Bowser, Charge Point, or both – what is fueling 2021 so far?

With Belgium yet to arrive, we looked at the June YTD figures for the largest volume countries of Germany, France, UK, Italy, Spain, Netherlands, Sweden and Poland. These EU-8 countries account for almost 5.2 million passenger car registrations in 2021 so far and unsurprisingly each shows a growth over 2020. Each market segment has contributed to this, but no more so than True Fleets in terms of volume, more on that later. However, if we add the context of a 2019 total market comparison, we can see the market is far from where it was, with figures down by 23.6%.

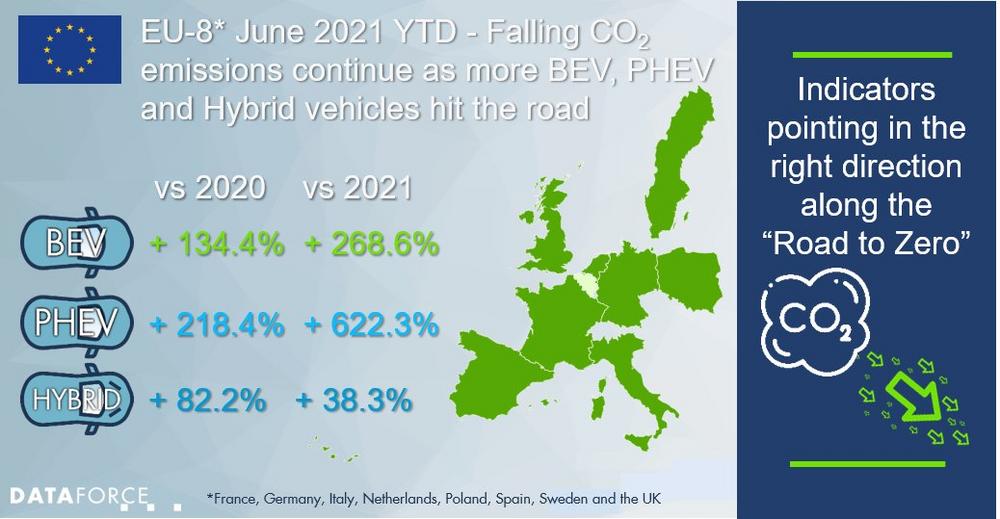

In terms of fueltype, we can certainly see a brightly lit future for the lowering of CO2 emissions. Electric, PHEV and Hybrid each show growth over 2020 YTD figures with respective increases of 134.4%, 218.4% and 83.2%, but the big numbers come in comparison to 2019 YTD. Granted that for Hybrid 2021 vs 2019 YTD it is a more sedate + 38.3%, but this is still 91,000 registrations more! For Electric, which brings the most impact in CO2 emission reduction, we saw an increase of 268.6% in registrations or a little over 270,000 extra vehicles over 2019. PHEV though was the clear leader here, + 622.3% bringing them storming in to the six-figure club and registering a compelling 417,000 vehicles in 2021 so far. Now for pure ICE registrations the writing is possibly well and truly on the wall. Petrol registrations in 2021 show a 19.7% increase over 2020 and for Diesel we see + 3.2%. Comparisons of 2021 to 2019 show a drop of 33.4% for Petrol and a massive – 44.0% for Diesel. Volume wise, the drop in pure ICE for 2021 when compared to 2019 equates to 2,331,574 less registrations!

CO2 – Targets, Testing and of course Tesla’s

The CO2 emission performance standards for new passenger cars and new light commercial vehicles, put into place as part of the Paris Agreement, are targeted to make road transport cleaner. The good news is it appears to be working! For the 25 European markets available to us, we have seen it drop from 149g to 131g as of June 2021 YTD. Now with a target of 116g for WLTP (95g is the NEDC target value), it appears there is some way to go. However, factoring in both Supercredits and Curb weight brings us to 120g, well on its way to achieving target.

There are some notable individual countries which have dropped their CO2 levels by some serious percentages over the Jan-Jun 2020 figures. Germany with a 16% reduction to 130g, Sweden 17% reduction to 109g, Italy 24% reduction to 130g, but we see a monster number from a country already doing more than their share. Norway is down 30%! From what is already a record 83g to 58g with Tesla leading the (electric) charge, so to speak. June YTD saw them deliver 205.9% more than in 2020 and while not the highest volume OEM, Toyota has that honor, they are in 6th. Perhaps the cyber truck will see them add a few LCV regs as these are what separates them from 4th place.

PHEV-ing the Fleets

Mentioned earlier, we spoke about the contribution of True Fleet and passenger cars from the EU-8 are making the shift to lower emission vehicles. The importance of this channel, not only now with the first registration, but with second owner registrations cannot be underestimated. These happen (mostly into the Private Market) on a shorter life cycle than private registered cars. With the figures we are seeing, True Fleets contribution to PHEVs on the road stand at almost half of all registrations in 2021! Increases for the full year 2020 over 2019 figures stood at 214.5%, 2021 YTD over 2020 (Jan-June) are already 203.3%! While PHEV is leading in terms of volume and growth, electric is also fast becoming a viable option for company cars and in the Leasing & LTR Market. Electric volume stands at a little of 135,000 for 2021 YTD and increased by 143.2% over 2020 and despite all the issues seen in the 1st HY 2020 we also saw a growth of 23.2% over 2019.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe.

In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-253

Fax: +49 (69) 95930-333

E-Mail: richard.worrow@dataforce.de

![]()