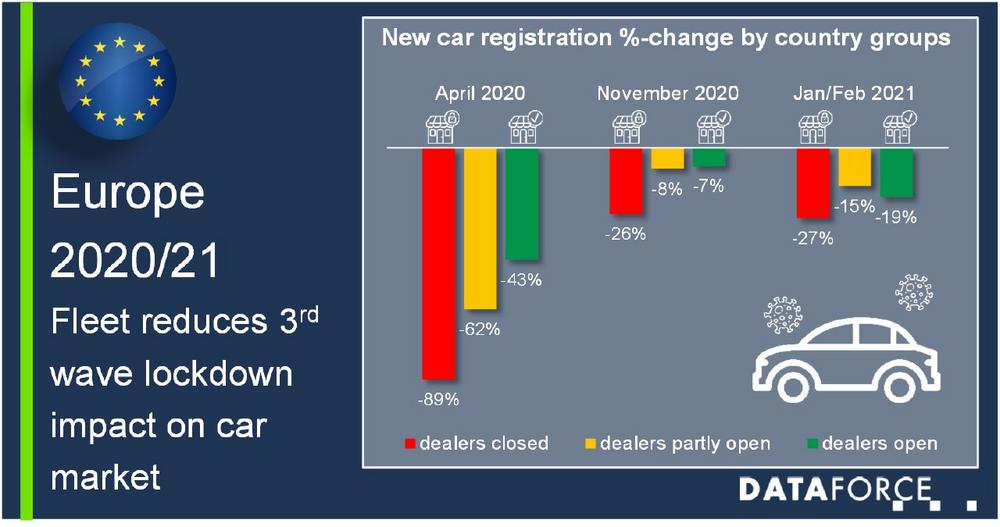

To answer this question, we have analysed European new car registrations in April and November 2020 as well as in January/February 2021. In each of these time periods we allocated the countries into one of three groups: First those countries who had closed non-essential shops for the full period, second countries with a lockdown only in part of the time and finally those markets were showrooms remained completely open. Comparing the percentage changes against the same month(s) from one year ago then provides an estimate on the lockdown impact.

Open showrooms made a big difference in April 2020

Over April 2020, the car markets plunged by 89% in countries with showroom closures while those who kept their dealerships fully operational shrank by 43%. This makes up for a huge difference of 46 percentage points (pp). A couple of countries went into a second lockdown in November 2020. This time, most countries allowed click & collect schemes, and this has mitigated the difference to an average of 18 pp though there is still a clear difference between the country groups.

Click & Collect mitigated the lockdown damage

January and February 2021 showed the smallest lockdown impact. The difference between countries with open and closed dealerships was just 8 pp. To put this into context, percentage changes within the groups were much larger. Registrations in the first group fell between 38% (UK) and 14% (Ireland) while the range in countries with operation dealerships went from – 45% (Spain) to a + 12% (Sweden). Individual factors such as tax changes or the economic situation have been more important.

But the Private Market is still suffering

However, this does not mean dealership closures no longer influence new car registrations.

Companies can adapt to click & collect more easily or are being served by leasing companies or key account managers. On the other hand, private customers prefer to talk in person and make a test drive before making a purchase decision. Short-Term Rental Companies and Dealerships and Manufacturers do not need open showrooms to register their cars but without a perspective to rent out/sell these cars they still cut their registrations.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive

industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

Kontakt für Presse

Telefon: +49 (69) 95930-232

Fax: +49 (69) 95930-333

E-Mail: Benjamin.Kibies@dataforce.de

![]()